The nuclear option:

Making new nuclear power viable in the energy transition

May 2023

Authors

Making new nuclear power viable in the energy transition

The future will run on electricity, yet the world is struggling to decarbonise its power supply and meet demand. The 2022 energy crisis has put energy security and reliability front of mind for governments and underscored the need to press ahead with the development of alternative energy sources.

Enter nuclear power, with one of the lowest lifecycle emissions of current power-generation technologies. Innovation and policy are creating new options, but nuclear has yet to overcome sizeable challenges and entrenched negative perceptions. What are the chances, then, that it will become part of the future energy mix?

Today, electricity meets around 20% of global energy demand. Over the next 30 years, almost everything that can be electrified will. Our Energy Transition Outlook ‒ the Wood Mackenzie base case ‒ sees a need for power generation to increase 1.7-fold from today’s levels to 48 PWh by 2050. Electricity’s share of the energy mix could more than double to 50%.

Renewables, complemented by energy storage technologies, will capture the largest share of power investment globally. But the global economy cannot rely on weather-dependent sources of power alone. A smooth energy transition will require multiple fuels and technologies.

Wood Mackenzie believes nuclear should play a central role in decarbonisation for many countries

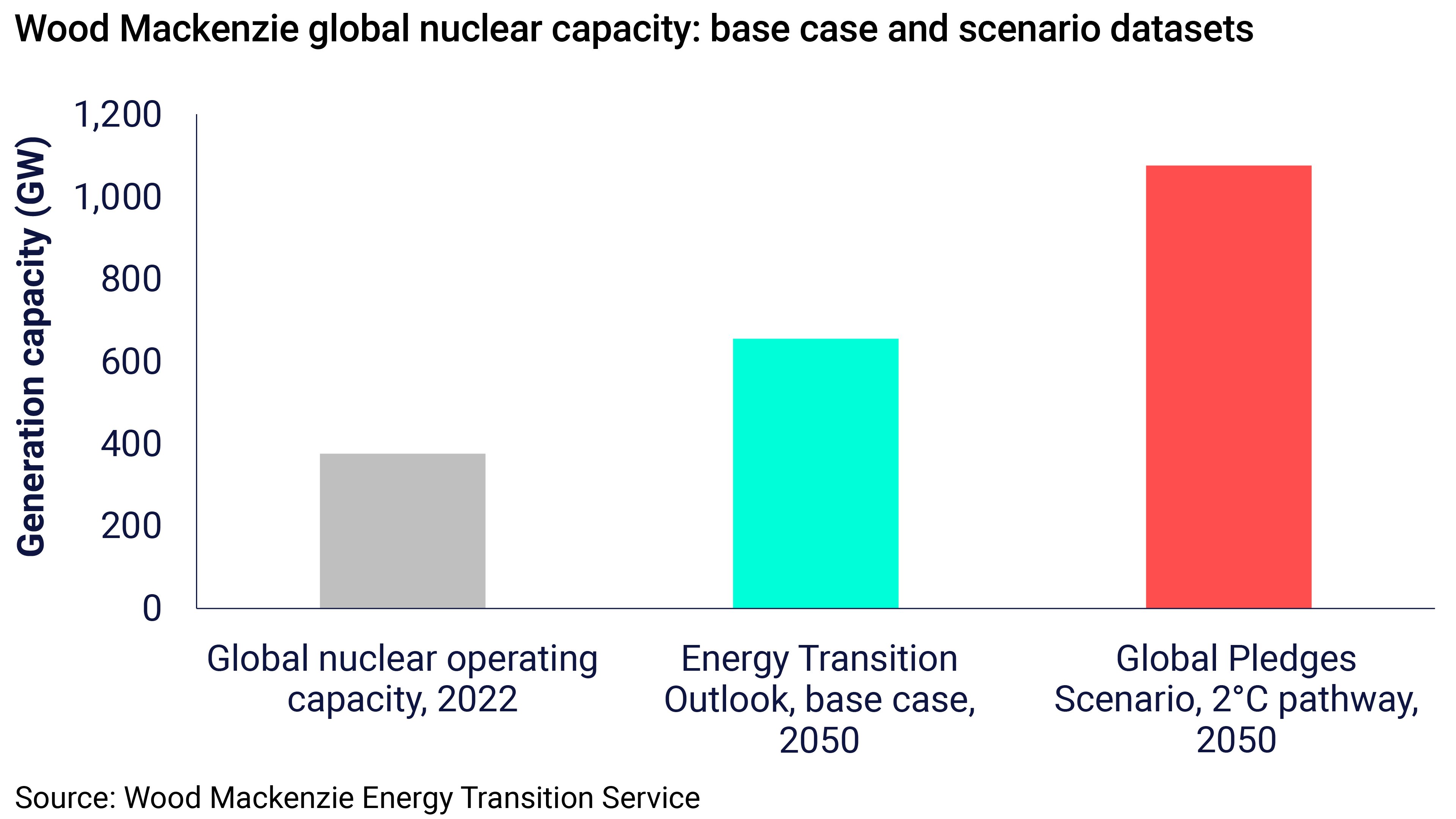

Wood Mackenzie believes nuclear should play a central role in decarbonisation for many countries. Under our base case, nuclear capacity expands 280 GW by 2050. Under our Global Pledges Scenario, consistent with a 2 °C warming pathway, a tripling of nuclear capacity is required. The biggest economic hurdle to the uptake of the latest nuclear and small modular reactors (SMRs) is cost.

However, at present, nuclear is just one of a number of technologies – geothermal, green and blue hydrogen-fired power, gas or coal with carbon capture and storage, long-duration energy storage – vying to deliver reliable decarbonised electricity supply. All are expensive and need technological innovation to build a position in the market.

For nuclear power to flourish, governments, developers and investors must work together to establish a new nuclear ecosystem, one that makes nuclear affordable and acceptable. The challenge of reshaping the future of nuclear is vast, but so is the opportunity.

Nuclear falls from favour, but China bucks the trend

Nuclear power today meets around 5% of global primary energy demand and 9% of power output. The biggest fleets by order of magnitude are in the US, France, China, Japan and Russia. France, though, is the totemic industry leader, depending on nuclear for over 70% of its power supply.

Investment in conventional new nuclear power has stalled in most countries this century. The Fukushima-Daiichi disaster in 2011 caused Japan and South Korea to pause future nuclear investments. It also helped spur a phase-out of nuclear in Germany, where the last reactor was shut down in April 2023. In the US, the unconventional gas revolution and cost declines in wind and solar have made it hard for nuclear to compete. Around 4 GW of capacity has been retired since the end of 2017 and more is potentially on the chopping block. The few projects built or under construction in Europe and the US recently – including Olkiluoto 3 in Finland, Flamanville in France, Hinkley in the UK and Vogtle in the US – have all seen cost overruns and start-up delays.

China, with the world’s third-largest fleet, has bucked the trend. If it succeeds in lifting capacity from 50 GW to 70 GW by 2025 as it plans, it will take second place in the global rankings. Energy security, reducing dependence on baseload coal generation and relative competitiveness with natural gas underpin our nuclear forecast for China. A Chinese nuclear reactor costs roughly 50% less than a similar reactor in Europe, in large part due to supportive government policies that set out clear construction timelines.

Society’s quest for a lower-carbon future comes at a time when the nuclear fleet is ageing. Around 75% of global capacity was installed between 1970 and 1990, with output from this growth phase plateauing in the early years of the new millennium. This has challenged the world’s ability to decarbonise. A case in point is France’s nuclear fleet in 2022. Outages linked to stress corrosion faults detected in some French reactors caused electricity output to drop from 361 TWh in 2021 to 278 TWh ‒ a 30-year low – increasing energy prices and the call on liquified natural gas (LNG) and coal across Europe.

This is hardly what world leaders had in mind in terms of setting a stable decarbonisation pathway.

Nuclear policy is increasingly supportive

Policy is strengthening in favour of investment in conventional and emerging nuclear technologies in markets that account for more than half of global capacity.

- North America: the Inflation Reduction Act, Infrastructure Investment and Jobs Act, and several Department of Energy programmes have provided more than US$6 billion in public subsidies for uranium supply, operating nuclear capacity, SMR reactors and new reactor designs.

- Canada: large-scale new builds are on hold. SMR deployment is being actively explored and GE-Hitachi’s SMR design is expected to be built in Ontario by 2028.

- Europe: the UK has a twin-track policy to build both new pressurised water reactors (PWRs) and promote SMRs. France has added eight new reactors to its nuclear growth plans. Poland has plans for six new AP1000 reactors and is considering SMR plants. Turkey is building 4.8 GW, with an expected build time of about seven years. Romania has awarded a front-end engineering and design (FEED) contract to NuScale for the country’s first SMR power plant.

- Asia: China is growing rapidly in terms of both existing and new technologies. Japan has approved an extension for existing nuclear reactors beyond 60 years. South Korea’s tenth electric plan targets six new reactors and makes stable power supply a top priority. In India, more than 5 GW of nuclear power is in active development, with 22 GW targeted by 2031.

Lower costs are key to realising new nuclear potential

High costs are arguably the biggest impediment to a nuclear renaissance. On our estimates, conventional nuclear power currently has a levelised cost of electricity (LCOE) at least four times that of wind and solar.

Investors and policymakers need to think holistically in evaluating and comparing nuclear costs with those of other technologies. LCOE is just one metric for quantifying the competitiveness of generation technologies. Typically, LCOE does not take into account additional grid costs and these can often increase the relative cost of wind and solar compared with baseload energy sources, including nuclear.

Even so, the nuclear industry will have to address the cost challenge with urgency if it is to participate in the huge growth opportunity that low-carbon power presents. At current levels, the cost gap is just too great for nuclear to grow rapidly.

Companies such as NuScale, TerraPower, Westinghouse and GE Hitachi and X-Energy are among those trying to improve the competitiveness of a new generation of SMR and reactor technologies. One key challenge for these companies is to prove that their plants can be delivered on budget and for less than the Generation 3 or 3-plus PWRs that account for most of the investment in nuclear power today.

The SMR cost-saving pathway

With SMRs still at the drawing board or prototype stage, all-in costs are even higher than for the current generation of PWRs and significantly higher than wind, solar, natural gas and coal power generation. But SMRs are a ‘short-cycle’ approach to nuclear power, intended to avoid some of the manufacturing and commissioning pitfalls that giant PWR projects have encountered. SMRs are designed to be modular, factory-assembled and scalable. They are expected to be quicker to market, with a target construction time of three to five years compared with the ‘nameplate’ 10 years needed to build a large PWR.

SMRs are a ‘short-cycle’ approach to nuclear power

According to SMR developers, industrialisation ‒ the scaling up of manufacturing and the supply chain – will drive costs lower. Plant life is also expected to be longer. New projects are designed for up to a 60-year lifetime, compared with 50 years for a PWR reactor. As outlined by developers, they also have a smaller geographical footprint than PWRs and lower metals intensity. According to the International Energy Agency (IEA), nuclear requires around 5 tonnes of critical minerals per MW of power compared with 15 t/MW for offshore wind, 10 t/MW for onshore wind and 6 t/MW for solar.

Other cost-reduction measures are on the table, too. Several SMR developers plan to repurpose unused infrastructure formerly used by retired coal-fired plants. Dispatchable storage, supplied from nuclear generation, will allow SMRs to follow power supply trends and be fit for purpose in a solar- and wind-dominated future.

The SMR waterfall: what to look for

SMRs will be a small part of the power market through this decade. High costs are holding back deployment. Based on disclosed estimates from developers, World Nuclear News and integrated resource plan estimates, first of a kind (FOAK) SMR costs could be as high as US$8,000 per kW and as low as US$6,000 per kW. We believe that FOAK costs will be at the high end of this range, and could be even higher, as developers build out early-stage projects.

From our SMR project tracking, we think that there are six potential FOAK SMR projects ranging in size from 80 MW to around 450 MW. The pace of final investment decisions will be influenced by multiple factors: financing terms, commodity costs, uranium availability and the political will to see projects succeed.

Building greater scale will depend on how fast costs fall to a level that’s competitive with other forms of generation.

Building greater scale will depend on how fast costs fall to a level that’s competitive with other forms of generation. Wood Mackenzie’s modelling shows that if costs fall to US$120/MWh by 2030, SMRs will be competitive with PWR nuclear, gas and coal – both abated and unabated – in some regions of the world. Further price declines between 2040 and 2050 improve the economics. This analysis incorporates our carbon price forecast for Europe of US$140/tonne in 2030 and US$177/tonne in 2050.

What capacity levels would support lower SMR costs? Our expectation is that at least 10 to 15 projects – between 3,000 and 4,500 MW of capacity for a standard 300 MW SMR – need to be under development between 2030 and 2040. At these levels, economies of scale could be unlocked across the nuclear supply chain, based on research from the US Department of Energy. At this level of activity, the global industry would start to regain the momentum it had during the last nuclear growth phase from 1970 to 1990. By comparison, wind and solar needed 10 to 15 years, thousands of projects and continued public policy support to outcompete thermal generation.

What will it take to go nuclear?

Governments, developers and investors must work collaboratively to establish a new ecosystem for nuclear to flourish. Expanding public support for nuclear will be critical to expanding investment; voters will need to embrace the value proposition of nuclear for it to have a social licence to operate. This is not as unrealistic as it sounds: today’s nuclear industry grew out of the energy security concerns and high commodity prices of the 1970s ‒ similar market dynamics to those we face today.

Voters will need to embrace the value proposition of nuclear for it to have a social licence to operate.

There are four key aspects of expanding nuclear that need greater focus:

- Governments must lay the groundwork

Policymakers need to set out clear rules for planning, permitting, regulation and safety; arguments that new nuclear is ‘safer’ have yet to be proved. A middle ground around permitting timelines ‒ one that allows public, industry, and government dialogue – is needed to produce predictable timescales. Incentives would need to be considered, along with regulations that include subsidies for nuclear under ‘green technologies’ – an ongoing debate in the EU that is hampering action.

The US has developed the Civil Nuclear Credit Program and multiple tax incentives under the Inflation Reduction Act to kick-start investment. Governments could also launch competitive tenders with contracts for difference in long-term contracts for new power plants. This model successfully scaled up wind and solar in Europe without busting the public purse.

These or similar steps will ensure that capital flows into the sector to finance growth. Policy support in the form of mandates to purchase nuclear power could also develop.

- Expanding the uranium supply chain

Russia’s invasion of Ukraine should be a wake-up call for the nuclear industry. Wood Mackenzie projects uranium demand to double under our base-case scenario and triple under our Paris-compliant Global Pledges Scenario. Russia is currently a key supplier to both low and highly enriched uranium markets, especially to Eastern Europe and France.

Expanding uranium supply and processing would help promote long-term price stability and availability. Further recycling of uranium, exploring the use of plutonium recycling in civil nuclear programmes, and early-stage uranium alternatives, such as thorium, are also options to reduce nuclear waste and improve the overall efficiency of the uranium fuel cycle.

- Developers need to establish and refine their skillset

While many large infrastructure projects face delays and cost overruns, the nuclear industry has some of the largest overruns in the energy industry. SMRs will need to overcome nuclear’s challenging track record. No commercial, new-generation SMR plant is operating today.

Concentrated technological learning over 10 to 15 years proved key to the dramatic cost declines in wind and solar. Nuclear will need to undergo something similar. The expertise to build nuclear plants needs to be consistently re-applied; developers should prioritise a few technologies rather than a wide array of options. This will result in greater cost savings and faster deployment over time. Knowledge will need to be localised; a global supply chain for nuclear technology is unlikely to develop due to national security concerns. A fresh generation of engineers must be trained to execute projects and operate plants. Developers must think long term, working with schools and universities to establish a pipeline of engineers to grow and sustain the industry.

- Strong offtake agreements

Utilities around the world want diverse options for reliable carbon abatement and, for many, nuclear will be an important part of the mix. To overcome cost concerns, offtake agreements will need to be more creative than ever. Buyers will need to place a value on nuclear’s ability to deliver stable zero-carbon power, zero-carbon process heat, nuclear-based renewable energy credits and power supply for low-carbon hydrogen. The cost of lowering carbon emissions via nuclear should be compared with other abatement options, including thermal power with carbon capture, utilisation and storage (CCUS) and direct air capture technology.

Explore our latest thinking in Horizons

Loading...