Get Ed Crooks' Energy Pulse in your inbox every week

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

Rising electricity demand in Texas: the canary in the coalmine for the rest of the US?

-

Opinion

Deals show the enduring appeal of US gas

-

Opinion

2024 is a year of elections. What will they mean for clean energy?

-

Opinion

Home energy storage booms in the US

-

Opinion

China’s solar growth sends module prices plummeting

-

Opinion

Everyone is worrying about rising demand for electricity. Do Microsoft and Google have an answer?

Millions will lack power, pollution deaths will continue and harm from climate change will be locked in unless the world changes course.

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

Rising electricity demand in Texas: the canary in the coalmine for the rest of the US?

-

Opinion

Deals show the enduring appeal of US gas

-

Opinion

2024 is a year of elections. What will they mean for clean energy?

-

Opinion

Home energy storage booms in the US

-

Opinion

China’s solar growth sends module prices plummeting

-

Opinion

Everyone is worrying about rising demand for electricity. Do Microsoft and Google have an answer?

The annual publication of the International Energy Agency’s World Energy Outlook is always a landmark event in the calendar. Even people who disagree with its conclusions acknowledge that it provides a wealth of thought-provoking data and analysis, and the 808-page 2019 edition, published this week, is no exception.

Media coverage highlighted a range of different lines, including the prospect that the continued growth of tight oil would bolster US influence over OPEC member countries, and the IEA’s warning that the world’s greenhouse gas emissions are set to rise until 2040, even if governments meet their existing environmental targets. Fatih Birol, the IEA’s executive director, warned that “the world urgently needs to put a laser-like focus on bringing down global emissions”.

Other analysts have delivered similar messages. Wood Mackenzie’s Energy Transition Outlook in August warned that the world was on a path to about 3 °C of warming, rather than the “well below” 2 °C objective of the 2015 Paris climate agreement.

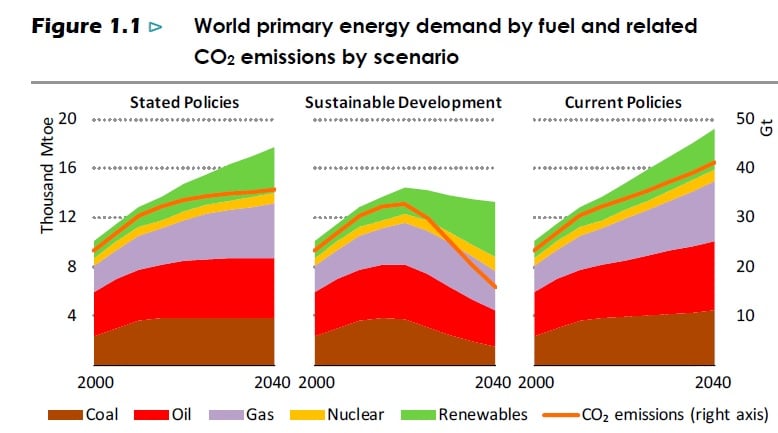

In some respects, however, WoodMac is rather more optimistic about the outlook. The IEA presents its projections as scenarios showing possible future states of the world rather than forecasts, and conditions those scenarios mostly on policy changes. Its three main projections are its Current Policies Scenario, which is essentially a” business as usual” case assuming existing frameworks remain in place, a Stated Policies Scenario, which incorporates announced policy intentions and targets, and a Sustainable Development Scenario, which would achieve the Paris climate goal as well as universal energy access and cleaner air.

Those three scenarios have radically different implications for total world energy demand, as this chart shows. In the Current Policies Scenario total world energy consumption by 2040 grows by 34% from its 2018 level, and in the Stated Policies Scenario it grows by 24%. Those numbers reflect the IEA’s caution about the outlook for energy efficiency.

However, David Brown, WoodMac’s head of markets and transitions for the Americas, argues that there is greater scope to bend the curve of energy demand than the IEA’s scenarios suggest. Even in our base case forecast, which is the closest to the IEA’s Stated Policies Scenario, we see more potential for improving the efficiency of energy use in industry, buildings and transport, meaning that by 2040 we see total world demand as rising by just 17%.

There are opportunities to go even further. WoodMac’s energy transition team is working on two scenarios showing the scope for curbing greenhouse gas emissions, to be published over the next few weeks, and the potential for faster efficiency gains are a central part of that work.

In June the IEA launched a Global Commission for urgent action on energy efficiency, chaired by Leo Varadkar, prime minister of Ireland. Its aim is to find ways to make sure that potential for efficiency gains is realised. If the initiative is successful, it will push the world towards the energy efficiency path that WoodMac’s researchers think is achievable.

How far can US LNG grow?

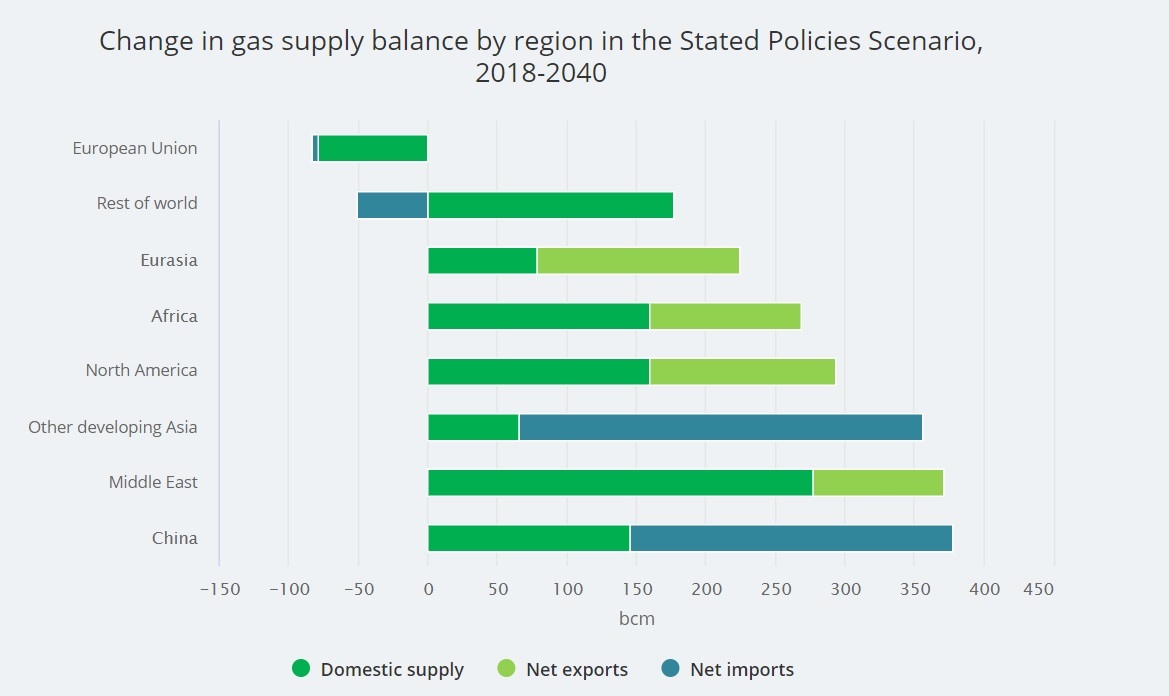

Another noteworthy point of difference between the IEA’s analysis and WoodMac’s comes in the projections for future US gas exports.

As this chart shows, the IEA’s Stated Policies Scenario projects significant increases in gas exports from Russia, the Middle East and Africa, as well as from North America.

Continue reading below...

How to get Energy Pulse

Energy Pulse is Ed Crooks' weekly column, published by Wood Mackenzie every Friday. Here's how to get Energy Pulse:

- Follow us on social media @WoodMackenzie on Twitter or Wood Mackenzie on LinkedIn

- Fill in the form at the top of this page and we'll send you an email when the latest issue goes live

- Bookmark this page to have access to the full archive of Energy Pulse

In this scenario, North America’s net exports of gas rise steeply from 16 billion cubic metres last year to 150 bcm in 2030, but then remain roughly flat until the end of that decade. The IEA thinks US gas production is likely to grow rapidly until the mid-2020s and then level off, in tandem with a similar plateau in oil production.

WoodMac however, thinks that by 2040 North America’s LNG exports could be 100 bcm a year higher than that, as gas production continues to rise.

In the IEA’s view of the world, by 2040 Qatar will again be the world’s largest LNG exporter, ahead of Australia and the US. WoodMac, by contrast, expects that after the US has overtaken Qatar in the mid-2020s to become the world’s largest LNG exporter of LNG, its continued growth means it will retain that position through the 2030s and beyond.

Further reading

For other views of the outlook for energy over the next few decades, try these reports:

- Wood Mackenzie’s Energy Transition Outlook 2019

- In last week’s Energy Pulse, I wrote about Equinor’s 2019 Energy Perspectives report

- ExxonMobil’s 2019 Outlook for Energy

- BP’s Energy Outlook 2019

Saudi Aramco sets out its stall

The other outsized publication of the week was Saudi Aramco’s long-awaited prospectus for its initial public offering, scheduled to close on November 28. The prospectus, which is 658 pages long, is available to download from the company’s website for people in many countries, although not in the US. The flotation will initially be on Tadawul, the Saudi stock exchange, and an international offer has been ruled out for a year, although it remains the ultimate goal. The Financial Times reported that in the IPO the Saudi government was looking to sell 1%-3% of the company, to raise $20-$60 billion.

The prospectus did not throw up any real surprises: the discussion of the business and its potential risks was all largely as expected. One line that did attract some interest was the question of climate risk: the potential for climate policies to affect demand for oil and hence Saudi Aramco’s finances. The term “climate change” appears 25 times in the prospectus.

Bolivia: a “lithium coup”?

Evo Morales, president of Bolivia, resigned after weeks of violent protests. From Mexico City, where he has taken asylum, Morales said he had been ousted by “racists and coup leaders”. Bolivia has some of the world’s largest reserves of lithium, a metal that is in increasing demand because of the rapid growth of electric vehicles and battery storage. World lithium demand is set to grow at an average rate of 13% a year from now to 2040, WoodMac’s Gavin Montgomery has forecast. The metal’s rising commercial and strategic importance has led to suggestions that the removal of Morales was a “lithium coup”. Writing in Foreign Affairs, however, Keith Johnson and James Palmer argued that that interpretation was “completely mistaken”.

In brief

China’s Premier Li Keqiang has emphasised the importance of coal for the country’s energy security, signalling that the government could ease off on driving the shift to clean energy in the forthcoming 14th Five-Year Plan. China’s energy imports have been soaring, and supporting coal production and use would be a way to boost domestic supplies, at a time when oil production is falling and efforts to develop the shale gas industry have fallen short of the government’s ambitions.

Tesla’s first Gigafactory in Europe will be built on the outskirts of Berlin. Elon Musk said Brexit had made it “too risky” to put the factory in the UK.

In the UK election campaign, parties are seeking to outdo each other with more ambitious commitments to renewable energy. Prime minister Boris Johnson pledged to raise Britain’s target for offshore wind from 30 GW by 2030 to 40 GW. Labour is aiming for 52 GW by that date, with the government taking a 51% stake in all new offshore wind farms.

The European Investment Bank has agreed to phase out lending for all oil, gas and coal projects within the next two years. WoodMac’s Nicholas Browne commented that the decision showed how although coal had in the past typically been the main focus for concerns about emissions, “gas is also increasingly in the spotlight of the climate debate”.

Thyssenkrupp, the German manufacturing group, has for the first time completed a demonstration run of a blast furnace for steel using hydrogen as well as coal. The project is a first step towards the company’s goal of “climate neutral” steel production by 2050. (An earlier version of this item incorrectly said the company had already used only hydrogen and no coal in a furnace. That is its goal for all four of its blast furnaces at Duisburg by 2022, but it has not happened yet.)

Fukushima prefecture in northeastern Japan, devastated by the 2011 earthquake and subsequent nuclear accident, aims to become a renewable energy hub. It is working on plans to develop 10 wind farms and 11 solar plants.

Sunpower, one of the largest US solar companies, is splitting itself in two, spinning off its solar panel technology and manufacturing operations as a new company called Maxeon Solar. Total, the French oil and gas group that owns a majority stake in Sunpower, will retain its holdings in the two companies after the split.

Ørsted, the energy company formerly known as Danish Oil and Natural Gas, has started construction on a 420 MW solar plant in the heart of oil country in West Texas, to help meet the area’s surging demand for electricity. The plant also includes storage with capacity to supply 40 MW for an hour.

And finally: The fact that the great 1982 sci-fi movie Blade Runner was set in November 2019 has prompted a rush of pieces comparing the imagined future to our reality. One obvious difference is that the Los Angeles skyline is not regularly lit up by huge gas flares. But every now and again, life imitates art.

Smart reads

Simon Flowers’ The Edge — Private equity: big buyers of oil and gas in the downturn

Jamie Thompson and Martin Kelly — Digitalisation: upstream’s silver bullet?

Nick Butler — Is digitalisation the fourth stage of the hydrocarbon revolution?

Matthew Vincent — BHP boss shows miners need low-carbon leaders

Matthew Green — The world's energy watchdog is undermining the climate change battle, critics say

John Kemp — How urbanization drives rising energy consumption

Liam Denning — This shale oil deal puts the “pit” in “capitulation

David Ferris — What we learned on the electric road trip

Quote of the week

"The shale revolution highlights that rapid change in the energy system is possible when an initial push to develop new technologies is complemented by strong market incentives and large-scale investment.” — Fatih Birol, executive director of the International Energy Agency, observes that although the energy industry is typically slow to change, there have been occasions when the landscape has been transformed in just a few years.

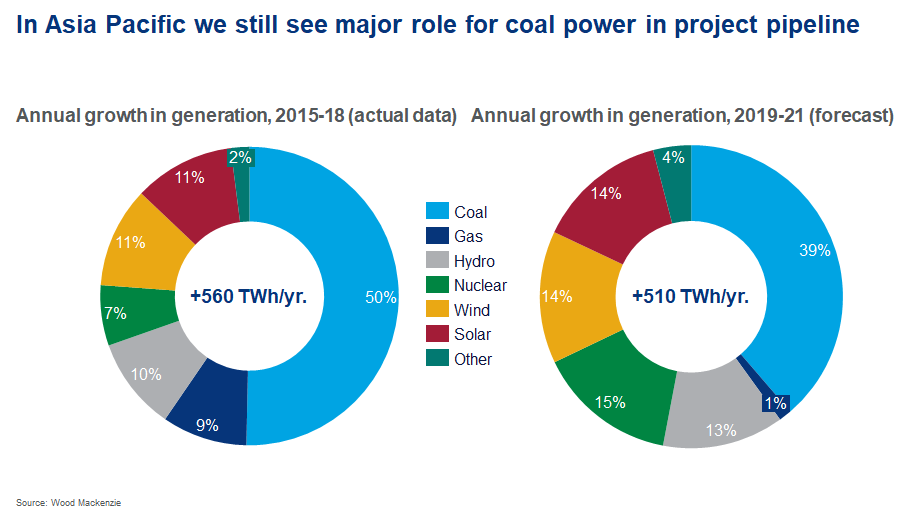

Chart of the week

These charts are derived from a presentation given by Alex Whitworth, WoodMac’s head of Asia Pacific power and renewables research, at our Singapore Energy and Commodities Summit on Tuesday. The point that leaps out here is the resilience of growth in coal-fired power generation in Asia. We expect wind, solar, hydro and nuclear power all to take a larger share of the increase in electricity supply in the Asia Pacific region over 2019-21 than they did in the previous three years. But coal seems remarkably resilient, still accounting for 39% of the increase in generation over the period. Gas, meanwhile, is stagnating, barely adding any net increase in generation at all.

The week ahead

One story to watch will be the question of whether the US and China can agree a truce in their trade dispute. Larry Kudlow, director of President Donald Trump’s National Economic Council, said on Thursday that he believed an agreement was close, although “not done yet”. The trade war and the prospects for peace are bound to be a central topic at WoodMac’s 2019 North Americas Metals and Mining Forum in New York on Tuesday November 19.