Rising to the North Sea emissions challenge

What’s the emissions intensity of the North Sea upstream sector – and who can drive change?

3 minute read

Although most North Sea oil and gas production remains with the largest global players, regionally-focused companies are taking an increasing share of the pie. That shift means these firms are also responsible for a growing percentage of the region’s emissions.

Our report – Who can drive North Sea decarbonisation? – draws on our Emissions Benchmarking Tool to explore the important role regionally-focused companies will need to take in the quest for net zero. Fill out the form to access an extract or read on for a quick introduction.

North Sea decarbonisation: where are we now?

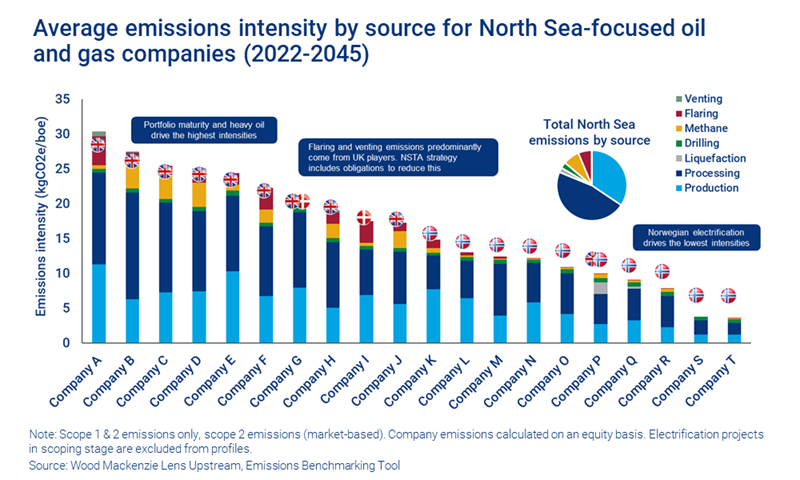

The UK and Norway’s North Sea oil and gas operations are a small but significant source of global carbon emissions. Our analysis indicates that 30% of Scope 1 and 2 emissions from the region to 2045 will come from regionally-focused non-Majors, with three-quarters of that coming from seven key players (operators of this type have yet to set Scope 3 net zero ambitions).

Norway’s emissions intensity is amongst the best globally, thanks to on-site electrification, a high percentage of onshore power coming from renewables and relatively new projects. That and other factors mean Norway is well positioned to become a super basin of the future. UK emissions intensity is higher by comparison, due to more mature fields and heavy oil that’s harder to extract. UK project economics are also challenged for the big ticket emissions reduction solutions, such as electrification, as carbon prices aren't as high as Norway.

What’s the base-case scenario?

Carbon emissions will fall as production declines and fields stop operating. But because emissions intensity rises as fields mature, the reduction in power used for production and processing equipment will be less than the reduction in barrels produced.

What’s driving change in the North Sea?

Pressure on companies is coming from two key sources. Investors are increasingly aware of the issue and are putting firms under greater scrutiny, while at the same time policy and regulation is forcing companies to act.

Increasingly stringent carbon pricing means producers will need to decarbonise or face substantial cost pressures. UK firms with high emissions, low margins and stretched balance sheets could be particularly at risk. Meanwhile, more stringent project approval criteria mean projects still awaiting final investment decision need to be lower emitting.

What can be done about the UK’s upstream emissions intensity?

Curbing venting and flaring and improving production efficiencies are easy fixes, but they won’t have enough impact. Bigger reductions are made possible by using an electric power source on platforms, but for mature UK assets, which may not have enough remaining value, the high cost of implementation is hard to justify.

Another option for companies wanting to reduce their overall corporate carbon footprint is through M&A with lower-polluting companies, although this won’t solve the problem at a national level. Or producers can focus on advantaged low-carbon hubs. That's what we are starting to see in Norway as electrified platforms offer lower emissions for near-field tie-backs.

Who can drive change?

Production will tail off over time, so the impact of decarbonisation is magnified substantially with earlier action. Collaboration between all stakeholders will be needed to move the dial, including exploration and production companies, supply chain, governments, regulators and energy providers.

If that happens, we estimate the 20 North Sea-focused companies could reduce carbon emissions by 8 million tonnes across the region by 2045 – if they start now. That’s the equivalent of 35% of overall 2022 emissions.

The full report covers this subject in detail, exploring which companies are best placed to contribute to decarbonisation.

Fill in the form at the top of the page to access a complimentary extract.