What do Colombia’s ambitious fiscal reforms mean for oil and gas?

Tax plans put more money in the hands of the Colombian government. But they will deter investment at a crossroads for the extractive industry

2 minute read

Vinicius Moraes

Research Analyst, Latin America Upstream

Vinicius Moraes

Research Analyst, Latin America Upstream

Vinicius specialises in coverage of Argentina, Brazil, Colombia and Trinidad & Tobago.

View Vinicius Moraes's full profileNoble Pendergrass

Principal Economist, Americas

Noble Pendergrass

Principal Economist, Americas

Noble Pendergrass is the Principal Economist covering Wood Mackenzie’s Americas upstream research

View Noble Pendergrass's full profileColombia’s newly elected President Gustavo Petro has made some big promises. Slashing poverty and reducing social inequality are top of the list, but he has also pledged to move away from the fossil fuel economy and make Colombia a leader of the energy transition.

Part of his plan is a bold programme of fiscal reform, characterised by increased taxes on high-income individuals and the extractive industries.

Colombia’s government relies heavily on income from fossil fuels. Hydrocarbons, including coal, serve as its primary source of revenue. And, like other emerging economies, the country is grappling with economic growth ambitions and long-standing challenges such as rising debt.

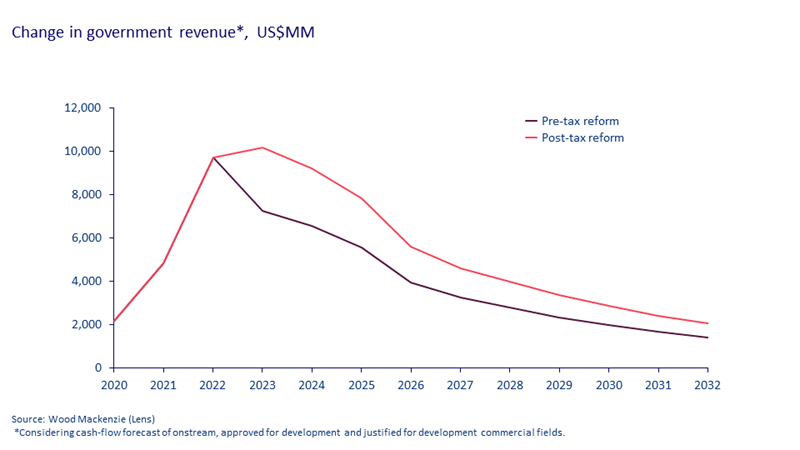

The new fiscal regime will have the immediate effect of putting more money into government hands - an estimated US$15 billion over the next decade - but what are the long-term consequences?"

The first in a four-part series, our insight Colombia’s fiscal reform explores some of the difficult challenges facing the Colombian government in the coming years and what it all means for the oil and gas sector. Fill in the form on this page for your complimentary copy or read on for some highlights.

Colombia could lose out to regional peers as investment becomes less attractive

Under Colombia’s new taxation rules, the average government take from oil and gas projects will increase, totalling US$15 billion over the next ten years. Consequently, the average corporate net cash flow will drop by 26%.

The reforms strike a blow to the country’s fiscal competitiveness and will prompt operators to reassess their strategies.

Exploration and production (E&P) companies could look elsewhere for new investment to regional peers such as Guyana, Suriname and Trinidad and Tobago. Meanwhile, Colombia will have to cope with dwindling revenue from the oil and gas industry at a time when hydrocarbon production is already in decline and funds are required to sustain the shift to the energy transition as emerging technologies develop.

To track where Colombia sits in the rankings for fiscal competitiveness, as well as understand how tax reforms have affected its prospectivity index, fill in the form on the page for your copy of our insight.

Which projects will be hardest hit?

All oil and gas companies will be affected by the new fiscal policy. But mature fields are set to be worst off – particularly smaller fields with modest production and marginal economics. In the short term, strategies for these fields are not expected to change, whereas longer-term investments are likely to be reconsidered.

Reforms are intended to expedite Colombia’s energy transition – but will they succeed?

A key objective of the ambitious fiscal plans is to accelerate the country’s energy transition and reduce reliance on natural resources. Increasing taxes on the extractive industry is aimed at facilitating a shift towards greener energy.

The country’s export sector relies heavily on crude oil and coal for revenue. But with those industries in decline and ongoing macroeconomic instability, it’s crucial that alternative revenue streams are explored.

The Colombian government faces the difficult challenge of balancing new policies and targets for the energy transition against the need to keep revenue flowing.

Fill in the form at the top of the page for a complimentary extract of this first insight.

In part 2 of our series, we take a look at the key players shaping Colombia’s upstream sector. Later in our series, we explore Colombia’s commitment to diversify away from the fossil fuel economy and the challenges it may face in its journey for energy transitions.