A tantalising year for North Sea exploration

As we near the mid-point of 2019, Glenn Morrall asks how the industry is going to continue the upward global trend

1 minute read

Glenn Morrall

Research Analyst, North Sea Upstream

Glenn Morrall

Research Analyst, North Sea Upstream

Glenn's research focuses particularly on the UK upstream sector.

Latest articles by Glenn

-

Opinion

Last dance for UK upstream exploration?

-

Opinion

A tantalising year for North Sea exploration

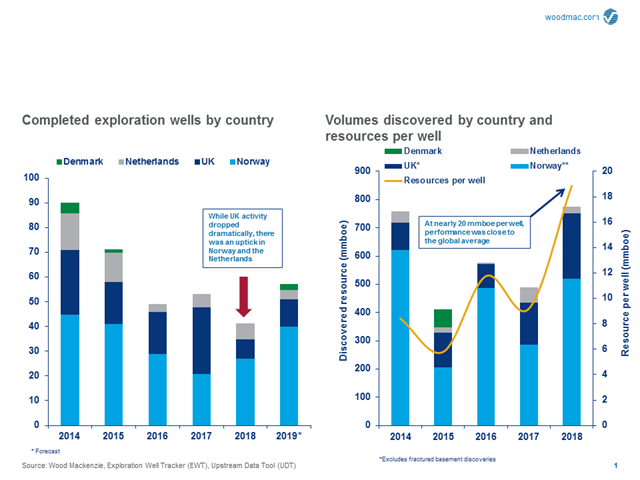

In the North Sea as a whole, we forecast that 2019 will see over 60 exploration wells – up 25% compared to 2018. What’s changed? Budgets are higher and company portfolios are brimming with prospects matured through the downturn. The competition for assets in the mergers and acquisitions market will continue to be fierce, particularly in Norway. So growth via the drill bit is arguably a more attractive option.

There is scale too. While many of the prospects drilled will be infrastructure-led, we will also see new plays and ideas being tested. In total, companies are targeting 10 billion barrels of gross unrisked resource in 2019. Volume, as well as value, is on the agenda.

While lower costs and nearby infrastructure means that returns from small finds are strong, companies are also looking to big prospects to shift the needle. This approach yielded 800 million barrels of oil equivalent (mmboe) across the UK, Norway and the Netherlands in 2018, and volumes per well were the highest since 2010.

Glengorm gets the party started

Exploration is back in the UK, having languished in 2018. Activity was at its lowest level since the 1960s. But companies are stepping back into the breach this year. And we expect there to be between 10 and 15 exploration wells, similar to the numbers drilled in 2015 and 2016.

Glengorm got the party started and followed hot on the heels of last year's Glendronach discovery. Glengorm is the largest discovery in the UK since Culzean in 2008, excluding Hurricane Energy's Halifax and Lincoln fractured basement discoveries, West of Shetland, which are not yet fully tested.

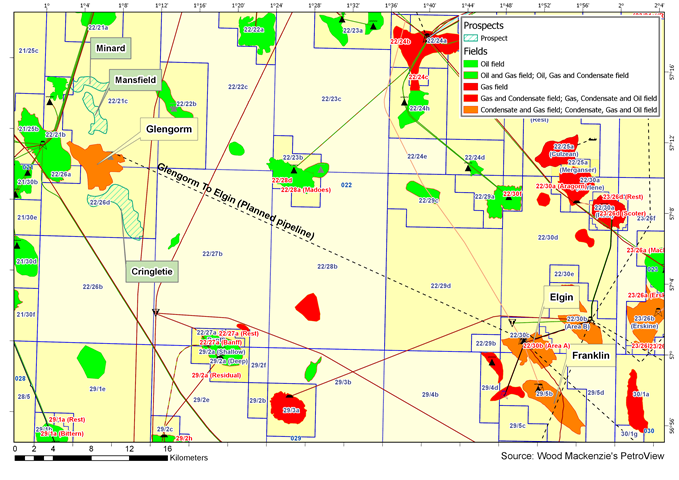

The discovery well revealed a 250mmboe HP/HT gas/condensate find in the Upper Jurassic Fulmar sandstone reservoir. The map below, from PetroView® , also shows the nearby Cringletie, Mansfield and Minard prospects. These show potential in the same Upper Jurassic Heather turbidites and Fulmar shoreface sandstone reservoirs as seen and discovered in Glengorm, although current plans to drill these prospects are not known.

We assume that Glengorm could be developed with a tie-back to Total’s Elgin/Franklin development, although other options exist.

No longer Barents or bust in Norway

For Norway, it’s no longer Barents or bust. Norway will be at the heart of the upsurge, with drilling expected to reach pre-downturn levels – we forecast over 40 exploration wells will be completed, up from 26 in 2018.

The recovery in mature area exploration is the key trend moving the needle. Well count in the northern North Sea is expected to double. The Barents Sea will continue to attract the biggest of the local players chasing nearly 2 billion boe across seven wells. But pressure to deliver is high following a series of disappointments, including the dry hole announced in February 2019 at Pointer and Setter.

As explorers chase some big North Sea prospects with the drill-bit, 2019 could be a year of creaming curve busters, as opposed to recent near-field lower volume exploration success.

Find out more about how PetroView® can support your exploration strategy. Fill in the form on this page to download an abstract from our recent 'North Sea briefings: Which Business Development strategies create value?' presentation.