How Italy’s lockdown is affecting power demand

And what that tells us about what’s to come in other markets

1 minute read

Peter Osbaldstone

Research Director, Europe Power

Peter Osbaldstone

Research Director, Europe Power

Peter is a research director with more than a decade’s experience in European power and renewables markets.

Latest articles by Peter

-

Opinion

Four key issues GB electricity market reform must address

-

Opinion

Can Spanish renewables avoid becoming a victim of their own success?

-

Opinion

Abundant, low-cost renewables will transform Nordic power markets

-

Opinion

European power markets emerge from the energy crisis

-

Opinion

European power: why reliance on gas is a hard habit to break

-

Opinion

This is not a drill: key lessons from GB power price spikes

Italy is currently the epicentre of the coronavirus pandemic, with more new and active cases than China – other European countries, Spain and Germany in particular, are not far behind. On March 13, in an attempt to slow the rate of infection and reduce the strain on health services, the Italian government implemented a country-wide lockdown. More than 60 million people were ordered to stay home. Only supermarkets and pharmacies remain open, some serving customers through windows. Only one member of a household can leave the house at a time. And police are fining people for being outside without good reason.

How is this shift in consumer behaviour affecting power demand?

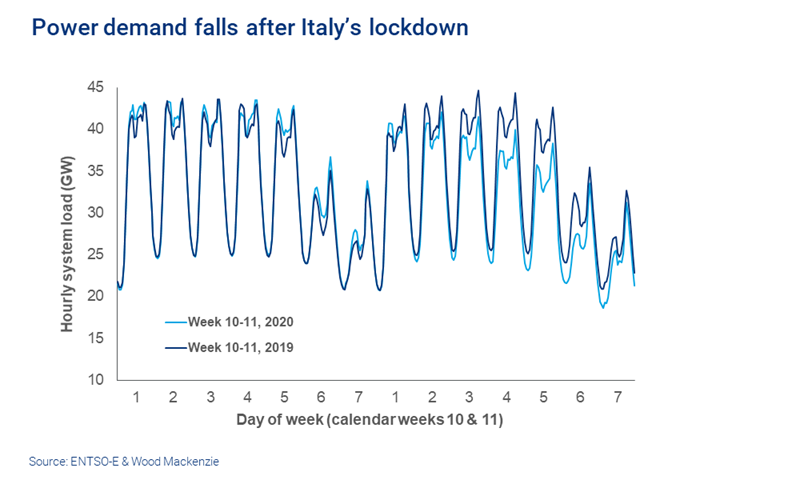

This emergency stop on the economy has led to a sudden and significant drop in power demand.

In the first week of nation-wide quarantine, power demand fell by 8%. That was a 7.3% drop compared to the same week in 2019 (Week 11). Overnight loads, between 01:00 and 06:00 last Sunday (16 March 2020) were at their lowest for March since the 2016 Easter weekend.

Power generation was -8.8% on the week before with gas-fired production (accounting for >40% of overall supply in the market) seeing a 5% reduction (-96 GWh). Non-dispatchable renewables also saw big week-on-week swings, with wind generation down 46% (-280 GWh) and solar up 24% (71 GWh) – highlighting that supply changes were being driven by renewable resource availability as well as lower demand. Net imports – Italy is Europe’s largest power importer – also responded with a -6.1% drop between weeks – the starkest change occurred on Sunday with flows down 45% on the previous week. Forward prices quoted last week for April delivery were down 6% on contracts struck in February.

What does this mean for other markets now facing lockdown?

Italy’s experience provides a guide to how similar restrictions might impact neighbouring countries in the coming days. Further demand reductions are expected across Europe as lockdowns become more widespread. Industrial and commercial demand is set to be particularly weak as economic activity slows.

European gas generators will bear the brunt of demand loss. Low gas prices have positioned CCGTs well ahead of many of their coal-fired competitors, meaning that – despite carbon prices falling in a nervous market over the past week – coal’s contribution to power supply is already much reduced in Europe. With supply swings from variable renewable generation during the relatively productive spring period, gas will be a key provider of flexibility to bring over-supplied power markets back into balance – weaker power demand will exacerbate this role.

We’re currently monitoring the impact on all major European power markets, with a particular focus on the following risks:

Demand in Spain this weekend (14-15 March) was down 5.6% on a week previous, although the week overall was broadly in line with the previous year.

French demand saw a -9.7% dip from a week earlier, Germany was in fact up by 1.5%, GB down 4.7% – the notable temperature sensitivity of French power demand will have been a factor (last week being warmer than the week before).

The coronavirus impact on global power markets is changing by the day

As a result, Wood Mackenzie has developed a new weekly series to help its power and renewables (P&R) research clients.

This report provides updates from the Wood Mackenzie Power & Renewables and Energy Transition teams on the rapidly evolving coronavirus impacts on the wind, solar, storage, and electric vehicle supply chains and development activities, as well as regional power markets. The deliverable will be updated on a weekly and ad hoc basis as the situation evolves.

Complete the form on this page to download the key findings and report brochure to understand how the coronavirus is impacting:

- Solar markets

- Wind markets

- Energy storage markets

- Electric vehicle markets

- Regional power markets

- The energy transition

Already a P&R client? Access the report here. If you want to learn how to become a client, email contactus@woodmac.com for more information.