The road ahead for electric vehicles

Three of the hottest topics in store this week

1 minute read

Are electric vehicles (EVs) poised to become fully commercially competitive?

A major transition lies ahead for the EV market. While government policy has been the main driver of adoption so far, in the 2020s that will shift gradually towards genuine competitiveness.

Policy will continue to play a critical role and will support global EV penetration through the late 2020s. However, by 2040 battery costs are forecast to be five times lower than today. As these costs fall EVs will become more competitive across all automotive segments. And that will help to lift sales from 2 million units in 2018 to more than 42 million by 2040.

When will this transition take effect? And what are the implications for the EV market – and for power, oils, metals and chemicals demand?

Find out in our inaugural Electric Vehicles Outlook to 2040, available in our store now.

Electric Vehicle Service: H1 2019 long-term outlook

China will have a million electric buses by 2023

Accounting for 98% of the global e-bus market through 2018, China currently dominates the heavy-duty EV segment. Growth fuelled by robust government policy and falling battery costs means that China’s stock will pass the 1 million mark by 2023, and reach 1.3 million by 2025.

To support this, a total of more than 50,000 e-bus charging points will be installed by the end of 2019. That figure is set to more than double by the end of 2025.

In the US and EU, the e-bus market remains in pilot phase, but that could be about to change. Falling battery costs will improve cost of ownership comparisons between like-for-like electric and diesel buses. And clean transportation targets should accelerate growth beyond 2025. But there are barriers to overcome on the road to mainstream adoption.

To find out more, read our report: The growing global e-bus landscape in China and beyond: E-bus and infrastructure forecast for China, Europe and the US.

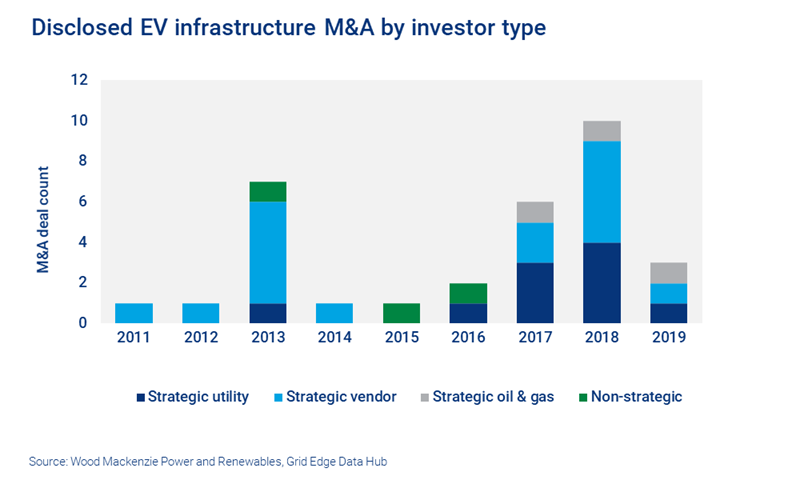

Strategic vendors and utilities dominate EV infrastructure M&A activity

EV charging infrastructure will see significant global growth in the coming years. We estimate that the EV charging equipment market will reach US$8 billion by the end of 2019, and US$20 billion by 2025.

Since 2011 there have been 32 acquisitions of EV infrastructure companies. Of these, 26 were by strategic vendors and utilities seeking to enter the market or strengthen their position.

Strategic vendors were the most active investors, leading 50% of acquisitions to H1 2019. European utilities were the second most active group, completing 10.

Acquisitions of network operators, charger manufacturers and vertically integrated vendors accounted for over half of these deals.

To read more about M&A and grid edge investment activity read Corporate activity in the EV infrastructure space.

reports and forecasts for assets, companies and markets

Get access to trusted natural resource intelligence

Our dedicated oil, gas, power and renewables, chemicals, metals and mining sector teams are located around the world. They deliver research based on our assessment and valuation of thousands of individual assets, companies and economic indicators such as market supply, demand and price trends.

At every stage, we apply a unique and rigorous analytical approach to provide objective analysis and trusted advice that is valued around the world.

Visit the store to find insights into your area of business