1 minute read

Luke Parker

Vice President, Corporate Research

Luke Parker

Vice President, Corporate Research

Luke is Vice President of Corporate Research with a specific focus on the Supermajors.

Latest articles by Luke

-

The Edge

Majors' capital allocation in a stuttering energy transition

-

Opinion

Video | Shell and Equinor announce UK asset merger to create new JV

-

Opinion

Beyond ESG: measuring corporate sustainability in an uncertain world

-

The Edge

Big Oil: upstream M&A gets serious

-

Opinion

Are NOCs prepared for the energy transition?

-

The Edge

How NOCs compare with IOCs on energy transition strategy

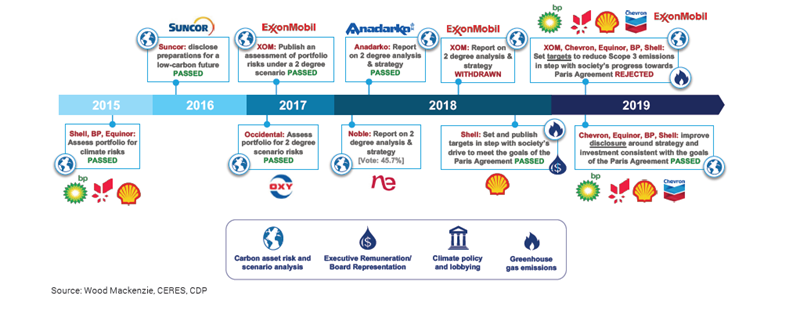

Investor pressure on Big Oil to address climate-related risk has ratcheted up since the Paris Agreement of 2015. Over the past five years – faced with the reality of tight oil and looming peak demand – the Majors have focused on ‘future-proofing’ oil and gas businesses. Re-engineering portfolios to ensure that their barrels sit at the low end of the cost curve. The idea is that they can keep producing oil whatever happens to top-line demand.

But for an ever-increasing proportion of investors, holding the lowest cost barrels is not enough. The Majors are being pushed to adopt ever-more stringent measures around governance, disclosure and targets, on emissions, risk and preparedness. And the pressure will only intensify from here.

Continued engagement is the model. Divestment solves nothing and risks undermining progress towards transparency, accountability and scrutiny.

Luke Parker

Vice President, Corporate Research

Luke is Vice President of Corporate Research with a specific focus on the Supermajors.

Latest articles by Luke

-

The Edge

Majors' capital allocation in a stuttering energy transition

-

Opinion

Video | Shell and Equinor announce UK asset merger to create new JV

-

Opinion

Beyond ESG: measuring corporate sustainability in an uncertain world

-

The Edge

Big Oil: upstream M&A gets serious

-

Opinion

Are NOCs prepared for the energy transition?

-

The Edge

How NOCs compare with IOCs on energy transition strategy

The direction of travel is clear

This is a journey. Everyone – consumers, policy-makers, corporations, investors – is moving in the same direction. How the journey plays out for oil and gas is the trillion-dollar question. Right now, there is no consensus – among investors or companies – on what ‘doing more’ to address climate-related risk actually looks like. On the contrary, there are wildly differing interpretations. In the long run, however, everyone is moving in the same direction.

Big Oil in 2050?

At this point, it’s impossible to know how the journey ends. But some things we do know… the world will still need oil thirty years from now – even in a 2-degree scenario. There will be an oil and gas industry, and the Majors will still be involved. But they will be unrecognisable from the companies we know today, and very different to one another.

At this point, investors are pushing for clarity on broad trajectory. They want to understand how companies plan to out-perform a sector that is being structurally de-rated. If the Majors are to remain investible, they will all need to map out and embark on their journey. Whatever the final destination. Staying put is not an option.

How will investors shape the Majors’ response to the energy transition? Luke Parker explores this topic in-depth in, “Big Oil and climate change: the long road.” Fill in the form on this page to get your complimentary copy.

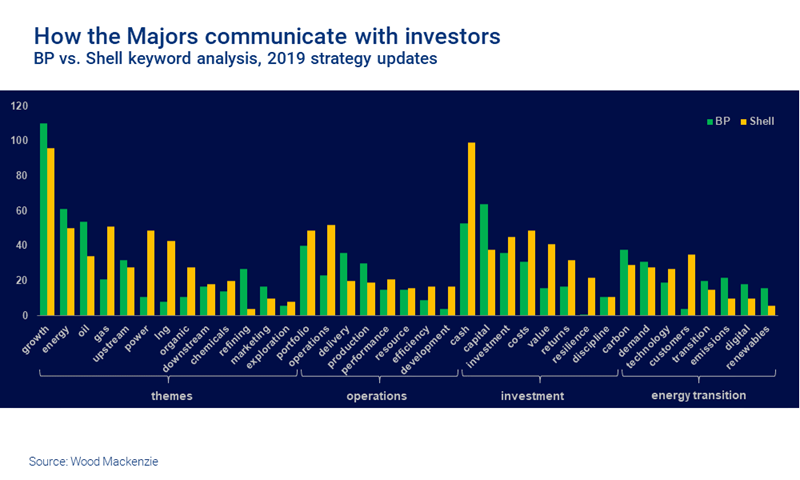

More than words

The Majors are very careful with their words. Every remark is considered, every message carefully crafted. Months of preparation go into showpiece strategy days – the most important date in any company calendar. So what are they saying, and what can we draw from it? In a complementary piece of research, Luke Parker considers the evolving strategies of Shell and BP from a different perspective: through the words they use when speaking to investors. He looks at the terms are they emphasising, how the messaging has evolved, and how the language of investor relations maps to strategy.