Why crude-to-chemicals is the obvious way forward

A look at the competitiveness of second-generation COTC complexes

1 minute read

Kelly Cui

Principal Analyst, Petrochemicals

Kelly Cui

Principal Analyst, Petrochemicals

Kelly is an expert in the coal-to-olefins (CTO) and methanol-to-olefins (MTO) sector.

Latest articles by Kelly

-

Opinion

Which global steam crackers are at most risk of closure?

-

The Edge

Big Oil’s opportunity for M&A in the petrochemicals downturn

-

Opinion

Why crude-to-chemicals is the obvious way forward

-

Opinion

Coronavirus to disrupt China’s chemicals sector more than SARS

-

Opinion

Can China’s CTO and MTO industries survive the threat of massive steam cracker investment?

-

Editorial

Why is China the early adopter of CTO/MTO

Crude-oil-to-chemicals (COTC) is a mega trend of the downstream value chain for good reason. The energy transition is shifting the drivers of oil demand towards petrochemicals, making refinery integration an important growth strategy. But how much value is this now creating? Which is more competitive, a US ethane-based cracker or a second-generation COTC cracker in China? And can other regions achieve the same ROI as China?

This article draws on the findings of our recent insight ‘Crude-to-chemicals is the obvious way forward’. Fill in the form for a complimentary copy of the full insight – or read on for some of the key findings.

Crude oil’s future lies with petrochemicals

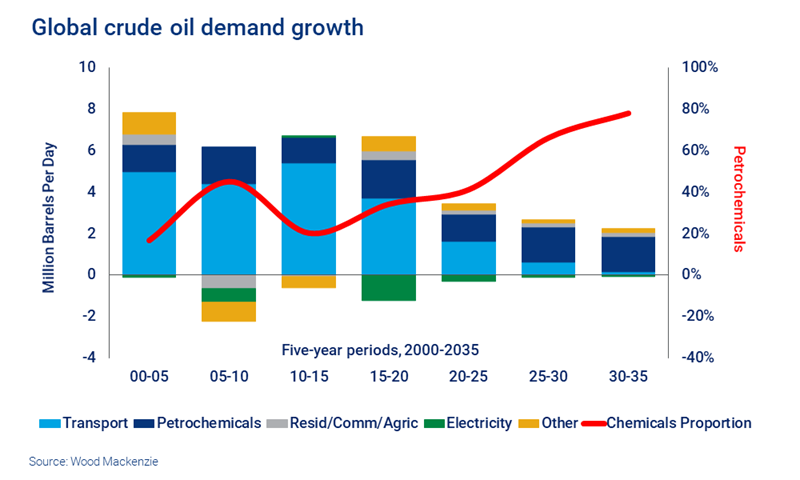

Transportation demand currently represents the majority of end-use for crude oil. But as the energy transition progresses – and drives the electrification of transport – that’s changing. Petrochemicals is now the fastest-growing share of the barrel.

Many oil producers and refiners are shifting their attention to chemicals, particularly olefins and aromatics, as a key target area for the future. Dedicated COTC technologies are being developed and many traditional refineries are exploring retrofitting or building new complexes to maximise production of chemical feedstocks.

This trend will add significant olefin and aromatic capacity, and likely lead to national and international oil companies steadily increasing their stake in the petrochemical market.

COTC creates greater synergy – and complexity

Integration adds value in several ways. It’s an opportunity to integrate resources, optimise allocation of resources and feedstocks, and share utility, logistics and energy costs. It can also allow a producer to switch product yields between refining and chemicals, depending on where the greatest value lies at the time. All of this can help to reduce cost and improve overall profitability.

The benefits of integration – and the value created – will vary by site, technology choice, complexity and scale.

Second-generation COTC complexes are out to prove their worth

There are three degrees of COTC. The first generation is the ‘traditional’ refinery-chemical integration. These sites still focus primarily on fuel production, with chemical yields at 15-20%. Second generation complexes are now targetting up to 40% chemicals yields. The third generation will tip the balance to 70-80% chemicals yields, but the technology for this is not mature yet.

We can look to China to see how the second generation is performing. China launched a new wave of integrated refinery and petrochemical investment after the oil price collapsed in 2014-15 and crude import licences and quotas opened up to private companies. In 2019, Hengli Petrochemical’s complex in Dalian became one of the first of the resulting mega-projects to come online.

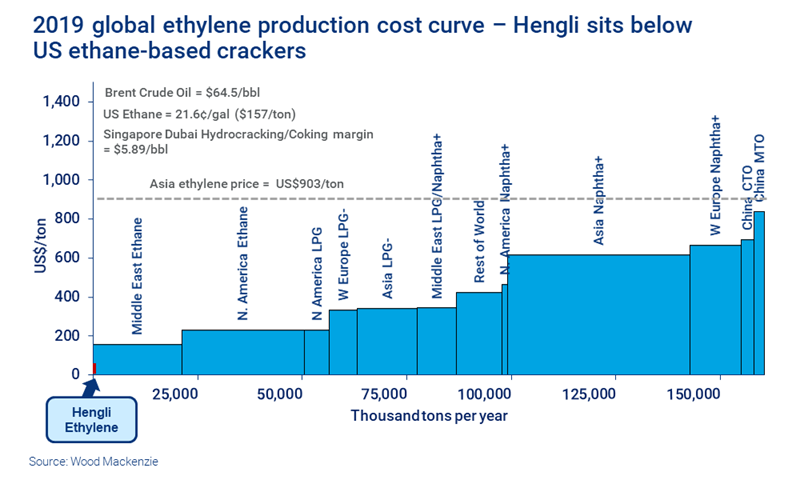

So, how does a second-generation COTC complex compare to a US ethane-based cracker?

Ethane cracker investments became highly attractive after the 2009 US shale boom. They have a low ethylene production cost, as their feedstock is closely linked to US natural gas prices. This makes them especially attractive investments when oil prices are high.

However, Hengli has a very low ethylene cash cost when compared to the global cost curve, as the chart below shows. And now, at the current low oil price of around US$30/bbl, its cracker is very competitive indeed.

This demonstrates that China’s second-generation COTC sites can deliver an attractive return on investment. But this ROI potential won’t apply equally in all regions. China has faster construction times and lower capital costs than the US and Middle East, and these factors could make a critical difference.

A closer look at how COTC can create value

Want to read more about the comparative competitiveness of the Hengli cracker, with a look ahead to the 2024 global ethylene production cost curve? Fill in the form at the top of the page for a complimentary copy of the full insight.

Interested in chemicals industry analysis?

Wood Mackenzie's industry-leading solutions and global experts can help you keep your strategy on course.

- Assess market trends

- Gain insight on topical industry issues, from feedstocks through derivatives to end-use segments

- Pinpoint opportunities and threats

Contact us to find out more.

Kelly Cui, Principal Analyst, Petrochemicals