Lens Upstream

Industry renowned data and analysis to build resilient, sustainable portfolios

Request a demo

Lens Upstream

Industry renowned data and analysis to build resilient, sustainable portfolios

Navigate the energy transition with certainty

Setting your course through the energy transition requires bold, future-focused decisions. Lens Upstream enables you to discover, model, value and rapidly assess strategic growth opportunities and efficiently allocate capital for resilient and sustainable portfolios.

Features and workflows

To analyse risk vs reward, you need trusted data. Lens provides you with the insights you need to increase performance and make decisions with confidence.

Key features of Wood Mackenzie's Lens Upstream:

- Opportunity screening and benchmarking.

- Asset and company valuations.

- Sensitivity analysis.

- Scenario modelling.

- Portfolio optimisation.

Wood Mackenzie's Lens Upstream provides data on:

- 280,000+ offshore facilities.

- 5,600+ upstream assets.

- 5,000+ tax markers.

- 500+ potential economic developments.

- 250+ fiscal regimes.

- 180 countries.

- 11,000+ companies and subsidiaries.

Wood Mackenzie's Lens Upstream enables a number of key workflows including:

- Discover, model and value assets and companies and test hypotheses to assess risk vs. reward.

- Identify strategic fit for potential targets and compare acquisition candidates within an intuitive interface.

- Generate multiple asset and company valuations using various pricing scenarios.

- Run 'what if' analysis for real-time M&A ideation and assessment.

Why choose WoodMac's Lens Upstream?

- Renowned quality from embedded industry relationships.

- All aspects of global upstream covered.

- Built from the bottom up, asset by asset. Verified.

- Trusted global fiscal coverage driven by the deep knowledge of each region and the intricacies of the tax positions of every asset.

- Ongoing access to a dedicated team of expert analysts.

- Truly integrated platform for all Lens solutions - data points are connected and aligned across all solutions for consistent analysis of any commodity across regions. A uniquely integrated and consistent global view.

Shell

Shell

Data is changing so quickly…A product like Wood Mackenzie Lens allows you to visualise in real terms, a particular aspect you are interested in researching.

Frequently asked questions

Here you’ll find answers to the most common questions you may have on Wood Mackenzie's Lens Upstream. If you have any other questions, get in touch.

Lens Upstream Discovery:

- Utilise the powerful search functionality as a starting point for investigations.

- Identify, evaluate, and screen for advantaged resources and geo-energy growth opportunities.

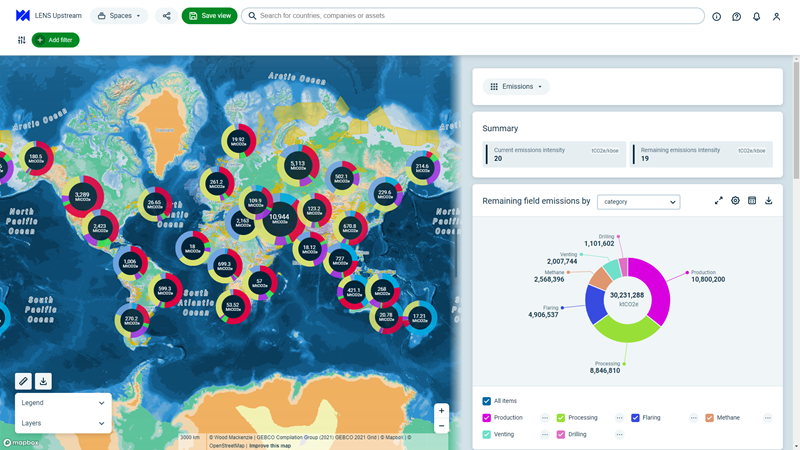

- Robust and instant mapping visualisation capabilities.

Lens Upstream Modelling:

- Value assets and company portfolios, and model scenarios under your own price assumptions to understand the impact on value and performance.

- Valuation scenarios are delivered in seconds.

- Perform sensitivity, benchmarking and risk analysis as part of your economic forecasting workflows.

Lens Upstream Optimisation:

- Make confident strategic decisions across your portfolio by rapidly testing different deal hypotheses to assess risk vs reward.

- Run ‘What if’ analysis across the asset mix, deal timing, equity stake, project acceleration or deferral.

- Screen and benchmark assets and companies on upstream carbon emissions (scope 1 & 2) to high-grade those that could have a significant impact on portfolio level emissions.

- Understand the contribution of upstream emissions by 7 category sources (e.g. flaring) and identify assets where investment in mitigation measures may result in a significant reduction in absolute portfolio emissions.

Our global data is unrivalled as it is built from the bottom up, asset by asset. We verify and sense check our assumptions and data with operators and partners, taking into account the corporate viewpoint to ensure you have a complete, accurate picture.

- What is the value of a company's portfolio or any part thereof under your own price and valuation assumptions?

- What is a company's capital, operating and abandonment cost exposure over the next 10 years?

- What is the value of an asset package under the $25 oil for the next 2 years.

- What percentage capex reduction is required to make an asset development plan profitable under $25 oil.

- What is the cash flow outlook for a company under your new price assumptions?

Contact an expert

Whether you’re evaluating M&A potential, building portfolios around advantaged barrels, or making capital investment decisions, our experts are on hand to guide you through how Lens Upstream can help you.