Emissions Benchmarking Tool

Data and insights to validate strategic decisions on emissions risk management

Competitive benchmarking, portfolio analysis and economic impact assessment

Emissions targets set under the 2015 Paris Agreement – and new pledges under the Glasgow Climate Pact – have far-reaching and material implications for the long-term corporate strategies of every player in the energy and extractive industries.

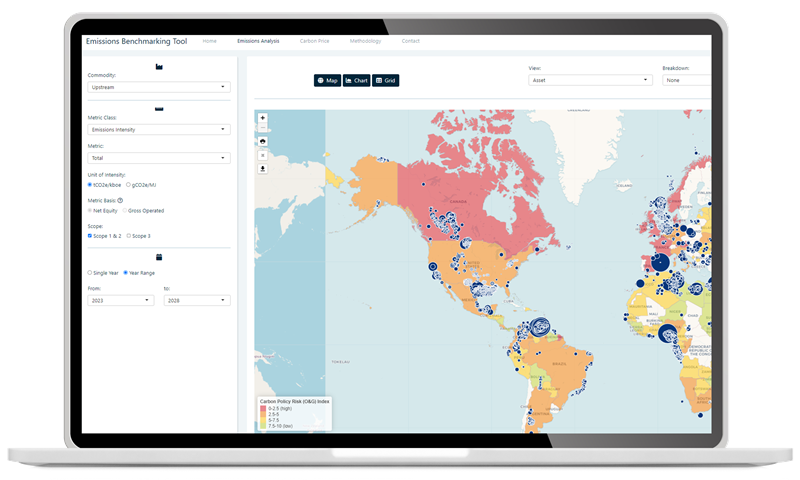

The Emissions Benchmarking Tool provides transparency at the asset and corporate level for Upstream, Downstream and Metals & Mining to enable a comprehensive assessment of emissions-related risks and opportunities.

Features and workflows

Prepare for a lower carbon future with a consistent, transparent and standardised view of emissions-related trends, risks and opportunities.

Key features of Wood Mackenzie's Emissions Benchmarking Tool:

- Emissions profiles: Asset-by-asset forecasts within each of the value chains to 2040/2064 (depending on sector).

- Carbon pricing and policy risk: Assessment of the likelihood and stringency of carbon regulation on the Oil & Gas and Metals & Mining sectors in all countries.

- Carbon benchmarking: Comparing companies’ and assets’ emissions profiles, risks and liabilities on a like-for-like basis.

- Financial liability: Evaluation of the impact of carbon pricing on asset and corporate valuations.

Wood Mackenzie's Emissions Benchmarking Tool provides data on:

- Asset level emissions by source: historical and forecasts to 2040 (Downstream and Metals & Mining) and 2064 (Upstream).

- 12,000+ assets and 1,500+ companies modelled in upstream oil and gas, 500 refineries and 230 companies in downstream.

- 8 key metals & mining value chains covered (Aluminium, Thermal Coal, Nickel, Copper, Zinc & Lead, Gold, Lithium and Met Coal, Iron Ore & Steel).

Wood Mackenzie's Emissions Benchmarking Tool enables a number of key workflows including:

- A comparison of the emissions profiles and intensities of your portfolio and assets with those of your peers.

- Assess sector-specific emissions-related regulatory risks at the country level.

- Analyse the impact of different carbon prices on asset or corporate valuations.

- Make strategic decisions on portfolio composition and mitigation opportunities.

Why choose WoodMac's Emissions Benchmarking Tool?

Standardised methodology ensuring accuracy and reliability, enabling you to compare like for like emissions data to make informed decisions to shape your sustainability strategy.

Full value chain coverage combining the experience of our upstream, power, and energy transition teams. The tool provides the unique ability to assess the full lifecycle emissions of upstream asset production.

Independent opinion so you can rely on analysis reconciled with reported data and feedback from the industry stakeholders, then further enhanced by our global analysts’ independent expertise.

Cross-sector tool integrating global data across all natural resource sectors to give you a complete picture at the asset and corporate level across the value chain for Upstream, Downstream and Metals & Mining.

Frequently asked questions

Here you’ll find answers to the most common questions you may have on Wood Mackenzie's Emissions Benchmarking Tool. If you have any other questions, get in touch.

-

How do corporate and asset emissions compare across upstream, downstream and metals & mining operations?

-

Which types of assets are most/least carbon intensive?

-

What are the largest sources of emissions?

-

To what extent are the oil & gas and metals sectors exposed to carbon regulation worldwide?

-

How could carbon-related costs impact asset and corporate valuations?

-

How can companies reduce emissions and financial exposure?

-

What is the global emissions footprint of the extractive industries?

-

Companies with Upstream and/or Downstream oil and gas assets, or mining, smelters or refineries in Aluminium, Thermal Coal, Nickel, Copper, Zinc/Lead, Gold, Lithium and Met Coal, Iron Ore & Steel.

-

Investment managers or institutional investors interested in understanding the risk in their extractive industry portfolios and how to mitigate that risk.

-

Investment banks looking to incorporate emissions performance and carbon risk exposure in their equity ratings or deal due diligence.

-

Governments wishing to assess the potential impact of carbon regulation on the country’s Upstream or Downstream oil and gas sector, or Metals & Mining sectors.

-

Service companies interested in understanding the risks and opportunities to their businesses arising from oil and gas, mining and metals processing emissions performance and carbon risk exposure.

Upstream Scope 1 & 2: Drilling, production complexity, processing complexity, flaring, venting, liquefaction losses, methane losses, ecosystem disruption.

Downstream Scope 1 & 2: Fuel, FCC, electricity, hydrogen production and flaring.

Metals & Mining Scope 1 & 2: Mining, fuel oil, smelter, coal, coke, gas, electricity.

Oil & Gas Scope 3: Transport and shipping, refining, downstream transport, distribution and end-use.

Contact an expert

Want more information on how our Emissions Benchmarking Tool can help you reach your emissions targets?