与我们分析师联系

Germany's ‘traffic light’ coalition greenlights a faster energy transition

Does the new deal mark the revival of the Energiewende?

3 minute read

Following weeks of negotiations, Germany has a new governing coalition. This ‘traffic light coalition’ sees a disparate political grouping – the Social Democratic Party of Germany (SPD), the Free Democratic Party (FDP) and The Greens – come together under a bold slogan: "Dare more progress". This applies to a wide range of issues at hand for the new government, not least the need to reinvigorate the country's lacklustre energy transition, or Energiewende.

The energy transition agenda of the new government is anything but underwhelming. From ambitious renewable energy targets to accelerated coal phase-out to a power market overhaul, there is a clear intent for climate action sooner rather than later.

So, how realistic are these plans, and what do they mean for the future of Germany's energy markets? Our experts weigh in.

Solar PV: ambitious target will call for expanded auction capacity limits and tariff payments

Daniel Tipping, Research Analyst, Solar:

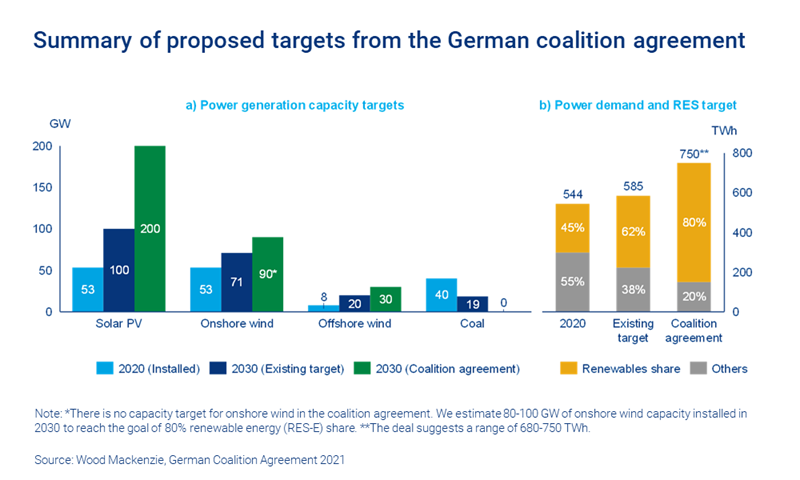

The proposed target of 200 GW of solar capacity by 2030 requires around 15 GW to be installed annually on average until the end of the decade. That’s three times Germany's recent annual average of 5 GW and almost twice the highest capacity additions of 7 GW from 2010 to 2012.

The global supply chain can meet this surge in demand, and there is little reason to doubt the solar industry's ability to accelerate deployment to the desired level. The onus remains on the incoming government to take further steps to hit the 2030 target.

The coalition has correctly identified expediting permit issues and supporting innovative solar systems, such as agrivoltaics and floating PV, as measures that will boost capacity growth. Moreover, the utility-scale capacity limits should be increased for tenders, which are currently limited to projects up to 20 MW in size. Increasing feed-in tariff (FIT) payments for distributed solar will also encourage uptake. Existing FIT payments are currently decreasing at about 1.4% a month for systems of less than 750 kW, increasing payback periods and disincentivising build-out.

With price cannibalisation set to become increasingly prevalent in the coming years too, asset owners will need to focus on battery deployment and securing premiums under tenders to capture optimal returns.

Wind power: permitting and grid bottlenecks must be mitigated

Sohaib Malik, Principal Analyst, Energy Transition Practice and Søren Lassen, Head of Offshore Wind Research:

Germany’s vibrant wind power industry can realise the offshore wind target of 30 GW by 2030. The regional offshore market is experiencing growing competition, and developers have already bid zero-subsidy tariffs for German projects. The centralised nature of the bidding process allows the government to award the desired capacity to developers reasonably quickly.

But we also note some questions that are yet to be answered. For instance, who will pay for the transmission infrastructure? Can its build-out keep pace with the offshore capacity addition? Similarly, regulatory nitty-gritty and the absence of a cost-sharing mechanism between partner countries have beset the plans for cross-border offshore projects, which needs to be addressed for post-2030 growth.

It's hard to categorise the outgoing government as ‘ambitious’ about onshore wind. However, its measures are producing positive signals, albeit incremental. The incoming coalition wants to allocate 2% of the country's landmass for onshore wind projects and create a more efficient permitting process for greenfield and repowering projects. We reckon these measures can enable a cumulative onshore capacity of 80-100 GW by 2030 – substantially higher than the 71 GW target pursued by the Merkel-led government.

Notably though, the federal government faces an uphill task where it wants southern states to toe the line.

Coal power: phase-out looms, but remains contentious

Dan Eager, Principal Analyst, Europe Power and Renewables and Peter Osbaldstone, Research Director, Europe Power and Renewables:

The coalition agreement targets the phasing out of all coal-fired generation 'ideally' by 2030, with the 2026 review envisaged in the Coal Phase-Out Act brought forward to the end of 2022 at the latest.

The existing phase-out plan includes specific closure dates for lignite plants, with 9 GW currently due to close beyond 2030. Hard coal generators are subject to closure as they either become obsolete under the market's Combined Heat and Power Act (KWKG) or participate in auctions organised by the Federal Network Agency (BNetzA) to award support to those choosing to close plants voluntarily.

The coalition has a lot to unpick if it is to accelerate the downward trajectory of coal.

The approved coal phase-out plan expected three reviews, the first to take place in 2023, followed by others at 2026 and 2029. The timing of the first checkpoint was set to allow assessment of the aftereffects of final nuclear closedown in 2022. The coalition has a lot to unpick if it is to accelerate the downward trajectory of coal.

There is also the consideration that Germany's coal-fired generators are not only producers of electricity; they are also responsible for significant quantities of heat and grid stabilisation. While additional renewables may replace lost power volumes, they will not, without significant additional spending, do the same for heat.

On this point, the coalition agreement recognises the role of gas-fired generation as a substitute in combined heat and power applications.

Gas market: ready to power the transition – but infrastructure questions remain

Murray Douglas, Research Director, Europe Gas:

An accelerated closure of coal, on the back of nuclear phase-out, was always expected to bolster Germany's gas demand. The agreement is explicit in its support for gas generation – noting that it is indispensable for a transition period. Any new gas-fired power plants must be future-proofed to accommodate climate-neutral gas (hydrogen ready), with the aim of incentivising these at legacy coal-fired plant locations to also provide combined heat and power needs where necessary.

Gas demand in buildings faces a less certain future with every newly installed heating system to be operated on at least 65% renewable energy. Hydrogen could be part of that solution, but heat pumps are more likely as low-carbon hydrogen will be prioritised into the most difficult to abate sectors.

For anyone watching European gas markets, the biggest question remains over the start-up of the 55 bcm/year Nord Stream 2 pipeline.

Murray Douglas

Vice President, Hydrogen & Derivatives Research

Murray is responsible for Wood Mackenzie’s global coverage across the hydrogen value chain.

Latest articles by Murray

-

Opinion

Our top takeaways from the World Hydrogen Summit

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what utilities and developers need to know

-

Opinion

eBook | The hydrogen opportunity from now to 2050: what industrial players need to know

-

Opinion

eBook | Investing in hydrogen from now to 2050: what you need to know

-

Opinion

What lies ahead for hydrogen and low-carbon ammonia?

-

Opinion

Ebook | Overcoming the challenges around hydrogen deployment

For anyone watching European gas markets, the biggest question remains over the start-up of the 55 bcm/year Nord Stream 2 pipeline. The coalition has not taken a definitive stance – rather simply referencing that they will coordinate closely with the European Commission on infrastructure. That could mean the commissioning of the pipeline slips into the second half of next year.

However, we still believe the severity of Europe's gas crisis this winter could deliver flows sooner. Germany still has two LNG import terminals that are targeting financial close in 2022. Although not mentioned in the agreement, it’s likely that for either of these projects to progress, they will also need to demonstrate how they can accommodate lower carbon molecules in the future.

Power demand: economy-wide electrification triggers unprecedented market expansion

Dan Eager and Peter Osbaldstone

The agreement anticipates that power demand will reach between 680 and 750 TWh by 2030, representing an increase of up to 25% from current levels. Drivers of this growth can be linked to targets for increased sector coupling and electrification.

For example, the 15 million electric cars and 10 GW of electrolysers in 2030 would require 50 TWh and 36 TWh of electricity, respectively. This incredible level of demand growth presents an opportunity for a higher renewable build as the agreement targets an 80% renewable energy share in the 2030 power mix.

The scale of this ambition – the challenge the targets represent – is put into context when lined up against the 2035 Network Development Plan (NEP, 2021 version) devised by Germany's four transmission system operators (TSOs). The NEP scenarios employ detailed system modelling by the TSOs, considering generation background changes and associated network reinforcement requirements. Several of the targets in the agreement can be mapped across to NEP scenarios, but with one important observation: the coalition agreement plans to deliver five, and in some cases, ten years ahead of even the most transformative of the NEP scenarios.

Only the targeted revision of the NEP in 2022 will confirm the feasibility of these ambitious generation and network expansion plans.

Flexibility and energy storage: a flexibility challenge overlooked?

Rory McCarthy, Senior Research Manager, European Power

The coalition agreement seems to have overlooked the flexibility challenge that will emerge over the next decade with higher variable renewables penetration and the additional pressures of an accelerated coal phase-out.

There is a clear recognition of natural gas being the bridging fuel, an important flexibility and system security tool. The future carbon risk of this asset build-out appears to be mitigated in the agreement by ensuring these are "hydrogen ready", which is a questionable solution.

We think that there needs to be more formal recognition of the need to incentivise the use of energy storage, demand response (in its various guises) and interconnection, alongside appropriate network build-out to support the anticipated decarbonisation.

The agreement recognises the need for hybrid interconnectors and a "System Stability Roadmap" by 2023 to figure out how to smarten up distribution networks. There is also mention of "competitive and technology-open capacity mechanisms and flexibilities through a new electricity market design." It is encouraging to see evidence of some foresight into the critical infrastructure required to run this variable renewable power system.

In addition, the government must appropriately incentivise storage and other clean, flexible technologies, alongside renewables, to address the future challenges of system security and reliability.