Where next for oil & gas exploration?

Attractive economics and the need for advantaged barrels bode well for future exploration

3 minute read

Oil and gas exploration plummeted during the pandemic, but attractive economics, a renewed social licence and a need to add more advantaged resources to company portfolios mean enthusiasm for discovering new fields is bubbling up again.

Our latest insight Exploration Quietly Recovering draws on proprietary intelligence and data from our Lens Upstream platform to provide a deterministic analysis of conventional exploration spend over the next five years.

Fill in the form to access the full report, or read on for a quick overview.

What will the next five years of exploration look like?

Oil & gas companies largely prefer to keep a low profile when it comes to exploration, and budgets are rarely publicised. However, we know from conversations with leading explorers and recent licensing that the appetite for wildcatting remains strong. This fits with the picture for the broader oil & gas sector – with advantaged resources in short supply, new exploration is seen as a potential solution.

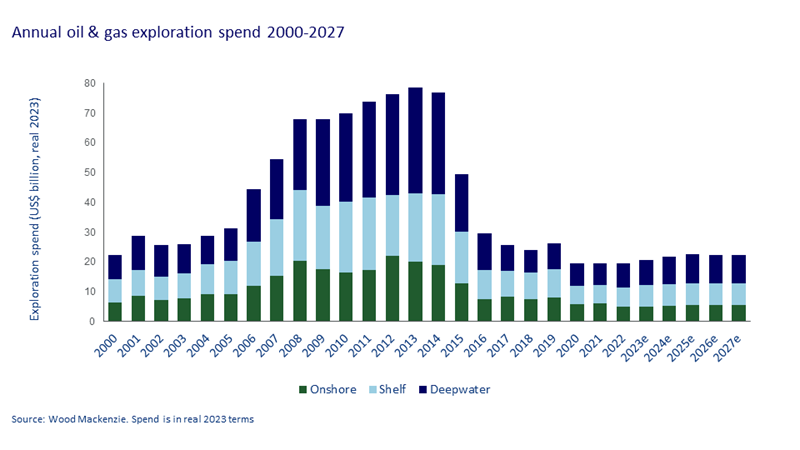

Our analysis indicates that while exploration will never return to the heady heights of the 2006-2014 boom, spend is recovering and will remain healthy over the next few years (see chart below). In fact, the estimated average annual spend of US$22 billion between 2023 and 2027 isn’t far off the average for the more disciplined years before the boom.

What’s boosting spend?

A number of factors are creating a strong tailwind for oil & gas exploration in the short to medium term. Taken together, they make for a robust business case for additional investment.

- Social licence to operate: The energy shock caused by the Ukraine war has shifted the political narrative towards energy security and affordability, softening attitudes to fossil fuel use.

- Attractive economics: Portfolio high-grading, better spending discipline, more careful prospect choice and more efficient development are boosting the bottom line – full-cycle returns from exploration have been consistently above 10% since 2018 and exceeded 20% in 2022.

- Hot new frontiers: New locations such as Namibia represent exciting opportunities, while advances in geoscience and imaging technology are opening up new plays in established basins.

- Strong financials: Record profits have helped create healthy balance sheets for many oil & gas companies – this is helping to boost confidence and encourage a more bullish approach.

- Demand for advantaged resources: The world needs more high-quality, lower-carbon oil and gas – renewal through exploration is a critical way for firms to improve their portfolios

What could hold exploration back?

While these tailwinds are encouraging, there will be a limit to how high renewed spending can go. A range of factors could prevent firms from investing more in exploration.

- Lack of high-quality prospects: Cuts to budgets during 2015-2018 after the 2014 oil price shock are being felt now in the form of limited prospect inventory.

- Diminished corporate landscape: While geoscience has evolved, there are far fewer small, specialised explorers ready to pursue diverse leads and work up novel ideas in frontier basins.

- Shortage of people: Layoffs during the 2020 downturn hit exploration and subsurface departments hardest – automation and machine learning help explorers accelerate their work but do not replace human expertise.

- Supply chain costs: Greater demand is driving up costs throughout the oil & gas value chain – while prospecting is less affected than projects, it isn’t immune to inflationary pressures.

- Financing hurdles: Most smaller firms need external sources of financing for exploration, which are increasingly hard to come by as mainstream banks reduce their commitment to oil & gas.

- Capital discipline: Neither investors nor oil company executives have any desire to return to the profligate spending of 2006-2014 – this will inevitably put a ceiling on future exploration spend.

Given these constraints, it remains to be seen whether exploration spend across will be high enough to position the oil & gas sector to survive and thrive in an uncertain future environment.

The full report contains more in-depth analysis of the tailwinds and constraints that will affect oil and gas exploration to 2027, as well as insight into key growth areas and detailed breakdowns of spend by region and peer group. Don’t forget to fill out the form and download the report.