与我们分析师联系

1 minute read

The energy transition is gathering pace. But however fast it moves, oil and gas will play a significant role in meeting energy demand for decades to come. However, as the industry has significantly more barrels available than needed, only the barrels with the lowest costs, lowest carbon emissions and best economics will come to market. These ‘advantaged resources’ exist at all stages of development – including incremental upside in producing fields, discovered green fields and prospective resources – and they depend on advantaged reservoirs.

So, how can the best reservoirs be identified? Which subsurface factors could narrow the search?

This is the first in a series of insights using the power of our new Lens Subsurface Discovery solution to analyse the critical subsurface factors that correlate with reservoir performance and value. In it, we focus on field recovery factors. Our analysis looks across the global population of fields, exploring subsurface reservoir parameters, such as porosity and depth, as well as other field parameters, including location, fluid properties, recovery mechanism, development technologies and investment.

A complex mix of geologic factors is in play. Relationships between reservoir geology and performance are strongest when the data are filtered by region or resource theme. And it’s only by looking at a wide population of similar reservoirs that operators can benchmark recovery factors – and pick out an asset, portfolio or play that presents an opportunity.

The scale of that opportunity could be huge. Brazil, for example, has by far the largest in place oil volumes, yet lags other leading deepwater countries in terms of average recovery factor. The prize for increasing deepwater field recovery to match international benchmarks would be enormous.

What are the subsurface factors that matter?

Our analysis focuses on three selected examples of key reservoir parameters that correlate with oil recovery factors.

These are:

- Porosity

- Reservoir depth

- Gross depositional environment (GDE)

Globally, the average oil recovery factors for combined primary and secondary recovery are around 32%. Increasing the recovery factor of maturing projects could significantly boost the economics of a mature asset. We can see this illustrated in our exploration of these three key subsurface factors.

1. Oil recovery factor and porosity

The correlation of recovery and porosity may seem obvious, when all other things are equal. But many other factors obscure what might be expected to be a clear trend.

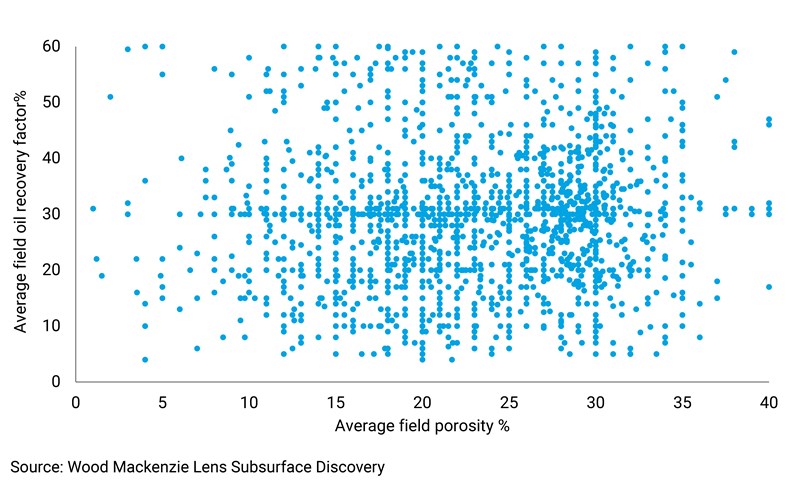

We plotted the average reservoir oil recovery factor against average reservoir porosity for over 13,500 offshore oil reservoirs available in Lens Subsurface Discovery. There is no apparent trend when data is viewed at this level, confirming that porosity alone is not enough to predict or benchmark recovery factor. The global spectrum of different fields introduces too many variables.

A deeper dive into the data is necessary.

Filtering to just deepwater fields reveals a general positive trend between average reservoir porosity and oil recovery factor. Nearly every deepwater reservoir is buried deeper than 1000m below sea level, averaging around 4000m.