Sign up today to get the best of our expert insight in your inbox.

Diverging views on the role of gas in the energy transition

Comparing Wood Mackenzie’s Net Zero 2050 scenario to the IEA NZE

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

What will define LNG’s three phases of market growth?

-

The Edge

The coming low carbon energy system disruptors

-

The Edge

Could US data centres and AI shake up the global LNG market?

Prakash Sharma

Vice President, Scenarios and Technologies

Prakash Sharma

Vice President, Scenarios and Technologies

Latest articles by Prakash

-

The Edge

Is it time for a global climate bank?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

The coming low carbon energy system disruptors

-

The Edge

Is net zero by 2050 at risk?

-

Opinion

Geothermal energy: the hottest low-carbon solution?

-

Opinion

Energy transition outlook: EU

By agreeing to transition away from fossil fuels, COP28 wrapped up last December with consensus for the first time on the goal of reducing demand for coal, oil and gas. In doing so, the dream of net zero 2050 was kept alive - albeit on life support.

Yet there remains little alignment on how the world actually gets to net zero.

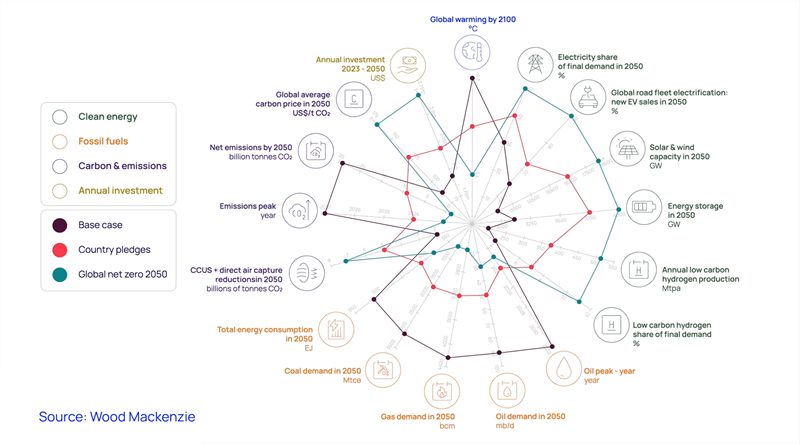

Here we again compare the International Energy Agency’s Net Zero Scenario (IEA NZE) with WoodMac’s latest Net Zero 2050 scenario (previously, the Accelerated Energy Transition 1.5 ˚C), both released last September. Gavin Thompson, Vice Chair EMEA, and Prakash Sharma, Vice President, Scenarios and Technologies, pick up the story.

Areas of agreement

With 2023 the warmest year on record and fossil fuel demand resilient in the wake of the Ukraine conflict, forging a pathway to net zero is more urgent than ever. The IEA NZE and our Net Zero 2050 scenario concur on the need for emissions to peak immediately through massive investment in renewables. The ‘electrification of everything’ requires sectors as diverse as road transport, space heating, steel making and hydrogen production to switch to renewable power.

With electricity demand tripling in both scenarios, renewables capacity soars. Although each scenario reaches 2050 with comparable renewables deployment, adoption to 2030 is significantly quicker in IEA NZE - we expect current weak market conditions to temper the pace of investment. With nuclear capacity doubling in both scenarios, renewables plus nuclear account for around 90% of power output by 2050.

Although we are more optimistic about low-carbon hydrogen and carbon capture use and storage (CCUS), the WoodMac and IEA scenarios require exponential growth in both sectors. In our Net Zero 2050 scenario, the expansion of renewables supports around 500 Mtpa of low-carbon hydrogen production by 2050 as costs fall to US$2-4/kg in many markets by the mid-2030s.

Coal and oil demand decline rapidly through the forecast period, though both scenarios recognise their current resilience. Oil demand slides from just under 103 million b/d in 2024 to 33 million b/d in our Net Zero 2050, with IEA NZE lower still at around 25 million b/d as electric vehicles dominate road transportation by 2050. Coal consumption by 2050 is 80% lower than today in our Net Zero 2050 scenario, 90% in IEA NZE.

Diverging views on natural gas

With so many variables, there is inevitably more than one way to achieve net zero. Both scenarios are broadly aligned on the decline in oil and coal demand by 2050. The chief area of difference is the role natural gas plays.

IEA NZE estimates gas demand declines by around three quarters to 920 bcm in 2050, whereas in our recent report, Global gas in the 2050 net zero world, WoodMac’s Gas & LNG team project a modest 35% decline to 2,500 bcm from current levels. There are three key reasons for this.

Firstly, assumptions on energy efficiency improvements. IEA NZE expects final energy use to decline by over a fifth by 2050 despite a global population increase of two billion people. In contrast, we expect final energy consumption to fall by less than 5%. With higher global energy demand, gas will be stickier, continuing to meet some heating demand despite rapid electrification and adoption of heat pumps. IEA NZE, on the other hand, shows zero gas demand in buildings globally by 2050.

Secondly, stability in the global power system. IEA NZE expects gas demand in power to decline by over 90% by 2050 as renewables ramp up, while we believe gas use in power is necessary to backstop variable renewables and maintain grid stability. Gas-fired power combined with CCUS will allow for flexible dispatchable generation, while IEA NZE expects renewables can deliver this in combination with a radical re-design of the grid and investment in transmission, distribution and energy storage.

Finally, the pace of the energy transition. IEA NZE is front loaded, with investment at scale happening immediately. We expect the pace of the transition will take longer to accelerate, constrained by critical metals supply and requiring longer lead times to build the monumental levels of renewables, energy storage, grid, electrolyser and CCUS capacity needed.

This is in large part due to challenges in raising and allocating capital. For many investors, current returns from clean energy projects aren’t enticing enough yet. Globally, nascent regulatory and subsidy support across many sectors compound this, particularly for major infrastructure projects with long payback periods.

A growing role for LNG

Given Asia’s pressing need to phase down coal, pragmatism trumps idealism. Gas, and particularly LNG, is the most feasible solution to support rapid electrification of global energy systems in the WoodMac . Moreover, some 130 Mtpa of LNG contracts will still be in place by 2050, supported by 200 mmtpa of new supply currently under construction – equivalent to 50% of the current market. Our forecast for LNG alone in 2050 is broadly two thirds of the IEA NZE total global gas demand by this time.

With COP28 recognising the role of “transition fuels”, natural gas demand looks more assured in our view. Our analysis of likely energy efficiency gains, the need for stability across power systems and the pace of the ramp-up in investment in low-carbon technology reinforces this.

Make sure you get The Edge

Every week in The Edge, Simon Flowers curates unique insight into the hottest topics in the energy and natural resources world.

Sign up today using the form at the top of the page to get The Edge delivered to your inbox.

2024 APAC Energy & Natural Resources Summit

9 May 2024 | Marina Bay Sands, Singapore

Book your tickets now