LFG-to-RNG: positive outlook and hidden potential

LFG-to-RNG capacity has nearly doubled in the last five years.

3 minute read

Dulles Wang

Director, Americas Gas and LNG Research

Dulles Wang

Director, Americas Gas and LNG Research

Dulles delivers analysis of all aspects of the natural gas value chain.

Latest articles by Dulles

-

Opinion

4 things you should know about North American gas to 2050

-

Opinion

North America's RNG market set for continued growth in 2025 after historic year

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

-

The Edge

Upside pressure mounts on US gas prices

-

Opinion

North America gas strategic planning outlook: A glimpse into 2050

-

Opinion

North America gas: 5 things to look for in 2025

Natalia Patterson

Senior Research Analyst, Americas Gas and LNG Research

Natalia Patterson

Senior Research Analyst, Americas Gas and LNG Research

Latest articles by Natalia

-

Opinion

North America's RNG market set for continued growth in 2025 after historic year

-

Opinion

LFG-to-RNG: positive outlook and hidden potential

-

Opinion

North America renewable natural gas: five questions answered

Mackenzie Monsour

Research Analyst, Lower 48 Upstream

Mackenzie Monsour

Research Analyst, Lower 48 Upstream

Mackenzie is focused on financial models for upstream oil and gas assets.

Latest articles by Mackenzie

-

Opinion

LFG-to-RNG: positive outlook and hidden potential

-

Opinion

Enhanced oil recovery with captured CO2: insights on CCS-EOR

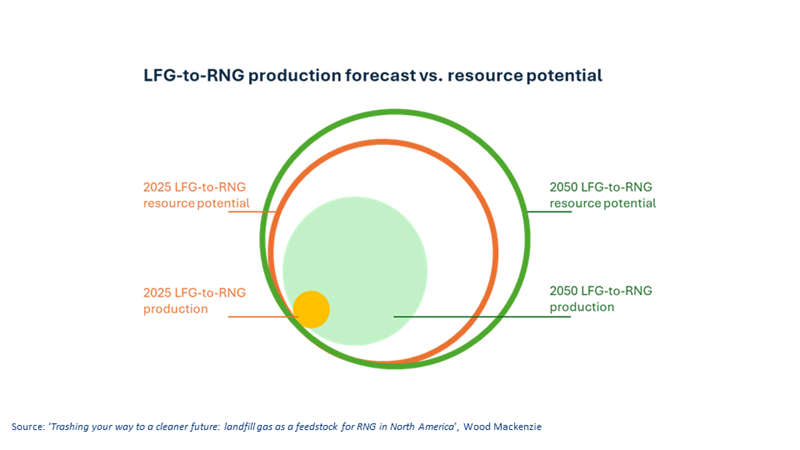

The renewable gas production (LFG-to-RNG) sector has been extremely active in the last two years with new project ramp-ups, blockbuster M&A deals and new players entering the market. That said, only 10% of resource potential is currently tapped.

As RNG plays an increasing role in decarbonising North American economies, LFG-to-RNG capacity has nearly doubled in the last five years, and we expect the trend to continue in the foreseeable future.

We recently released a comprehensive analysis that evaluates RNG production and identifies the key factors influencing project economics. Fill in the form to download an extract of the report or read on as we explore resource potential and prospects for the LFG-to-RNG industry.

Resource potential within the LFG-RNG space

LFG’s popularity is no surprise as, historically, it has been the most popular feedstock option for RNG production due to its availability and the mature technologies which are used for the RNG upgrade process.

The sector is also consolidating, with the top seven developers making up more than 60% of the market today. As RNG is a direct substitute for fossil-based natural gas, there is tremendous potential for future growth and its prospects in carbon reduction goals.

What is surprising, however, is that untapped opportunities are awaiting. In our report Trashing your way to a cleaner future: landfill gas as a feedstock for RNG in North America, we reveal that LFG-to-RNG capacity has nearly doubled in the last five years, and the prospect for more activity is considerable, with only 10% of the resource potential currently being utilised in North America.

What factors impact project economics the most?

While increased regulatory scrutiny on methane regulation could further boost LFG-to-RNG conversion, the relatively high CI compared to other RNG technologies could drive investors away as they seek higher returns from subsidies. The inflationary pressures in recent years may also affect cost breakevens structurally. However, LFG-to-RNG is the lowest-cost option for RNG production, and the subsidy value of .

Challenging economics for small-scale or more remote projects may also hinder the pace of long-term project development as costs rise for second-tier resources. However, according to our latest LFG-to-RNG report, four main factors contribute to the ultimate success of an LFG-to-RNG project:

- Economies of scale: Economies of scale have the largest impact on project costs, as studies have noted a stronger correlation between cost and scale than cost and upgrader technology type.

- Location: An RNG upgrader’s proximity to a landfill has the largest impact on the interconnection costs and states with more stringent environmental regulations can increase costs as well.

- Upgrader technology: Capital costs for upgraders can vary based on technology type.

- Operational efficiency: Operating costs can range from 3% to over 60% of capital costs, with a significant portion coming from utility costs.

Bright outlook on LFG-to-RNG production

Despite some challenges and unknowns, the report also reveals that there is a bright future for LFG-to-RNG and that RNG will play an increasing role in decarbonising North American economies.

Building on the recent momentum from producers, Wood Mackenzie analysts forecast that the resource potential could exceed 5 billion cubic feet per day (bcfd) by 2050, up from less than 4 bcfd today, and that production could reach 2.2 bcfd by 2050, up from .3 bcfd today.

Opportunities through regulations and incentives

Regulations and incentives around RNG production also support its growth. Landfills are one of the largest sources of methane and increased scrutiny by governments on methane regulation will likely boost more LFG-to-RNG conversions. Policy incentives have also focused on the RNG industry due to the increasing demand, particularly in the transport sector.

Furthermore, the relatively lower carbon intensity (CI) of the LFG-to-RNG process on a life-cycle basis compared to conventionally produced natural gas provides the economic justification for the subsidies.

As RNG is a direct substitute for fossil-based natural gas, there is tremendous potential for future growth and its prospects in carbon reduction goals. For more detail, fill in the form to read the complimentary extract of our Trashing your way to a cleaner future: landfill gas as a feedstock for RNG in North America report.

Find out more about our Biomethane/RNG Service

In-depth insight into the biomethane / renewable natural gas (RNG) market to identify opportunities, mitigate risks, and support investment and decarbonisation strategies