The success of EU’s ‘Fit for 55’ package hinges on the action of local authorities

The proposed measures will increase demand for wind power across the EU – but strong barriers on the local and national level repress an accelerated wind buildout

1 minute read

On 14 July 2021, the European Commission presented the ‘Fit for 55’ package, laying out the bloc’s green economy blueprint through 2050. A host of proposed measures in the package is dedicated to alleviating challenges faced by the wind industry.

Fill in the form to download the full insight “Is the EU ‘Fit for 55’ – Brussels may want to check with local authorities first”, where we give the verdict that the success of the measures to speed up wind buildout hinges on the action of local and national authorities in the EU-27.

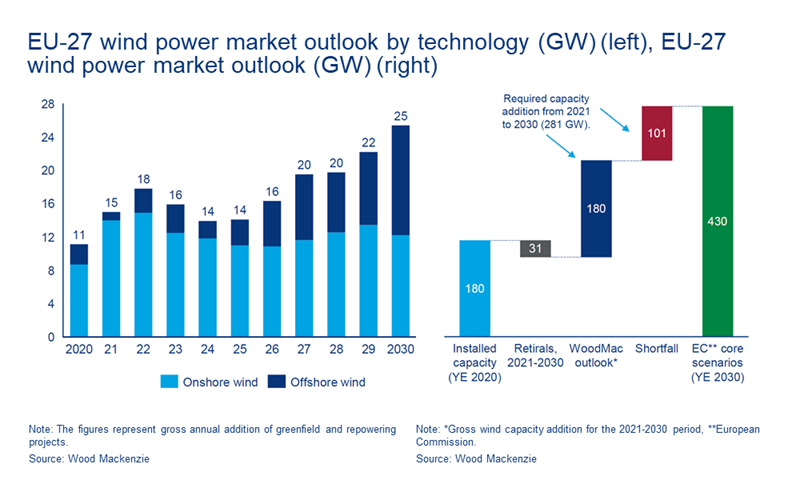

The EU risks falling 101 GW short of their wind ambitions for 2030

The ‘Fit for 55’ package proposes an increase of the renewable energy share target in the EU-27’s final energy consumption from 32% to 40% by 2030. To reach this target the European Commission bets big on wind power buildout. Even though no specific capacity targets have been set in the package, the EU’s ambitions necessitate 430 GW of wind power capacity by 2030, as outlined in their core scenarios.

To reach this level of cumulative installations, the EU-27 need to connect 281 GW of wind capacity between 2021 and 2030, 56% more than forecasted in Wood Mackenzie’s current base case outlook.

EU’s proposed measures improve prospects for C&I demand and cross-border cooperation

Complex and heterogeneous regulatory frameworks across the Member States and difficulties in securing finance have been main barriers to the expansion of corporate and industrial (C&I) demand for renewable energy. To accelerate corporate procurement of renewable energy the European Commission proposes access to credit guarantees to all corporates to lower financial risk and guarantees of origin for all renewable energy producers. Lowering key barriers for C&I PPAs will enable higher demand for wind capacity buildout.

Additionally, the EU aims to foster cooperation across Member States to accelerate capacity buildout. The Commission obliges the Member States to have a cross-border pilot project in place within three years; either in the form of statistical transfer, support scheme, or joint project. Due to cost efficiencies and better use of resources, cross-border cooperation enables lower LCOE, lower CAPEX, and OPEX and overall lower support cost.

Therefore, the EU incentivises shared projects through EU funds such as the renewable energy financing mechanism and Connecting Europe Facility of Renewable Energy Fund. Better economics through cross-border cooperation further increases the demand for new wind installations.

Permitting remains the main roadblock for quick wind power capacity ramp-up

Despite the demand upside from C&I PPAs and better economics due to cross-border cooperation, the main barrier for wind installations in the EU remains: permitting. Bureaucratic bottlenecks and restrictive local policies disable or delay permitting procedures. Across many key wind markets in Europe such as Germany, Italy, and Poland a lack of permitted projects has caused undersubscriptions and decreased wind wins at renewable energy auctions.

While the EU stresses the need for simplified and efficient permitting procedures, it stops short of going farther because measures from the Renewable Energy Directive II are in the implementation phase already. Member States are to report on measures to improve administrative procedures for renewable energy installations in March 2023 in their progress reports – yet, Brussels has little ability to influence local politics or objections to wind buildout. More administrative resources and local acceptability are the necessary conditions for an accelerated deployment of wind power.

Therefore, the success of the EU’s measures and the upside to Wood Mackenzie’s base case outlook depend highly on tangible improvements in the Member States’ national and local policies through the first half of the 2020s.

Fill in the form at the top of the page for complimentary access to the full insight.