与我们分析师联系

Commodity slowdown in China could be different this time

1 minute read

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash Sharma

Vice President, Head of Scenarios and Technologies

Prakash leads a team of analysts designing research for the energy transition.

Latest articles by Prakash

-

The Edge

The narrowing trans-Atlantic divide on the energy transition

-

Opinion

Energy transition outlook: Asia Pacific

-

Opinion

Energy transition outlook: Africa

-

The Edge

COP29 key takeaways

-

The Edge

Is it time for a global climate bank?

-

The Edge

Artificial intelligence and the future of energy

In today's meeting of the National People’s Congress, China announced slower growth this year, with its gross domestic product (GDP) growth targeted at a range of 6 to 6.5% in 2019.

This should not come as a surprise as there have been a flurry of reports on demand slowdown in China and its potential impact on the world economy.

China is the single biggest driver in commodity markets and 2019 will be no different. As the government attempts to stabilise the economy, while grappling with uncertainty from the ongoing trade wars with the US, the world will be watching China closely from all fronts.

China is implementing a series of structural supply-side reforms and environmental policy actions to transition towards a consumption-led economy. Progress has been made, albeit slowly. Lower GDP target doesn’t mean China will weaken its commitment for blue skies. We think green China is non-negotiable and renewables' share will continue to increase.

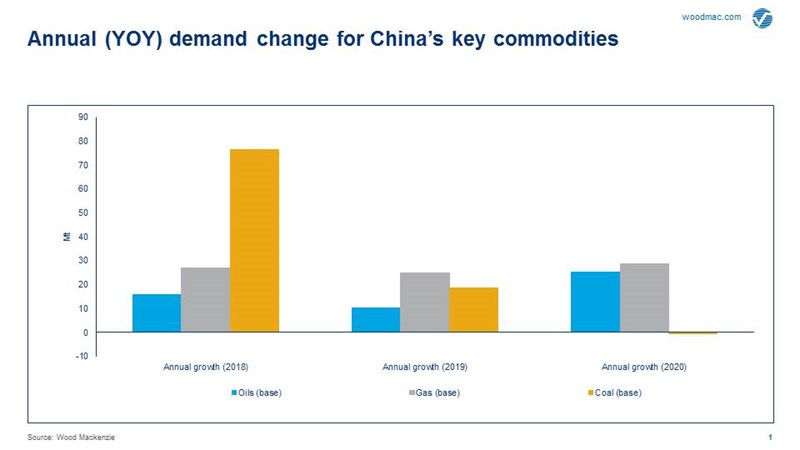

The near-term impact on commodity demand and imports will not be straightforward. Looking at our base case GDP of 6.1% for 2019 and 5.9% in 2020, we forecast the outlook for the various commodities.

We expect oil demand to increase from 12.9 mb/d last year to 13.2 mb/d in 2019; the slowest growth in a decade.

Considered approach in coal-to-gas switching

China achieved around 17% growth in gas demand and 41% growth in LNG year-on-year in 2018. In our base case, we have growth slowing as a result of a more considered approach to coal-to-gas switching and a shift to coal-to-electricity in some provinces, as the government becomes better prepared in handling winter demand.

Total gas demand is expected to grow by 11% both in 2019 and 2020. We expect LNG demand to increase from 54 Mt last year to 62 Mt in 2019.

Gas is now an integral part of China’s energy mix and latest policy reaffirms China’s support to its long-term growth.

You might be interested in:

Oil imports slowest in a decade

China’s oil demand is largely connected to its transport sector which is in transition. Electric vehicle (EV) penetration is increasing. Of the two million EVs sold last year, over one million units were sold in China. Though it is still a small portion of the vehicle stock, the government is increasing electrification as it helps control air pollution.

The risk is more apparent in diesel demand as it ended 2018 on a weak note. China's manufacturing PMI has fallen below 50, reflecting weakness in industrial production and demand, in turn affecting diesel demand, primarily in the coastal provinces. An escalating trade war would have further knock-on effects on for diesel.

While a recovery is expected as the International Maritime Organization sulphur cap boosts marine gasoil demand towards the end of 2019, the challenge is from two wild cards: GDP slowdown and the impact of environmental policies.

Weak domestic oil production means imports will remain an important component of supply. We expect oil demand to increase 12.9 million barrels/day last year to 13.2 million barrels/day in 2019; the slowest in a decade.