North America’s EV charging infrastructure suggests a smooth road ahead for heavy vehicles

Public chargers are gaining market share, but with Tesla pulling the plug, the impact has sent shockwaves throughout the industry.

4 minute read

Ben Hertz-Shargel

Global Head of Grid Edge

Ben Hertz-Shargel

Global Head of Grid Edge

Ben leads research across electrification and grid technologies, drawing on a decade of executive experience.

Latest articles by Ben

-

Opinion

eBook | Power surge: can US electricity supply meet rapidly rising demand?

-

Opinion

Large load tariffs: a looming challenge for utilities

-

Opinion

The new grid defection: breaking down the large load co-location fight at FERC

-

Opinion

Uncertainty dominates the 2025 US power outlook

-

Opinion

Uncertainty dominates the 2025 US power outlook

-

Opinion

US DOE shows that virtual power plants are very real

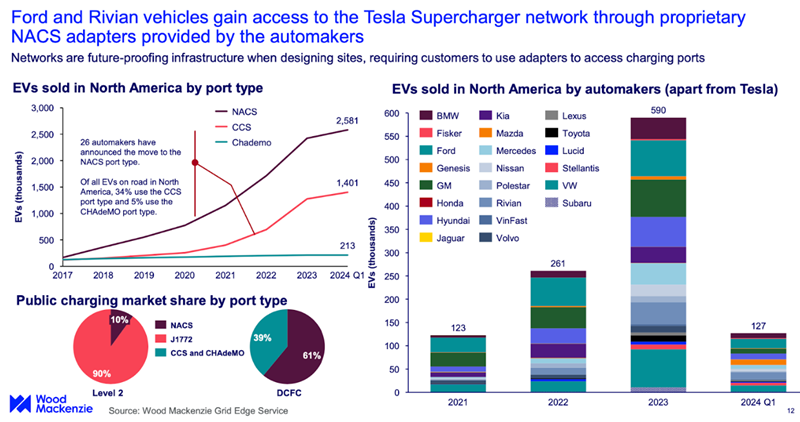

The first quarter of 2024 has seen a slowing of EV sales in the US, with sales rising by just 2.6% year-on-year – and falling a substantial 15.2% compared to the previous quarter. The charging market was a mixed bag in Q1, too: public fast charging (DCFC) has slowed due to delays in site commissioning, while the market for lower output Level 2 chargers saw a boost, experiencing double-digit growth for the first time in two years.

It looks likely that this expanding public infrastructure will catch up with the residential market in the coming years – but significant government investment will be essential, and Tesla’s move to scale down its charging division is already putting a spanner in the works. Fill in the form for your copy of the full report or read on for a summary.

Public chargers pick up pace

Charging for heavier-duty vehicles has seen slow growth, with residential charging taking slightly more of the market this year. However, public charger deployment should gain momentum in the next few years, matching residential’s share by 2030.

A public charging network will of course be a capital-intensive project, and large-scale government investment will be crucial to the success of the roll-out. We expect a boost in uptake thanks to government incentives and mandates, along with charging corridors – but even though home charging will see a slowdown in the period to 2035, it is likely to be the mainstay for most EV owners in the US.

Tesla applies the brakes

When it comes to residential charging, most automakers have improved their customers’ satisfaction levels in the last year. Tesla takes the lead, with the best-rated home charging experience, with Emporia ranked second. This is partially thanks to its suite of complementary offerings in the home energy management space. It is not a completely smooth ride for residential charging, though: while overall satisfaction levels are up, problems with wi-fi connection loss in Level 2 chargers have increased.

Tesla continues to lead the industry, dominating in both vehicles and chargers. Its Supercharger network accounted for 59% of all DCFC ports deployed in the first quarter of 2024, but as the company has now laid many employees within its charging network division, growth is expected to slow drastically.

With the company shifting focus away from the charging business, many automakers transitioning to Tesla’s fast-charging NACS port type have been left in limbo. Ford and Rivian have supplied proprietary NACS adapters in the first quarter, allowing customers to access the Tesla Supercharger network. However, the twenty-two other automakers who have committed to the NACS transition still do not have access to these fast-charging adapters.

Adapting to change

In the battle for charger dominance, the ISO 15118 Plug & Charge is likely to emerge as the long-term winner. For the time being, though, its lack of backwards compatibility remains a barrier to adoption.

Some states are progressing much more quickly than others. A year after the National Electric Vehicle Infrastructure (NEVI) standards were announced, Maine, Pennsylvania and Colorado have reached Phase 2 of their programs, with Pennsylvania boasting the largest number of sites and the largest amount of investment. There are signs an effective business model is developing for charging at physical stores: more than 70% of all NEVI bids have gone to corporations operating travel centres, gas stations, and convenience stores.

Four charging network operators account for most of the NEVI-funded charging ports announced to date, with Tesla dominating. Once again though, Tesla’s downsizing of its charging division may lead to many of the planned NEVI projects being left stranded.

The price of charging

EV charging is more consistent and less expensive than gas. Fast-charging prices for EVs show less variation across the US than gas prices, with the lowest prices observed in the upper Midwest. To reduce the impact of demand charges, and boost EV adoption, twenty-nine states have introduced utility rates specific to transportation; in most cases, these are lower than commercial rates.

Transportation rates, where they exist, do not seem to correlate strongly with prices at fast-charging stations. This suggests that other factors are influencing DCFC pricing strategies. Most large charging networks are now implementing dynamic pricing, enabling site hosts to modify per-kWh rates according to real-time site energy costs, utilisation, and local competition.

The states are adopting different approaches, in the effort to manage the growing demand for EV power. California has taken the lead in regulating the uptime of public charging, with Maryland and New Jersey following suit. The New Jersey senate directed the Board of Public Utilities to develop and implement a process to establish, monitor, and enforce compliance, with the 97% uptime requirement for EVSEs receiving incentives from public funding. In a bid to future-proof charging hardware, the California Energy Commission has recommended that charging providers ensure that chargers using J1772/CCS or J3400/NACS connectors are ISO 15118-ready.