1 minute read

One of the key issues that we see in the next few years is that refiners in Asia will need to meet increased crude import demand in the face of declining domestic production. In fact Asia will see the largest regional decline in domestic crude production in the world. With the US looking for new export markets, is Asia the most likely candidate for this supply? Canadian oil sands will also export to Asia. Plus some African and Middle Eastern crudes are likely to switch from supplying Europe to meet growing demand in Asia. No other region needs to import as much incremental crude as Asia.

The condensates market

With strong petrochemical demand growth and declining exports from the Middle East, Asia will see a tightening of its condensate market. Despite growth from Australia's new condensates, declines in other parts of the region will mean domestic supply only rises modestly. We believe that exports to Asia from the Middles East will halve between 2016 and 2023.

Although condensate from the US looks like a good option for Asia, quality differences will need to be mitigated. We expect these factors to combine and overall, lead us to believe that there will still not be enough supply to meet Asia's ideal condensate demand over the next five years. This tightening market will lead to an uplift in condensate pricing.

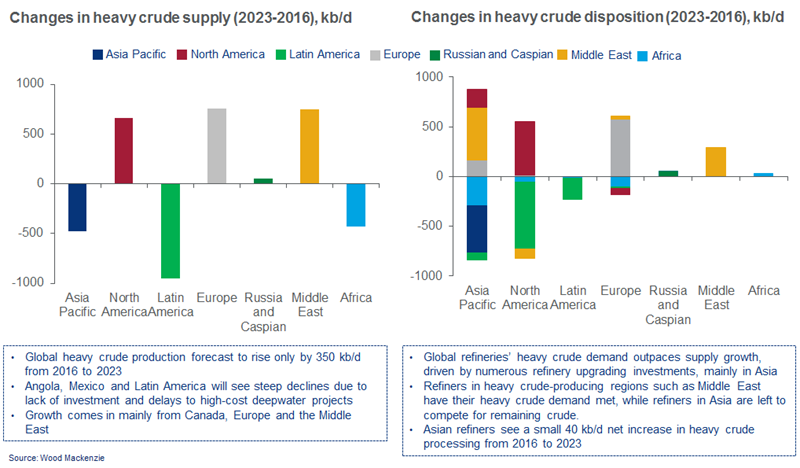

Heavy crude

Most of the traditional sources of heavy crude will see steep declines in production and although the Middle East and Canada will lead future growth in heavy crude supply, there are many uncertainties providing a downside risk to supply. Asia will struggle to compete with the US, China and India for it's share of heavy crude. However, a strategy to secure the right quality of crude oil by partnering with producers could be a key differentiator.

Heavy crude balance

Source: Wood Mackenzie. Will the rising heavy crude demand due to increased upgrading capacity be met?

IMO 2020

Finally, IMO 2020 has the potential to disrupt crude trade as it will result in a wider sweet-sour crude differential. With huge demand in Asia for bunker fuel, we expect a large shortage of very low sulphur fuel oil (VLSFO) in Asia following the introduction of this new regulation. Although this demand could be met by the regional surplus in gasoil, the likely outcome is that bunker fuel will become more expensive for shippers.

This is the final part in our mini series on the changing global crude trade landscape.

Click here to read part 1 which looks at the global story.

Click here to read part 2 which highlights the six key themes.

Download the full insight and slide deck by filling in the form on top of this page.

Available now: Crude Trade Service

This solution is designed to give you the data you need to address your key concerns on:

- Where are the key demand growth markets for crude and how to secure long-term supply?

- Where are the opportunities for new crude streams coming onstream?

- Changes in crude differentials impacting crude selection

- How do you re-optimise existing fleet operations?