US community solar market will bring 4.5 GWdc online over the next five years

Expanded incentives and program allocations boost the forecast – but siting and interconnection challenges are growing

1 minute read

US community solar is set to get a boost from expanded state-level programs enacted in the last six months. Since our last outlook was released in July 2021, we have increased the national five-year forecasts by 9%. Meanwhile, new state legislation to implement or expand community solar programs could provide further upside. But as the sector grows, so do its siting and interconnection challenges.

A full analysis of the market, including five-year forecasts, can be found in our US community solar market outlook H2 2021, created in collaboration with the Coalition for Community Solar Access (CCSA).

Fill in the form for a complimentary extract and read on for some key highlights.

Current market conditions have driven an uplift to our US community solar forecast

Community solar refers to local facilities shared by multiple community subscribers, such as homeowners, renters and businesses. Each subscriber receives credits on their electricity bills for their share of the power produced.

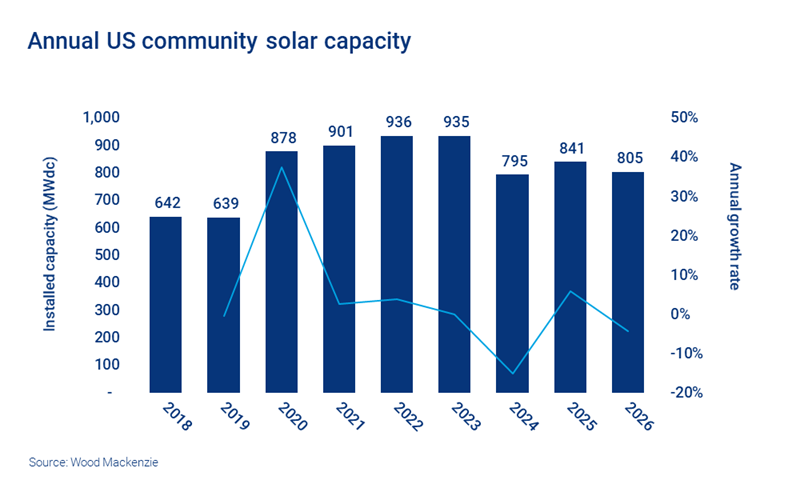

We expect a peak in installations over the next few years. Volumes decrease after 2023 once pipelines under current incentive regimes begin to dwindle and the Investment Tax Credit (ITC) drops down to 10%.

Expansions of existing programs, including those in New Jersey and Illinois, have driven the 9% uplift to our forecast. New NY-SUN distributed solar goals also contribute. New York accounts for nearly 30% of growth to 2026.

Some state markets will struggle to match this growth without policy reforms that remove market constraints and concerted efforts to address interconnection challenges. Though we have increased our overall national outlook, we decreased forecasts for states contending with these issues. Forecasts for Minnesota and Maryland were decreased due to siting challenges, and for Massachusetts and Maine as they deal with delays due to interconnection studies.

Proposed community solar legislation would boost long-term outlooks

Over the past year, several states have passed or proposed legislation for community solar programs. While many of these bills have received bipartisan support, disagreements with utilities and various stakeholders have meant that passage is not guaranteed. That said, both Delaware and New Mexico have recently signed legislation into law. Each state is projected to yield about 200 MWac of community solar coming online over the next few years.

Legislation in other states is in early stages but developers and advocates are generally optimistic. Pennsylvania, Wisconsin, Michigan and Ohio all have bills proposing state-led programs. Though it is difficult to predict just how much community solar these bills will yield, their passage could introduce significant upside. The earliest we expect to see projects built because of these programs is 2024.

Interconnection challenges will hinder the community solar market

Grid upgrades are often necessary to interconnect larger distributed generation, such as community solar. However, utility interconnection studies can involve frequent delays and result in high upgrade costs for project developers. Cluster studies in Massachusetts and Maine have led to significant delays and uncertainty around cost allocations. Well over a gigawatt is currently tied up in cluster studies in their utility territories, resulting in project attrition.

These challenges could be replicated in markets across the country. Regulators and stakeholders should proactively address these issues to avoid similar project delays.

Action from Congress and federal agencies may provide some upside for community solar

Though community solar is dependent on state-level programs, federal policy can also influence these markets. While an ITC extension will lead to big gains in other solar segments, it would modestly increase community solar deployments.

However, several state markets expect to see a decline in installations after 2024 thanks to both the ITC reduction to 10% and the timing of several larger state incentive programs. An ITC extension would help smooth that decline and increase the outlook from 2023 onward. The fate of the ITC, originally included in the stalled Build Back Better budget bill, remains uncertain. Wood Mackenzie will continue tracking relevant legislation.

The US Department of Energy’s (DOE) new distributed generation goal calls for the equivalent of five million homes to be powered by community solar by 2025. While achieving this goal would be a boon to developers, the market is currently on pace to miss the target by a significant margin.

The announcement of this goal is a signal that the Administration is committed to distributed solar. But the DOE will need to significantly increase investments and engage in robust inter-agency cooperation to increase the chances of meeting these targets.

Addressing interconnection challenges is key to a healthy community solar sector

Community solar is poised for considerable growth. But to maintain it, regulators, utilities and developers will have to contend with siting and interconnection challenges that will impact most markets.

This outlook reflects policy and market conditions as they exist today. There is considerable upside if programs and incentives are expanded.

The full report explores this topic in more detail. Fill in the form at the top of the page for a complimentary extract.