Power purchase agreements: how will they support renewables growth?

PPAs offer attractive investor guarantees, but the market is still relatively small

1 minute read

Prashant Khorana

Director, Power & Renewables Consulting

Prashant Khorana

Director, Power & Renewables Consulting

Prashant is Director, Data Product Owner – Asset Valuations within Wood Mackenzie's research and data organisation.

Latest articles by Prashant

-

Opinion

What we learned from conversations with power and renewables investors in 2024

-

Opinion

Underwriting Battery Energy Storage Systems (BESS) as an asset class

-

Opinion

10 transaction themes for private equity and principal investors in 2024

-

Opinion

What we learned from conversations with power and renewables investors in 2023

-

Opinion

How power and renewables investors should navigate the Inflation Reduction Act and recent power market volatility

-

Opinion

Who will foot the bill for the energy transition in Asia-Pacific?

Power purchase agreements (PPAs) are now commonplace in the renewable energy sector. PPAs are attractive as they provide a near guarantee that cash flow will be stable for a good portion of an asset’s life. For potential investors, they are critical as they drive project profitability and increase security of returns.

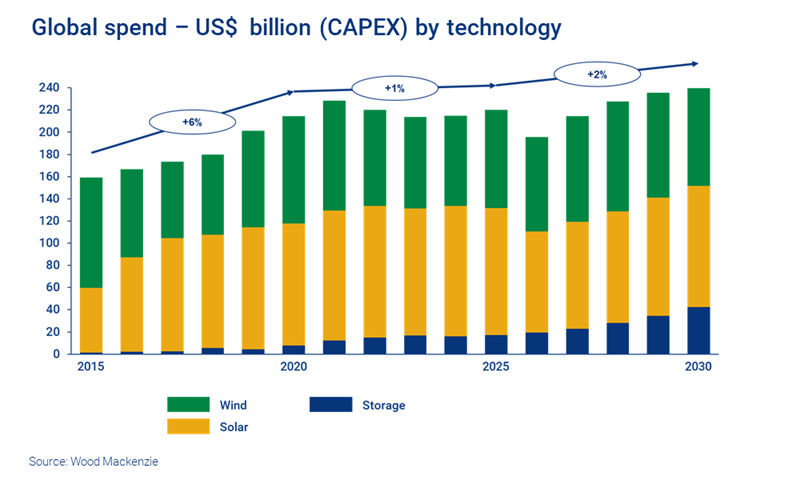

But the overall market for PPAs is still relatively small. With wind, solar and storage capacity set to attract an estimated US$200 billion in capital per year between now and 2030, how will PPAs support the growing renewables market? And which regions are leading the way?

On a recent webinar, we discussed how the PPA market is evolving. Got 40 minutes? Fill in the form to access the replay. Got 5 minutes? Read on to catch up with the highlights.

Has Covid-19 affected the PPA market?

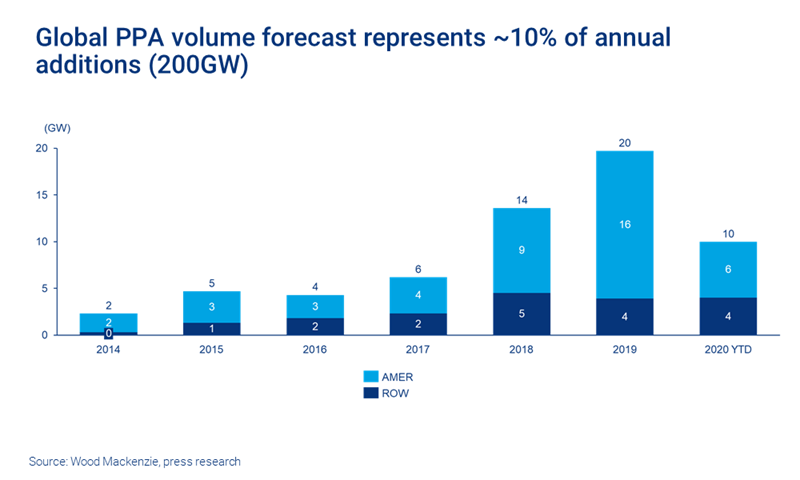

Global PPA volumes cover about 10% of renewable energy projects. That’s still relatively small, but the market is growing fast: 2019 saw an increase to 20GW of installs – a steep uptick from the 14GW contracted in 2018.

While PPA numbers took an initial hit in the early part of this year due to coronavirus, the rush of activity in the last quarter should mean that 2020 volumes recover to levels broadly similar to 2018.

Where are PPAs most prominent?

North America leads the way, supported by its flexible market structures. 2018 was a boom year for corporate renewables procurement in the US, and the region will continue to be a hotspot for PPA deals through to 2025.

While there is an appetite for PPAs in Europe, growth is constrained. Auctions are still key to driving utility-scale solar photovoltaic (PV) growth, financing 69% of installations.

Asia is emerging as a leading market.

Some providers, such as those in fast-moving markets, can command a premium price. But it’s all about balancing risk and reward. Listen to the webinar to understand what investors should consider.

What can we expect for PPAs over the next 20 to 30 years?

The transition away from legacy models for renewables financing – including feed-in-tariffs and auctions – is a positive sign that the market is evolving and that renewables are better understood.

And we can expect the market to continue to evolve. Inevitably, as investors have more confidence in financing renewables, the reliance on fixed-term contracts – of the kind offered by PPAs – for 20 to 25 years will diminish.

A combination of revenue streams will become the norm as PPAs and contract structures develop in complexity.

How big a role will auctions continue to play, and for how long? Listen to the webinar to find out.

Who’s investing? And will Big Oil become a more significant player?

Three types of investors usually dominate capital deployment in wind, solar and storage: listed funds, unlisted funds and utilities.

Although there is interest from new investors in the renewable space, it will be some time before the overall investor profile changes significantly.

Big Oil is one new market entrant. As the Euro Majors build their renewable energy portfolios to support bold decarbonisation targets, we expect they will aim to maximise PPAs as they develop assets, attracted by the stability these contracts provide. However, their involvement should be a relatively small slice of overall market activity.

For more on this topic, watch the webinar replay. Fill in the form at the top of the page for complimentary access.