Could new EU tariffs on Chinese imports slow EV adoption?

Planned measures are intended to clear the road for European electric vehicle manufacturing, but they could backfire

4 minute read

Prateek Biswas

Senior Research Analyst, Transport and Materials

Prateek Biswas

Senior Research Analyst, Transport and Materials

Prateek specialises in EV policy drivers, automaker electrification strategies and battery supply chain trends.

Latest articles by Prateek

-

Opinion

Have policy headwinds pushed electric vehicles into the slow lane?

-

Opinion

How will the new US Republican government reshape the global electric vehicle supply chain?

-

Opinion

Could new EU tariffs on Chinese imports slow EV adoption?

-

Opinion

What’s next for the EV and battery value chains?

The European Commission has announced plans to implement tough new import tariffs for Chinese electric vehicle (EV) producers. The intention is to incentivise and support the scaling up of EV manufacture within the European Union. But with the transition to electric vehicles showing signs of stalling, could these new measures misfire?

Wood Mackenzie’s Metals & Mining team have published an insight detailing eight key implications of the new tariffs. Fill out the form at the top of the page to download a complimentary copy of the report or read on for a quick overview of the topic.

What’s happened?

In October 2023, the European Commission (EC) initiated a probe into whether Chinese battery electric vehicle (BEVs – defined as full EVs as opposed to plug-in hybrids) manufacturers enjoyed an unfair competitive advantage, posed a ‘threat of economic injury’ to European carmakers, and could distort the region’s car market imminently.

The probe was in response to rising BEV imports within Europe as well as increasingly aggressive business expansion announcements by Chinese EV makers.

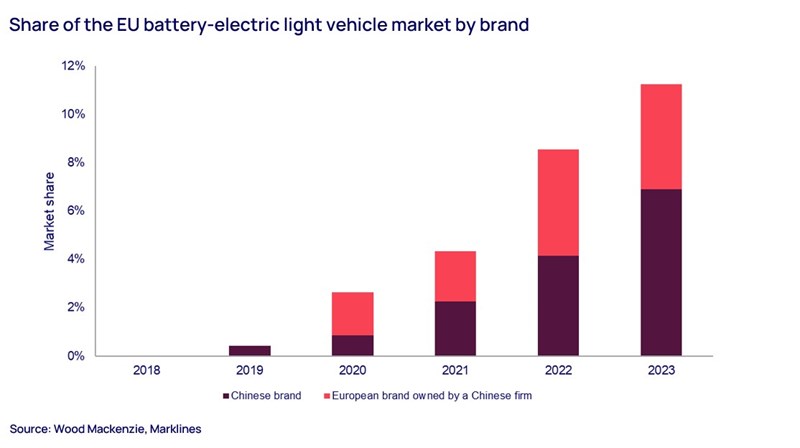

Note: Chinese firm-owned European brands include Volvo, Polestar. Chinese brands include MG, BYD, Xpeng, Nio, etc.

On 12th June 2024, the Commission provisionally concluded that BEV manufacturers in China benefited from unfair subsidisation and applied countervailing duties (CVDs) between 17.4% to 38.1% on imports from the country.

On 3 July 2024, after extensive discussions with the Chinese government, the Commission marginally reduced the top end of the duties and published an Implementing Regulation (2024/1866) in the Official Journal.

The CVDs are producer-specific, ranging from 17.4% on BYD vehicles to 37.6% on ones produced by the Shanghai Automotive Industry Corporation (SAIC). BYD (‘Build Your Dreams’) is one of China’s largest privately owned businesses, with Berkshire Hathaway owning a 6% stake. SAIC – which has joint ventures with General Motors and Volkswagen and sells cars under the iconic MG badge in Europe – is state owned. In addition, OEMs who voluntarily took part in the investigation are destined to pay supplementary duties at a 20.8% rate. Meanwhile OEMs who refused to cooperate will find themselves hit with a huge 37.6% additional tariff.

What are the likely consequences?

The EU’s targeted duties seem to have three clear aims:

- To give European OEMs breathing space to scale up EV manufacturing and achieve profitability

- To incentivise Western OEMs to produce upcoming low-cost EV models within the bloc

- To encourage Chinese OEMs to invest in European manufacturing bases

Currently, around 20% of battery electric cars and vans, or ‘light duty vehicles’ (LDVs), sold in Europe are imported from China. Assuming the provisional tariffs are converted into definitive duties as is (and Chinese producers pass them through to consumers), they will have a significant impact on the total cost of ownership of EVs within the EU.

This will be the case regardless of the efficacy of existing subsidies, corporate benefit-in-kind policies and exemptions from road and registration taxes. We revised down our near-to-medium term EV forecast for Europe in March 2024 in anticipation of these CVDs.

Could anything stop the tariffs coming into force?

While severe, this protectionist measure is still provisional. Whether or not Europe and China can reach a new deal, divisions within the EU suggest that the tariffs could either be rolled back, or at least eased, by November.

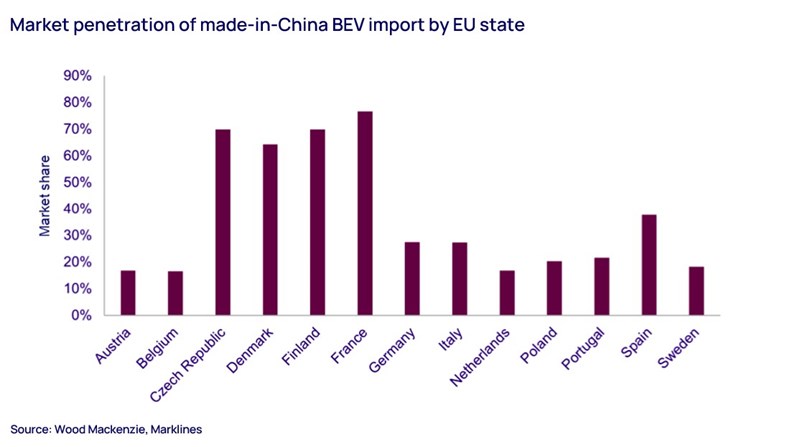

Enthusiasm for the new tariffs within the bloc has largely depended on the level of threat Chinese EVs pose to individual countries’ manufacturing base, as well as each member state’s exposure to potential Chinese retaliation. France, where Chinese manufacturers account for around three-quarters of BEV sales (see chart below), has been most vocal in its support – especially since French OEMs mainly operate at the lower end of the EV market where China dominates.

In contrast, Germany’s OEMs largely target the upper end of the market and derive a third of their sales from China, while Chinese EV penetration into the German market is relatively low. As a result, the German government has actively opposed the measures. Similarly, Sweden has a vested interest in opposing the scheme; Chinese penetration into the Swedish BEV market is below 20%, and Swedish marque Volvo is majority owned by Geely, which is a Chinese company.

The tariffs are therefore likely to face considerable pushback and may even be blocked in the EU’s Trade Defence Instruments Committee in November, if Germany and Sweden can form a qualified majority with other interested parties.

Regardless of the final decision on tariffs, however, Chinese EVs face other difficulties in the European market where brand equity is a major barrier to entry.

Learn more

Don’t forget to fill out the form at the top of the page to download your complimentary copy of the report, which provides our analysts’ eight key takes on the topic.