与我们分析师联系

Global olefins: 10 trends to watch as coronavirus reshapes the industry

A look at the forces defining the ‘new normal’

1 minute read

The coronavirus outbreak is having a transformational effect on global olefins. Supply, demand, trade, pricing, costs and margins are all being affected to the extent that it will undoubtedly reshape the wider industry.

So, what forces are defining the ‘new normal’?

In a recent insight, we outlined 10 trends to monitor as the industry evolves. Visit the store for the full insight, or read on for a summary of the top five.

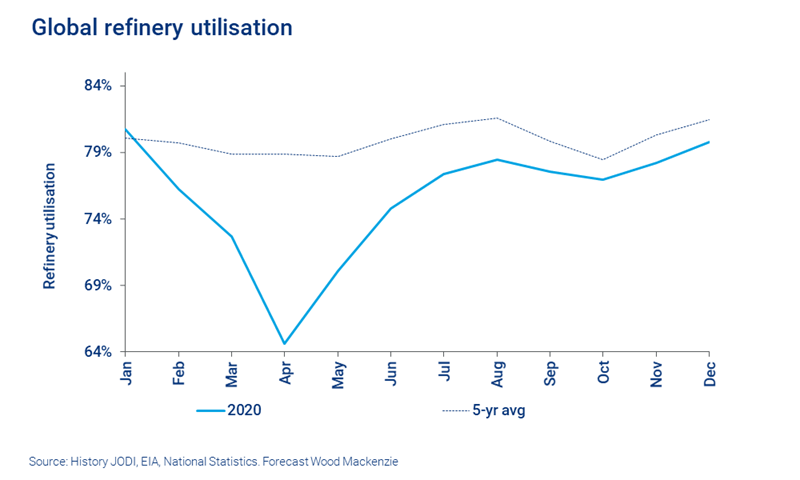

1. Refinery run cuts have started – and could intensify

Reduced demand for transportation fuels has led to refiners cutting rates to manage supply. The impact on olefins supply varies by region, but there is a clear domino effect.

Olefins production is linked to the refining industry in two key ways:

- Direct propylene supply (primarily via gasoline production)

- Feedstock supply for steam crackers, converted to ethylene and propylene

There is now potential for feedstock limitations at refinery-integrated steam crackers, with limited options for alternative supply. Lockdown measures could disrupt refinery and steam cracker maintenance, increasing supply in the near-term, but this will have little impact on the overall effect.

This situation could open up debate about the strengths and risks of further refining-olefins integration – a trend expected to grow through the energy transition.

2. OPEC+ oil supply cuts will impact NGL supply

OPEC+ production cut agreements could have a sizeable knock-on effect on NGL feedstock supply. A quarter of the world’s ethylene supply is tied to ethane-based production in locations that will reduce oil production: the US, Saudi Arabia, Kuwait, UAE and Russia.

The full extent and location of oil supply cuts will ultimately determine the impact on petrochemical feedstock supply – and the potential for lower output.

3. Feedstock inter-competition has magnified

The rapid fall in crude oil price has significantly altered global steam cracker feedstock preferences, and inter-competition is intensifying. Flexible assets will be best positioned to take advantage of near and medium-term volatility.

In the US, flex-crackers could have an opportunity to take advantage of butane economics relative to ethane cracking. LPG will continue to compete with ethane.

Outside the US, international ethane cracking is increasingly challenged in 2020 as the least preferred feedstock. Europe and Asia will see naphtha return to the preferred feedstock, at the expense of propane and butane.

4. Globalisation will be reassessed

The coronavirus outbreak could spark a reassessment of trade patterns, with a shift to shorter supply chains.

Near-term, the low oil price impacts the competitiveness of export-oriented trade models. Feedstock, olefins and derivatives projects – and potential future expansions – are dramatically altered at current levels.

Longer-term, geopolitics and enhanced perception of risk could also drive change. Increased state and government support to local industries could reduce the use of finished goods manufacturing in low-cost labour centres. Expansion in demand centres will offset the risk of supply chain disruption.

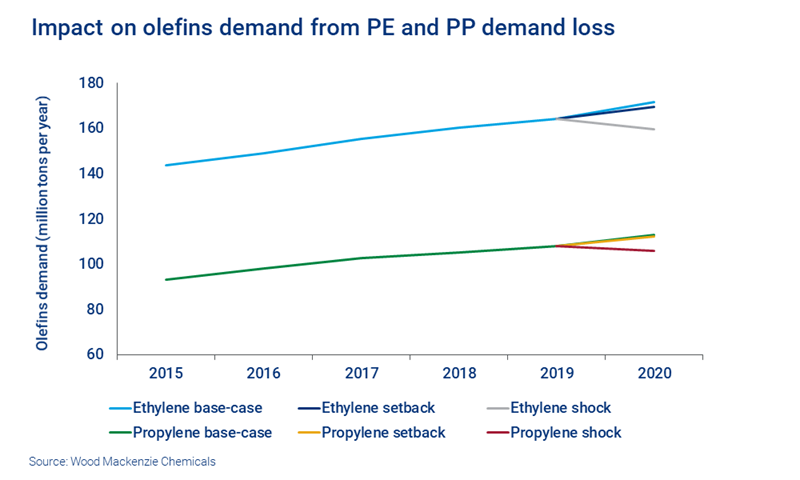

5. The uncertain impact on global olefins consumption

The full impact of the coronavirus on olefins consumption is highly uncertain. The current increase in medical and packaging applications is providing a short-term demand boost, but it will be undermined by a major economic contraction.

Our new polymer demand model highlights two potential scenarios for the industry: setback and shock. Based on these scenarios, we forecast demand loss from Polypropylene (PP) and Polyethylene (PE) alone at between three and 20 million metric tons.

Five more trends shaping the future of the olefins industry

Read the full insight for more on these trends, plus:

- The flattening of the global ethylene cost curve

- Staggered capacity for global olefins projects

- Inter-regional pricing levels and P/E pricing ratios

- The plastics circularity debate re-opens – and development slows

- A potential jump in M&A activity – with new olefins industry actors.

Visit the store to find out more about Global olefins: 10 trends to monitor as the industry seeks the next normal.