Why polyolefins are the polymers to watch

Polyolefins are both a petrochemicals industry bellwether – and an opportunity to differentiate

1 minute read

Polyolefins dominate global plastics production. As such, this family of polyethylene and polypropylene thermoplastics offer useful insights into the overall health of the petrochemicals industry – and even the wider global economy.

So what are the drivers of demand? How has the coronavirus pandemic altered the picture? What key challenges lie ahead? And what really sets polyolefins apart in a chemicals portfolio?

We provide monthly market overviews for both polyethylene and polypropylene. Fill in the form for a complimentary sample from our new global editions, or read on for a brief polyolefins overview.

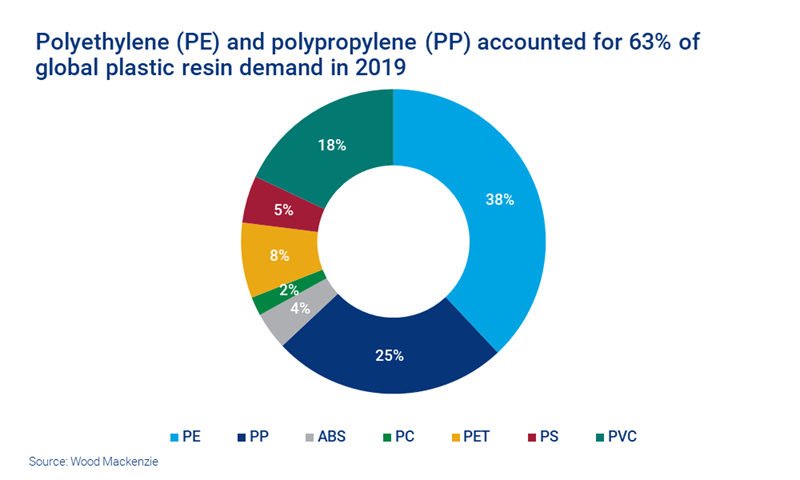

Polyolefins account for two thirds of global plastics demand

Plastics is a major growth area for petrochemicals, and polyolefins account for almost two thirds of global demand.

One reason for polyolefins’ dominance is their versatility. They have an incredibly broad spectrum of end-use applications, including rigid forms of plastics (such as plastic sheeting and pipes), bottles and containers, and more flexible products (such as films, pouches, and bubble wrap).

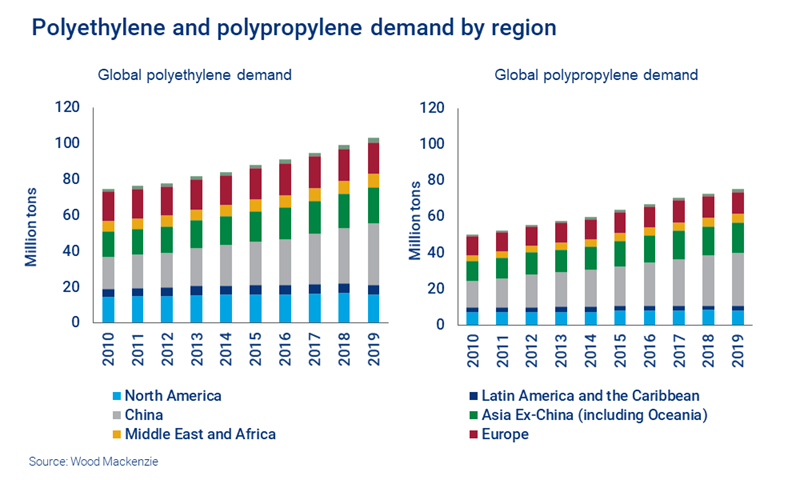

Polyolefins demand has steadily increased over the last decade to 105 million tonnes in 2019, and it’s attracting significant investment as a result. Both production and demand are shifting to the largest areas of population.

Chinese demand has grown at around 8-9% over the last 10 years (around 1.5 times its GDP) and is expected to return to growth in 2020 following the impact of coronavirus. Asia is also the centre of consumption and production, with China the driving force in both polyethylene and polypropylene plastics manufacturing.

Polyolefins are closely aligned to consumer and economic trends

The polyolefins market is deeply entwined with macroeconomics and consumer behaviour, making it a good barometer for the global economy. One example of this was the reaction to the global financial crisis in 2008-2009, where the polyolefins market shrank as the world’s economies contracted. However, the market showed resilience after the heavy loss in global demand and returned to growth by 2010.

Polyolefins have also shown resilience during the coronavirus crisis. Many of the end-use applications are in consumer-facing industries and are influenced by changes in customer spending. A notable example here is the rise in consumer packaging demand seen in 2020, as global lockdown led to an increase of ecommerce and home deliveries – meaning greater consumption of packaging and non-durable plastics.

While the specific drivers vary, demand is typically broadly aligned to the health of the economy, consumer spending and urbanisation trends.

Polyolefins offer opportunities for differentiation

The petrochemical value chain is a complex journey from refinery through to the finished product. It’s after the polymerisation process, where the various forms of polyethylene and polypropylene are manufactured, that a real opportunity to differentiate emerges.

Some parts of the value chain are commoditised. Monomers, such as ethylene or propylene, make up around 85% of the total manufacturing costs, but ethylene from one manufacturer is much the same as that from another. Polyolefin production, on the other hand, presents companies with opportunities to differentiate, add value and expand margins. The technology used for production, the type/grade of polymer being produced, and the level of integration (horizontal, upstream and downstream) all offer such opportunities. Brand and pricing are therefore essential in this space.

In essence, polyolefins can be what makes a petrochemicals portfolio stand out.

The war on plastic poses a threat

Of course, it’s not all plain sailing for polyolefins. In the longer term, they are at the centre of a consumer megatrend: the push for sustainability.

As pressure grows from consumers and regulators, there is greater focus on whether plastic products are recyclable. In the case of polyethylene, it's mainly high-density polyethylene (HDPE) products, such as milk jugs, bottles and sheets, that are recycled. In fact, less than 10% of polyethylene is recycled globally, and more than 30% is used in single use consumer applications. Changing regulations could therefore pose a challenge for polyolefins producers.

Tracking polyethylene and polypropylene markets on a monthly basis provides important insight into the health of petrochemical industry and the global economy. Fill in the form at the top of the page for a complimentary sample from our latest overviews.