Get in touch

-

Mark Thomtonmark.thomton@woodmac.com

+1 630 881 6885 -

Hla Myat Monhla.myatmon@woodmac.com

+65 8533 8860 -

Chris Bobachris.boba@woodmac.com

+44 7408 841129 -

Angélica Juárezangelica.juarez@woodmac.com

+5256 4171 1980 -

BIG PartnershipWoodMac@BigPartnership.co.uk

UK-based PR agency

National Oil Company international M&A spend hits 20-year low

But market drivers may change this scenario as Middle East NOCs look to diversify and energy security issues in China could prompt action from Asian NOCs

3 minute read

While the mergers and acquisitions market has been recently supercharged by international oil companies (IOCs), national oil companies (NOCs) have sat on the sidelines, with international spending down significantly from highs a decade ago, according to recent analysis from Wood Mackenzie.

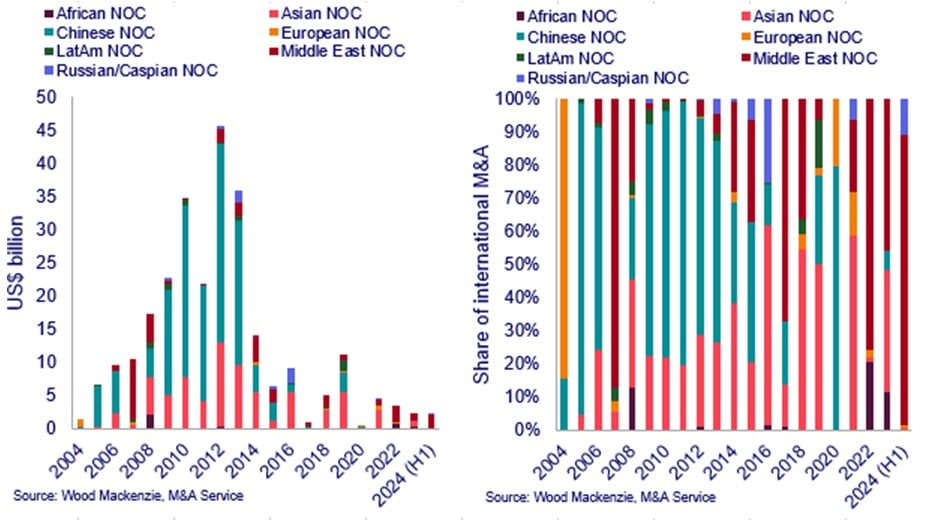

According to Wood Mackenzie, international M&A spend from NOCs has collapsed from over US$30 billion per year (2009 - 2013) to less than US$5 billion (2019 - 2023). The peer group's share of global spend has fallen from nearly 50% at peak to less than 5% today.

“NOCs were once big spenders in international business development, but M&A spend has slumped in recent years,” said Neivan Boroujerdi, director, corporate research at Wood Mackenzie. “However, with M&A valuations attractive and NOCs’ financial ratings at all-time highs, the drivers for NOCs to fill strategic gaps through international business development have never been stronger.

“With (some) NOCs becoming increasingly privatised, motivations for foreign expansion have moved towards those shared by IOCs in terms of portfolio competitiveness and sustainability. We could see several NOCs take advantage of international opportunities to expand, especially those from Asia and the Middle East.

“We don’t expect a return to the heady days of the early 2010s as geopolitical barriers continue to limit potential, but there has never been a better time for host governments to align corporate and country drivers and return to international business development.”

NOC international M&A spend by peer group

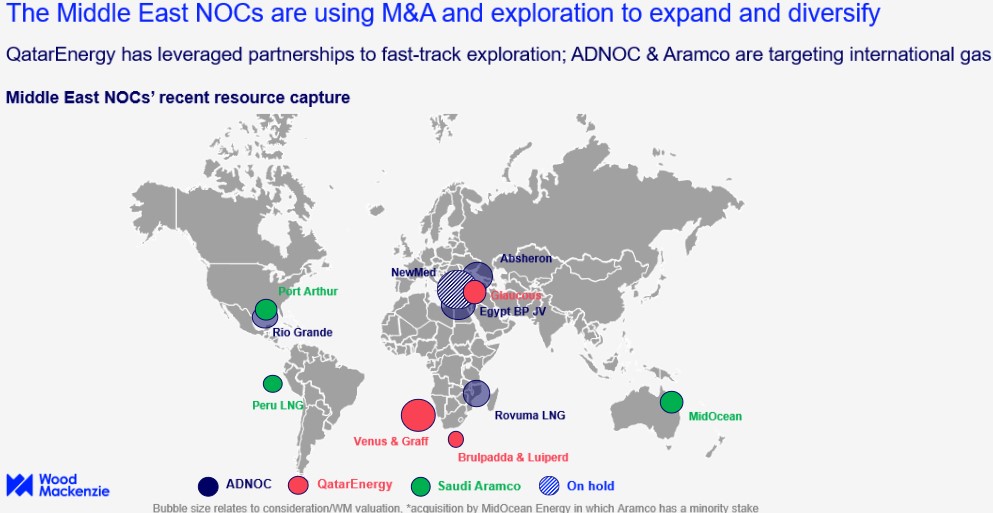

Middle East NOCs emerge as major players

Middle East NOCs are growing oil and gas capacity and – as a group – will be producing more in 2050 than they are today, according to Wood Mackenzie.

“Middle East NOCs are well-placed to out-last other producers, but they do have areas of relative weakness, with portfolios overwhelmingly concentrated towards either domestic oil or gas – significantly more so than other NOC peer groups,” said Boroujerdi. “As a result, several have already kick-started Internationalisation efforts in search of more diversity. We have already seen Saudi Aramco and ADNOC fast-track entry into LNG and QatarEnergy look to grow via exploration. Achieving critical mass will be the challenge but they have the ambition – and capacity – to do it.”

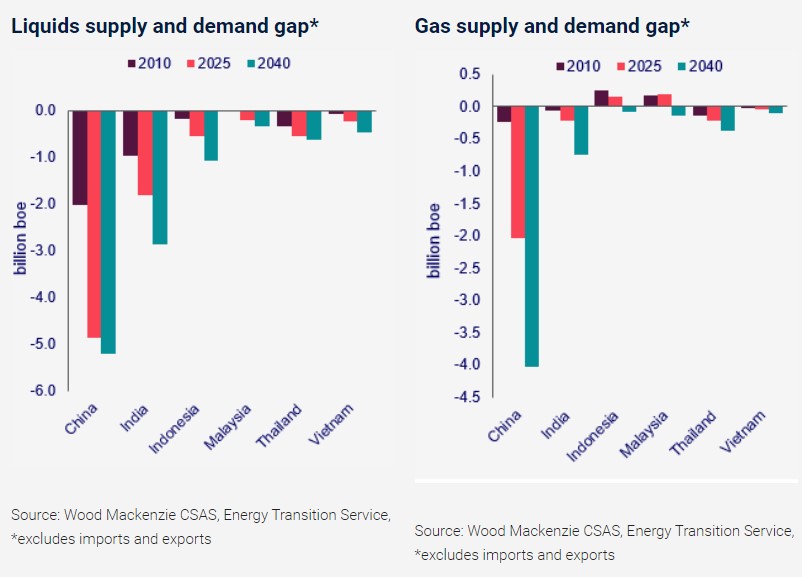

Asian and Chinese look to reduce import reliance

In Asia, booming populations, expanding economies and coal-to-gas switching will see national energy demand increasingly outstrip local supply. While these countries are committed to net zero in one form or another, Wood Mackenzie forecasts an aggregate oil and gas supply shortfall of 13 billion boe per annum by 2030 – up from 9 billion today.

“Despite successful efforts at growing domestic production, homegrown resources are becoming increasingly costly and in short supply. China’s ‘import bill’ is set to rise from 83 billion boe (2000-2025) to 225 billion boe (2026-2050) in our base case,” said Boroujerdi. “Domestic yet-to-find resources and import contracts will help bridge the gap. But overseas resource capture would help hedge against an increasingly volatile environment.”

Deal pricing remains favorable

Oil and gas mega-mergers have made headlines over the last 12 months, but there's still room for NOCs to acquire.

"Outside of North America, where there's been a consolidation frenzy, the upstream M&A market is uncrowded," says Wood Mackenzie's head of upstream M&A, Greig Aitken. "There were only 200 transactions globally in 2023, that's the second fewest number of deals in the last 20 years. But there are still a number of material, high-quality opportunities available internationally.”

Continued Aitken, "Some of those US corporate transactions have looked expensive, but elsewhere deal valuations remain much more subdued, despite having moved off post-covid lows. But companies across the industry are increasingly re-focusing on oil and gas portfolios in response to a slowing energy transition. As this pivot continues, it’s ultimately going to increase competition for acquisitions and push up deal prices. On that outlook, you want to be a fast mover.”