与我们分析师联系

Can biomethane decarbonise Europe’s gas market?

Europe is the leading global producer of the net-zero carbon renewable gas, but continued growth depends on policy support

3 minute read

The European Green Deal has set Europe a target to be climate neutral by 2050, with a 50-55% reduction in greenhouse gas emissions by 2030. As a net-zero carbon renewable gas, biomethane could play a role in achieving this goal. Europe is the leading producer globally – but is the policy framework in place to support growth?

This article is an extract from Biomethane in the European gas market: a look at five key countries. Fill in the form for a preview with a summary of key policy approach by country.

What is biomethane?

Biomethane is a purified form of biogas, which is produced through the anaerobic digestion of organic matter. Commonly used feedstock includes food waste, crops, slurry, and manure. Upgrading biogas to biomethane removes contaminants from the raw biogas stream, leaving more methane per unit volume of gas – typically over 95%.

Biomethane is close enough to the properties of conventional natural gas that it can be directly injected into the existing gas network, compressed in the form of CNG or liquefied as bio-LNG. So it’s a strong substitute for use in hard to decarbonise sectors, such as heating and transport.

This effectively opens up a distinct route to a carbon-neutral gas market, outside of hydrogen, carbon capture and storage, and electrification.

How big is the biomethane opportunity in Europe?

In 2019, European gas demand reached 514 bcm. In the power sector, gas has come under pressure from renewables. Decarbonising the non-power sectors is a key opportunity for biomethane. It not only supports emission reduction commitments underlined by the European Green Deal, but also reduces the reliance on gas imports.

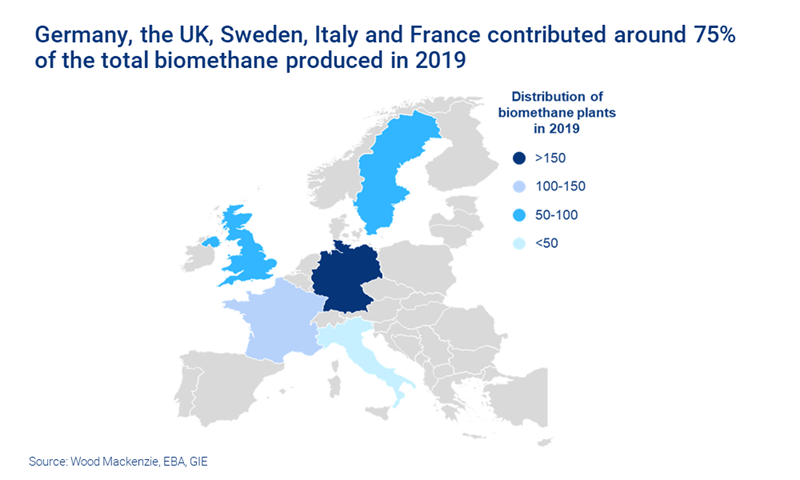

Europe is already the leading producer of biomethane globally, with Germany, the UK, Italy, France and Sweden as the key markets. But it’s still a very small component of the gas supply mix. Total production for these five countries is estimated at 2 bcm in 2019. Germany leads the pack, contributing around 54%.

Between 2010 and 2019, biomethane production increased by 1.8 bcm. The UK has ramped up from close to zero output since 2014, showing the fastest growth. Production in France also increased exponentially. In both cases, there’s a strong correlation between supportive policy and direct investment into biomethane.

Right now, policy varies significantly by country, with feed-in tariffs as the most common measure. Fill in the form at the top of this page for a preview of the full report with a complimentary breakdown of the key policy framework.

Germany

Biomethane produced in Germany is largely used in the power sector. This supports ambitious renewable targets – at least 35% of total electricity production by 2020 and 80% by 2050.

The sector has thrived thanks to government policy that set an initial 20-year remuneration period for new installations. However, the remuneration starts to elapse from 2021. If no ongoing support is provided, producers could struggle to keep operating due to high ongoing costs, including debt servicing. It also becomes a higher risk investment for new producers.

UK

Biomethane has been injected into the National Grid from certified Renewable Heat Incentive (RHI) installations since 2014. Lucrative rates successfully activated interest in the market.

The UK aims to reach 12% renewable heat, 30% renewable electricity and 10% renewable transport by 2020, and has a net zero target of 2050.

Italy and Sweden

These countries currently produce similar levels of biomethane, though Sweden maintains more than double the number of plants. Both governments recently laid out a specific policy framework to support biomethane for use in the transport sector.

Italy plans to make use of bio-LNG for freight vehicles. Sweden is targeting 100% biomethane in vehicle grade gas by 2030 – and aims to achieve 100% biomethane within the gas grid by 2050.

France

Like the UK, France has committed to a 2050 net zero target. Energy policy calls for ambitious growth in the biogas sector, with the quantity of biomethane fed into the public grid targeted at 0.8 bcma by 2023 and 3 bcma by 2030.

While biomethane in France is primarily used as vehicle fuel, there’s no specific focus on that sector. The domestic heating market, which makes up the largest share of total demand in France, could instead provide a target for future growth.

What stands in the way of growth?

Robust policy support is vital. Europe currently hosts a patchwork of mechanisms that lack clarity and keep changing. Large differences in approach could make major investment into the sector more difficult for multi-national companies, compared to other renewable developments. And the European Green Deal appears to have a focus on developing hydrogen projects – which could compete with biomethane for future financial and political support.

Biomethane/RNG Service

Gain access to in-depth insights specifically tailored for the biomethane/RNG industry

Learn More