Does lower reinvestment mean tight oil can’t grow?

Stakeholders are demanding tight oil players cap reinvestment rates at 70% to reduce leverage, preserve free cash flow and boost shareholder returns

1 minute read

By Ryan Duman and Linda Htein

Once pursuing growth at all costs, the tight oil industry is changing its business model as stakeholder demands for capped reinvestment rates become a new imperative. Many overly indebted companies have already spent the past year largely unresponsive to rising oil prices. But with the demand to reduce leverage by capping reinvestment at 70%, can tight oil grow production?

How are stakeholder demands playing out?

A more mature tight oil sector means investors are looking for value, not just growth. They see over-leveraged company balanced sheets after a decade of taking on debt to fuel acquisition – some with gearing ratios of more than 40%. Achieving shareholder value and getting those ratios down to 20-30% will mean limiting reinvestment, as well as reducing drilling and production.

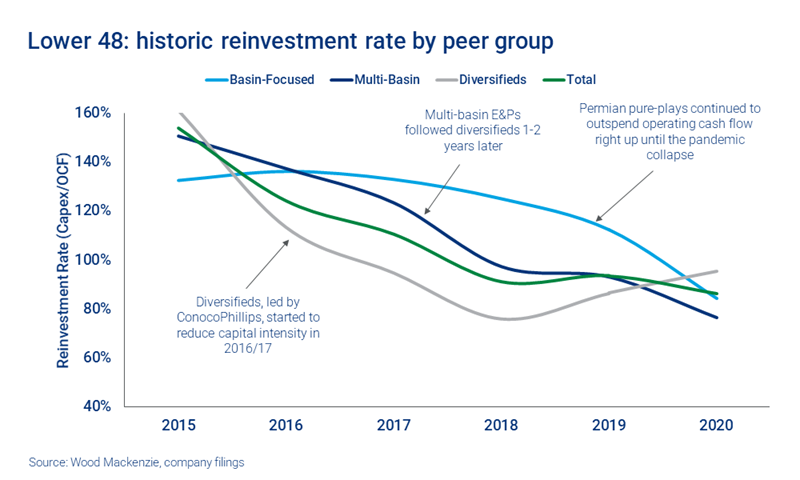

E&Ps will be expected to push reinvestment rates even lower, especially after consistently outspending cash flow for years. The 33 companies we track reported US$14.9 billion of operating cash flow in Q1 2021 and a total capex of US$8.4 billion, equaling a 48% reinvestment rate.

With capital spend down 50% in 2020 compared to 2018 and 2019 levels, tight oil drilling recovery has been slow and may not reach pre-price crash levels until late in 2022. This lack of responsiveness despite the rise in oil prices has led to historically low activity levels this year.

Impact of lower investment rates on tight oil supply

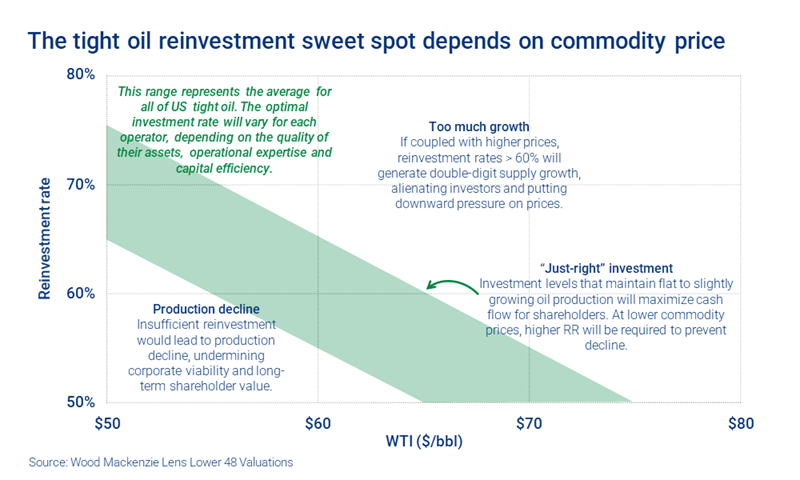

With oil at US$60 per barrel or higher, maintaining reinvestment rates of more than 70% would generate double-digit supply growth that could drive prices down. But rates of 50% or lower would create a decline in production and diminish stakeholder value, meaning that the 60-70% reinvestment rate is the sweet spot for maximizing cash flow.

We estimate tight oil production in the Lower 48 could grow by more than 2 million barrels per day (b/d) in the next five years at a 70% reinvestment rate, based on Lens Lower 48 Valuations.

Tight oil capital discipline ripple effects

If tight oil continues down this path of restraint, we’ll see global and sector-specific effects on everything from infrastructure to oil price.

- Permian infrastructure remains overbuilt in all but our most aggressive reinvestment scenario at 80%, and even then it would be 2050 before greenfield projects would be needed.

- On the corporate side, we expect to see surplus cash flow returned to shareholders through variable dividends.

- M&A activity could increase if tight oil sustains lower reinvestment rates, attracting more buyers.

- Private companies could become ‘swing producers’ without pressure to limit capex or invest in ESG initiatives.

- Underinvestment or overinvestment result in a spread of 6 million b/d by 2025, which could have significant implications for the global oil market and commodity prices.

This insight was powered by Lens Lower 48 Valuations.

With Lens, our analysts are able to quickly screen and evaluate investment opportunities in the Lower 48 using integrated well, land, and company data in a single tool. Model the entire region under different oil price scenarios and reinvestment rates, or use it to evaluate acreage, multi-region companies and specific assets.

To learn more about how Lens can equip your team with our latest price assumptions and create multiple dynamic scenarios, fill in the form at the top of the page to request more information.