Discuss your challenges with our solutions experts

Competition heats up for the top three US residential solar installers

Impressive growth and market consolidation amid the top five US solar players could threaten Sunrun’s dominance in 2022

1 minute read

Caitlin Connelly

Senior Analyst, US Solar

Caitlin Connelly

Senior Analyst, US Solar

Caitlin focuses on distributed solar and supports research and data collection.

Latest articles by Caitlin

-

Opinion

RE+ 2024: Our 7 biggest takeaways

-

Opinion

Shake-up on the US distributed solar leaderboard

-

Opinion

Competition heats up for the top three US residential solar installers

-

Opinion

US residential solar: why is customer acquisition still so costly?

US residential solar has continued to soar, growing nearly 30% year-on-year and reaching a record-breaking 4.2 GW of new installations by the end of 2021. The year, however, was not without challenges. Installers faced volatile supply chains, rising system prices and Omicron-fuelled labor shortages. The impacts of these constraints dispersed unevenly depending on the company and region of operation.

So, which installers struggled to maintain their market share – and who rose to the challenge?

We track the top commercial and residential installers and equipment suppliers in the solar market in our US PV Leaderboard, part of our US Distributed Solar Service. Read on for an overview of the latest report.

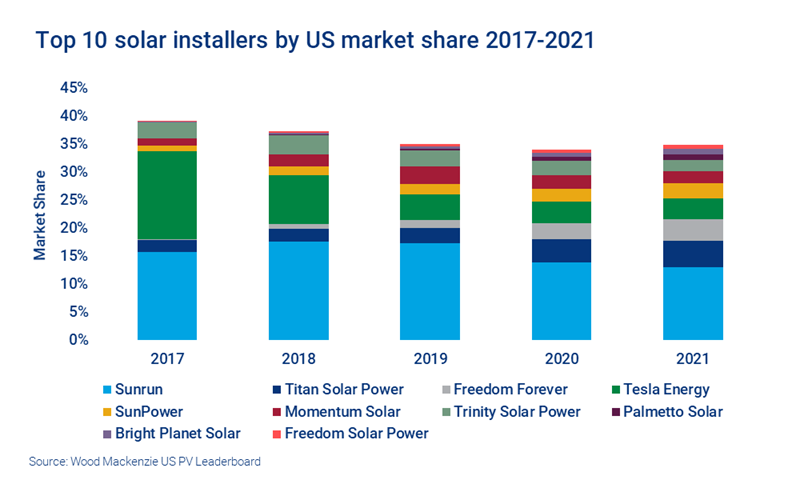

Sunrun, Titan Solar Power and Freedom Forever command over 20% of the residential market

Publicly-traded Sunrun again showed off its dominance as the top residential installer for the fifth consecutive year, securing 13% of the total market. However, Sunrun’s market share is down nearly a point since 2020 – the second year in a row the company experienced market share declines. Although both Sunrun’s direct and indirect installation volumes continue to grow, flat Q4 volumes attributed to Omicron-related labor shortages ultimately hurt their market share for 2021.

While Sunrun still maintains a comfortable lead, the rising pressure on the company’s growth rate is a testament to the unyielding momentum of other top players.

The most notable shift in rankings goes to Freedom Forever, which secured 3.9% of the total market and squeezed Tesla out of a top three spot for the first time. Freedom Forever’s installation volumes grew a massive 80% in 2021, and the company entered 12 new state markets. Simultaneously, Tesla has become increasingly dependent on subcontractors for solar installations as the company shifts its business model more towards that of a full-suite technology supplier. Given these two factors, we expect to see Tesla continue to decline in the installer rankings over the next several quarters.

At its current rate, Freedom Forever’s growth puts pressure on Titan Solar Power’s position going into 2022. While Titan managed to grow installation volumes and market share this past year, its growth is significantly smaller compared to previous years. As large regional installers with expansive networks, Titan and Freedom Forever often compete for sales volumes, and their operations overlap in 15 state markets. Additionally, both companies follow similar business models that rely solely on third-party sales companies. Outsourcing sales to third-party companies – a customer acquisition strategy also used by Sunrun – continues to be a popular tactic for top installers looking to create efficiencies as they expand their geographic footprints.

Market consolidation heightens competition among second-tier US solar installers

Further down the Leaderboard, competition continues to intensify for a spot in the top five. In the latest example of consolidation in the residential market, SunPower announced the acquisition of Blue Raven in October 2021. In 2020, SunPower and Blue Raven made up 1.4% and 1.0% of the total market respectively. Heading into 2022, the combined entity SunPower holds 2.7% of the total market, settling comfortably ahead of both Momentum Solar (#6 with 2.2% market share) and Trinity Solar Power (#7 with 2.0% market share).

The acquisition of Blue Raven strengthens SunPower’s direct installation business, expanding their geographic footprint for direct installs from eight to 19 states. SunPower has noted that direct installs are central to expanding service options and revenue streams. We will continue to track closely how Blue Raven is incorporated into SunPower’s business model and impacts installation volumes over the next year.

Top commercial installers maximize growth with community solar

US commercial solar (including community solar) continues to consolidate for both development and asset ownership. The top 75 national installers accounted for over 60% of the market for the first time since 2013, when Leaderboard data begins.

The top asset owners now command almost 40% of the annual market, up from 32% last year. While commercial solar remains a difficult business to scale, many top developers and asset owners have grown their businesses faster through this route. These projects are well known to offer scale (most are several megawatts in size), and faster customer acquisition for non-residential customers. After all, it’s easier to subscribe to community solar than put solar on your own roof.

Interconnection delays and costs are holding up gigawatts of development in key community solar states.

Caitlin Connelly

Senior Analyst, US Solar

Caitlin focuses on distributed solar and supports research and data collection.

Latest articles by Caitlin

-

Opinion

RE+ 2024: Our 7 biggest takeaways

-

Opinion

Shake-up on the US distributed solar leaderboard

-

Opinion

Competition heats up for the top three US residential solar installers

-

Opinion

US residential solar: why is customer acquisition still so costly?

However, community solar projects are large enough that they suffer from the same hurdles as many utility solar projects. Interconnection delays and costs are holding up gigawatts of development in key community solar states. Additionally, larger projects tend to procure equipment from overseas, exposing them to the same equipment constraints as many utility solar projects. Overcoming these challenges will be critical for continued consolidation in the commercial solar sector.

Loans financed more than two-thirds of market activity in the second half of 2021

The residential finance market is also consolidating. The top five largest players financed over 70% of the residential market in 2021, up from 60% in 2020. Market consolidation ramps up competition between financiers, driving down interest rates and dealer fees.

GoodLeap held onto its position as the top financier and loan provider, capturing 26% of the total market. Sunrun leads the third-party owned (TPO) market, capturing 15%. While TPO capacity volumes grew in 2021, loan volumes continue to dominate new growth and now represent over 60% of the market. We expect this trend to become the norm over the next couple years before the investment tax credit expires for customer-owned systems in 2023.

Additional key findings from the latest Leaderboard include:

- Leading commercial installer Borrego broke 10% of total market share for the second year in a row.

- Enphase beat out SolarEdge in Q4 to regain the #1 position in the residential inverter supplier ranking for 2021. The two companies combined won over 90% of total market share for the second consecutive year.

- Hanwha Q CELLS maintained the #1 residential module supplier ranking for the fourth consecutive year and the #1 commercial module supplier ranking for the third consecutive year.

Want to keep track of the leaderboard in 2021? Find out more about the US Distributed Solar Service.