The four changing priorities in the polyolefins industry

Discover how the industry is turning challenges into opportunities

1 minute read

The rising demand for polyolefins, found in the packaging of many products, such as milk cartons (HDPE), food pouches (LDPE), film wrapping (LLDPE)and crisp packets (PP), is being driven largely by increased urbanisation and improved standards of living. Global demand for polyethylene (PE) will likely be driven by film, pipe and blow moulding processes, and the industry as a whole is being increasingly burdened by new regulations.

Change 1: Global recycling and waste dynamics

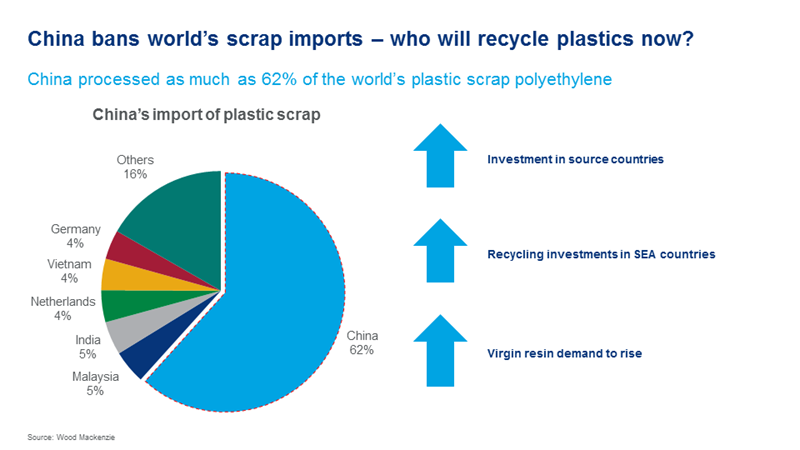

China banning scrap-imports is a big deal. Before the ban came into force in early 2018 China was handling 62% of post-consumer polyethylene, and over 50% of all post-consumer plastics. Most western countries were outsourcing the recycling of their waste plastics to China. What will the world do with its plastics waste now?

While some of these scrap exports have found their way into other Asian countries, the recycling industries in these countries are not yet fully developed. So scrap producing nations are looking for other ways to manage their waste. Banning single-use plastics is one solution.

There is also a waste disposal problem. There are low collection rates for polyolefins and poor infrastructure makes separation of waste challenging. However, once collected, there are many positive outputs, including electricity generation (plastics provides a useful alternative to imported fossil fuels); incineration (for example in India, plastic waste is also used in cement kilns to reduce the overall energy input while producing cement); and of course it can be recycled. Recycled plastics can be made into various applications, for example plastics in the road to offer flexibility for the bitumen, wood-plastic composite (deck, benches) railroad ties, bottles, containers and bins, and some fibres can even be used for manufacturing shoes.

Change 2: Demand drivers and optimisation of assets

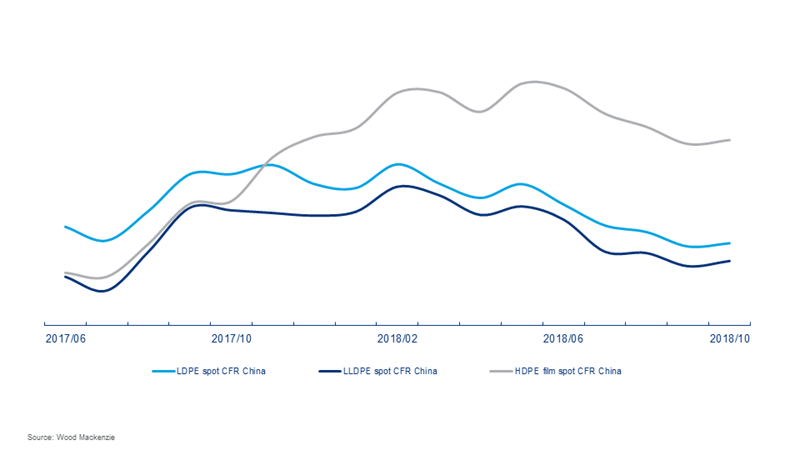

Availability of HDPE was tight for the majority of 2018, which was mainly caused by strong demand in the pipe market. HDPE pipe grades have two primary drivers, firstly, the switch to using gas from coal for power plants and, secondly, the growing infrastructure and housing projects with associated increasing water and gas distribution. As the pipe market was strong, the reactors produced pipe resin at the expense of blow moulding and films material, leading to a shortage of film/blow moulding resin as well. HDPE resins were sold at a premium in 2018, compared to LDPE and LLDPE.

The LLDPE markets are particularly driven by bubble wrap, packaging films and stretch films required to facilitate the global e-commerce boom. Due to persistently tighter HDPE conditions, many gas phase assets are considering switching to HDPE production at the beginning of 2019.

And with ever-increasing access to electricity in India and other developing economies, we are observing greater uptake of polypropylene in the appliances market. Developments in the automotive sector have also supported a rise in demand for polypropylene impact copolymer.

of US imports of finished goods are imported from China

Change 3: US-China trade war

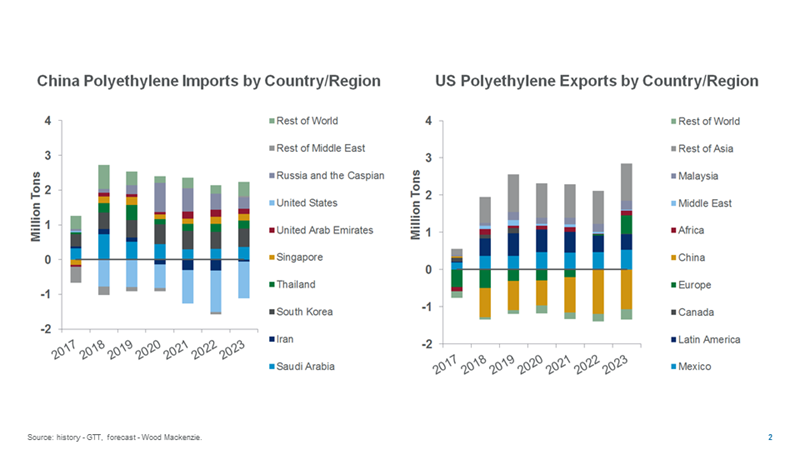

The United States exported less than 5% of its production to China and this had been expected to double by the end of this decade. However, the trade war is threatening these export expectations. All the major polyolefin types (LLDPE, PP and HDPE) are exposed to Chinese tariffs of 25%. In terms of finished goods, the US imports 30% of its finished goods from China.

US producers were expected to export shale-based advantaged polyethylene to the market that offers higher net-backs and the trade war is expediting this process. However, moving large volumes to a single market other than China will be a challenge. Africa, Latin American and other Asia markets tend to be fragmented and smaller when compared with China.

The currency weakness is compelling US producers to reduce export prices, especially when exporting to the emerging nations and incremental finished goods can be sourced from other suppliers such as Mexico, South East Asia countries, India and Latin American countries.

The US-China trade war has impacted the Chinese converting industry as well. However the government in China is taking action to improve this situation. Overall, the investment environment in the polyolefins industry is impacted, and investors are taking a more cautious “wait and watch” approach.

Change 4: Inter-polymer competition

Inter-polymer competition between LLDPE and LDPE in film markets has enabled LLDPE to penetrate, for example, LDPE markets in Europe. There is also inter-polymer competition between HDPE and PP, and the switch is often affected by the relative price point for each grade.

Polypropylene competes on injection moulding applications with polystyrene and polyethylene and with LLDPE and LDPE for flexible packaging applications.

How will these changing priorities affect the polyolefins industry?

With more cities, states and countries regulating the use of single-use plastics, there will be a greater impact on polypropylene. Around 70% of brand owners are considering sustainability and environmentally friendly packaging initiatives compared to 45% of suppliers. As we wait to see how these solutions unfold, there remains plenty of potential to benefit from the megatrends impacting polyolefins.

In the new year we'll share the six megatrends we see unfolding and their wider implications.

Want to know more about our supply/demand forecasts and the changes affecting the polyolefins industry? Fill in the form to receive an extract from our presentation The changing priorities in polyolefins business strategies: Polyethylene, Polypropylene and sustainability outlook delivered at the 2018 Americas Olefins Conference.