Get Ed Crooks' Energy Pulse in your inbox every week

Trump and Harris set out contrasting visions for US energy

The rhetoric from the two presidential candidates is very different, but they will face similar constraints if elected

11 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

What the "big beautiful bill" means for US energy

-

Opinion

Inside the ‘crazy grid’

-

Opinion

The Big Beautiful Bill is close to passing

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

Back in January, when I looked ahead to the US elections on 5 November, I predicted “plenty of twists and turns in the race”. That turned out to be something of an understatement. President Joe Biden’s decision to drop out of the running, leaving Vice President Kamala Harris as the Democratic nominee, transformed the contest. Former President Donald Trump has a new opponent who he never expected to face.

In spite of all the drama, however, his chances of retaking the White House have not changed much. At the start of the year, the race was finely balanced, and that remains the case today. Vice President Harris has an average lead in the polls of about three percentage points, but in the 2020 election, the polls significantly overstated President Biden’s lead. He was about eight percentage points ahead in the final polling averages, but only four percentage points ahead in the actual vote.

And because the president is chosen by the Electoral College, not by the popular vote, his actual margin of victory was even smaller. If just 45,000 votes in key swing states had gone the other way, former President Trump would have secured a second term.

The prediction markets, which provide an approximate summary of conventional wisdom, reflect expectations of another close race this year. They are divided, with Polymarket putting former President Trump slightly ahead, while PredictIt favours Vice President Harris by a similarly slender margin.

The bottom line is that both candidates are about equally likely to win, and businesses need to be ready for either outcome.

Trump aims for a steep fall in energy prices

Former President Trump rejects any attempt to address climate change, and instead has focused his campaign on the cost of energy for consumers. This week, he gave a speech to the Economic Club of New York that highlighted some of the key themes he has been raising on the campaign trail. They included:

- A pledge to “cut energy prices in half, or more, within 12 months of taking office” by opening more federal lands for oil and gas development and taking other measures to boost production. He suggested US gasoline prices, currently averaging about US3.29 a gallon, would be cut below US$2 a gallon. “If I was president, [US] oil production today would be four times higher than it is now,” he said. (More on this below.)

- A National Emergency declaration “to achieve [a] massive increase in domestic energy supply”, in part to deliver increased electricity supply for artificial intelligence.

- Sweeping new authorisations to “blast through every bureaucratic hurdle to issue rapid approvals for new drilling, new pipelines, new refineries, new power plants, new electric plants, and reactors of all types”.

- An end to regulations encouraging the adoption of electric vehicles.

- Deregulation to encourage “the industries of the future”, including “making America the world capital for crypto[currency] and Bitcoin”.

- A new government efficiency commission, to be chaired by Elon Musk, charged with conducting “a complete financial and performance audit of the entire federal government”.

- Extending the tax cuts passed in the 2017 Tax Cuts and Jobs Act (TCJA), with a further reduction in the corporate tax rate to 15% from 21% for companies that manufacture in the US.

- “Very substantial” new import tariffs. In other speeches, former President Trump has suggested rates of 10% or 20% for the new tariff, with a rate of 60% or higher on imports from China.

Harris again rejects a ban on hydraulic fracturing

Vice President Harris, meanwhile, has been lighter on policy specifics. In a recent interview with CNN, she defended the record of the Biden administration and set out some broad indications of the strategy she would pursue for energy. The key themes she outlined included:

- A commitment to continue to addressing climate change. “I have always believed – and I have worked on it – that the climate crisis is real, that it is an urgent matter to which we should apply metrics that include holding ourselves to deadlines,” she said.

- A reiterated pledge not to attempt to ban hydraulic fracturing. Seeking the Democratic nomination in 2019, she said she was in favour of banning “fracking” and offshore drilling. Talking to CNN last month, however, Vice President Harris argued that while her values were still the same, her views on policy had changed. “As vice president, I did not ban fracking,” she said. “As president, I will not ban fracking.”

- Support for the tax credits in the 2022 Inflation Reduction Act (IRA) and other incentives for low-carbon energy. She said the Biden administration had created more than 300,000 new jobs in clean energy. Vice President Harris also argued that this showed it was possible to make progress in tackling climate change without a ban on hydraulic fracturing.

LNG export approvals decision points to future policy

One other development this week was not mentioned by Vice President Harris but hints at the position her administration would take on LNG exports. In January, the Biden administration announced a “pause” in awarding new authorisations for LNG plants to export gas to countries that do not have a free trade agreement with the US. But this week, the Department of Energy (DoE) awarded one such approval, for New Fortress Energy’s Altamira FLNG1 project to export US gas from Mexico.

The DoE decision followed a court ruling in July that the pause should be lifted. But the ruling does not look like the start of a comprehensive reversal of the policy, according to Mark Bononi, Wood Mackenzie’s principal analyst for North America gas and LNG asset research. But the department’s reasoning behind its decision gives an insight into its thinking, which could shape policy in a future Harris administration.

The DoE said the global gas market was “changing rapidly due to economic, geopolitical, technological, regulatory, and climate change-related developments,” and it would assess future applications for LNG export authorisations in the light of those changes. It added that it could attach terms and conditions to future export approvals “to protect the public interest”.

Former President Donald Trump, meanwhile, has said he would end the pause on LNG export approvals as one of his first acts in office.

Constraints facing both Trump and Harris

Whoever wins the election will be forced to work within a set of constraints imposed by the US and global economy that will limit their freedom of action. The biggest issue for the next president of either party is likely to be the looming expiration of the key measures in the TCJA.

Many of the tax cuts are scheduled to expire at the end of 2025, threatening to raise tax bills for many companies and individuals. Former President Trump has said he wants to make those tax cuts permanent, which has an estimated cost of about US$4 trillion over the subsequent 10 years. Vice President Harris has said she would aim to let most of those tax cuts expire while mitigating the impact on businesses with a main corporate tax rate of 28%. That would be higher than its current 21%, but lower than the pre-TCJA rate of 35%.

Both Trump and Harris would also most likely be forced to work with a Congress that does not have an overwhelming majority for either party. The battle for control of the House of Representatives looks finely balanced. The Republicans are on course to retake control of the Senate with possibly 52 of the 100 seats. Independently minded members of Congress could wield considerable influence.

Wood Mackenzie view

Former President Trump’s goal of cutting the price of energy in the US by a half or more seems difficult to achieve, particularly on the 12-month timetable he has proposed. A Trump administration that made progress on cutting the regulatory burden on the oil and gas industry and opening new areas for development would have an effect on production over time. But it would be highly unlikely to have an impact at the speed and scale he has suggested.

Wood Mackenzie analysts say the principal constraints on US oil and gas production are companies’ finances and capital allocation strategies – not regulations or access to federal lands and waters.

Past decades have shown little or no correlation between US oil and gas production and the president’s political alignment. That’s likely to remain the case. President Biden has been more committed to addressing climate change than any of his predecessors, but under his administration, US oil production continues to break new records.

A Trump administration would be expected to put intense pressure on the IRA tax credits for low-carbon energy, especially for sectors that former President Trump has personally opposed, including wind power and electric vehicles. However, a substantial segment of the Republican party is working to preserve the IRA credits. In a finely balanced Congress, that group will wield considerable influence.

Probably the most important step for a future administration of either party would be to expedite approvals for infrastructure projects, an issue that affects all energy and natural resources sectors. Legislation to streamline the permitting process has been making progress in the Senate, and this week a similar plan was proposed by a House Republican. The Senate plan, modelling published this week suggests, would lead to a net reduction in US greenhouse gas emissions.

Former President Trump has spoken out on the need to break down bureaucratic barriers to investment. There will be keen interest in whether Vice President Harris expresses similar support.

In brief

Leading members of the OPEC+ group of countries – including Saudi Arabia, Russia, Iraq and the United Arab Emirates – have agreed to postpone their proposed increase in oil production following the recent fall in crude prices. In a statement on Thursday, the group said the eight countries that have made voluntary production cuts totalling 2.2 million barrels per day would extend those reductions for another two months, until the end of November 2024, and begin to phase them out starting in December. The group had aimed to start unwinding the cuts in October but had made clear that the proposed output increases would depend on market conditions.

Brent crude was trading on Friday at around US$73 a barrel, down from about US$85 a barrel at the beginning of July.

The Biden administration has announced US$7.3 billion in financing to support rural electric cooperatives’ purchases of low-carbon energy and investment in infrastructure. The White House described it as “the largest investment in rural electrification since the New Deal”. The programme is being funded through the Inflation Reduction Act.

ADNOC is taking a 35% stake in ExxonMobil’s low-carbon hydrogen plant in Baytown, Texas. The facility is expected to be the largest of its kind in the world, with capacity to produce up to 1 billion cubic feet of low-carbon hydrogen per day, and more than 1 million tons of low-carbon ammonia per year. A final investment decision is expected in 2025, subject to supportive government policy and securing the necessary regulatory permits, with anticipated startup in 2029.

Wood Mackenzie analysts said the ADNOC investment would help to cover the significant capex commitment for the project and build on the existing relationship with ExxonMobil. It represents another significant step forward for ADNOC’s strategy of building its portfolio of lower-carbon energy sources and growing internationally. The deal puts it on course for net hydrogen production of about 0.6 million tons per year by 2030.

Other views

The competitive edge of China's electrolysers – Tiantian Zhao and Bridget van Dorsten

Transforming energy: 5 key questions ahead of Gastech 2024 – Massimo Di Odoardo and others

Japan’s LNG decarbonisation challenge – Gavin Law

Can CO2 utilisation drive increased carbon capture? – Rohan Dighe

Oil and gas communities are a blind spot in America’s climate and economic policies – Noah Kaufman

America’s new climate delusion – Zoë Schlanger

American drives signal a top in gasoline demand – Liam Denning

Quote of the week

“The human exploitation of creation, our common home, has contributed to climate change, leading to various destructive consequences such as natural disasters, global warming, and unpredictable weather patterns. This ongoing environmental crisis has become an obstacle to the harmonious coexistence of peoples… we sincerely call on all people of good will to take decisive action in order to maintain the integrity of the natural environment and its resources.”

Pope Francis and Nasaruddin Umar, the grand imam of Istiqlal State Mosque of Indonesia, signed a joint statement highlighting their shared view that climate change is one of the most serious crises facing the world today.

Chart of the week

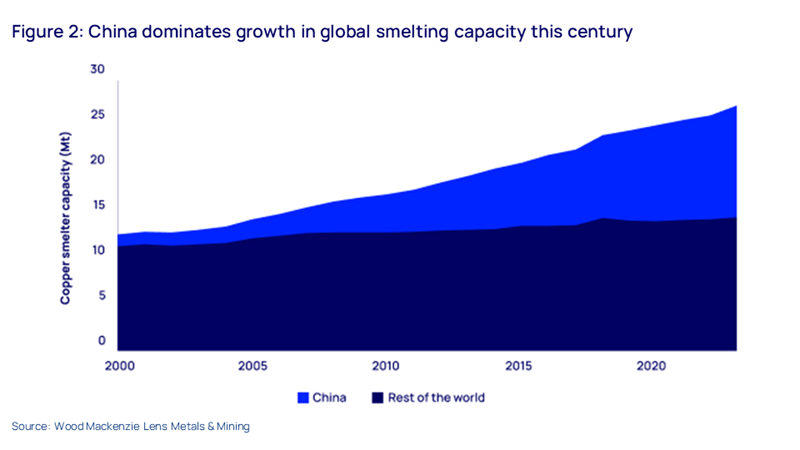

This striking chart, from our recent Horizons report: ‘Securing copper supply: no China, no energy transition’, shows how China has dominated the global growth in copper smelting capacity since 2000.

One conclusion, the report’s authors say, is that “for the copper market to remain effective and deliver on the world’s requirements, key stakeholders need to chart a realistic course that involves China… the scale of China’s dominance in the copper supply chain means it cannot be fully replaced.”

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today to ensure you don’t miss a thing.