1 minute read

Volkswagen has pledged to become carbon-neutral by 2050. Included in its roadmap for reaching this target is a plan to manufacture 22 million battery electric vehicles (BEVs) by 2028. Its electrification plan is more aggressive than any other automaker in the top ten. Can Volkswagen (VW) deliver on its ambitious plans? We called on our analysts along the value chain from metals to renewable energy storage and battery raw materials to explore what could help and hinder VW’s transition.

Read on for some of the highlights from that research.

What's Volkswagen's electric vehicle growth strategy?

Volkswagen has pledged to become carbon-neutral by 2050. It plans on manufacturing 22 million BEVs as part of the roadmap. Wood Mackenzie expects the company to miss this target. However, according to our analysis, VW will hit 14 million by 2028 – making it the world's largest BEV manufacturer by the end of the decade.

According to our base case scenario, VW would need to capture 53% of global BEV market share to sell 22 million EVs by 2028. The company would also need to secure 57% of all EV battery pack production, something that would prove to be extremely challenging.

In the full Volkswagen automaker profile, we look at what share of markets around the globe would be needed to achieve the target of 53%.

Which markets does Volkswagen operate in?

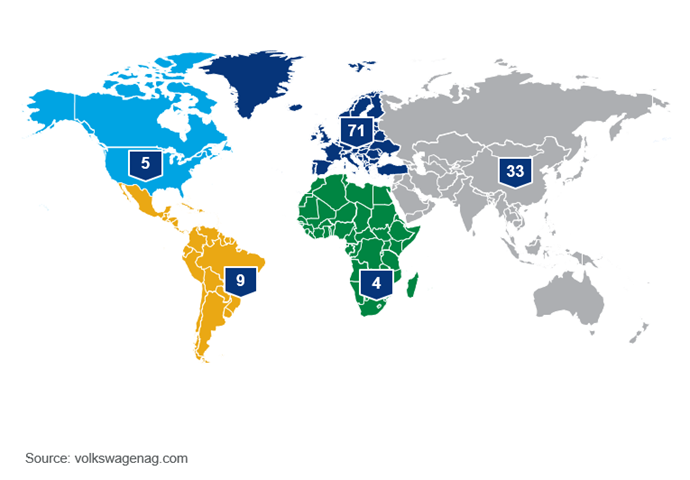

China and the EU represent 81% of Volkswagen’s 2018 sales and have the most aggressive decarbonisation policies. Volkswagen’s manufacturing footprint mirrors its sales distribution, with 71 factories in Europe and 33 in China. Volkswagen plans to transition seven of its plants to manufacture BEVs by 2022.

VW's current global electric vehicle portfolio has two entry-level cars, two luxury cars and a sports car. No hybrid or plug-in vehicles have been announced as part of the plan. However, the company's New Energy Vehicle (NEV) line-up looks much different than its global offerings. And various subsidies and aggressive Chinese policies on NEVs have led to several China-only products.

Chinese policy can be a double-edged sword. A change to the range requirement of EVs meant the Passat plug-in electric vehicle did not qualify for subsidies and therefore was pulled from the market.

Volkswagen’s electric vehicle timeline shows continuous improvement of value to consumers. A decline in the vehicle-cost-to-range-ratio indicates improvements to production costs as well a system efficiency.

What share of battery pack production will be required to support VW’s plans?

Considering the average growth of pack size; this plan will require Volkswagen to secure 57% of all EV battery pack production. Attempting to secure that large a market share on cells would prove challenging. VW has reached an agreement with Ganfeng to supply lithium for the next decade. It also has cell supply deals with Samsung SDI, LG Chem, SK Innovation and CATL. Most recently, VW invested $1 billion in Northvolt, a Swedish battery manufacturer. However, there have been issues with some of these companies, therefore threatening VW's targets.

Where can I find out more about Volkswagen?

Wood Mackenzie’s 30-page Volkswagen profile looks at the performance of its electric vehicle portfolio to date, its plans for the future and what factors could accelerate or constrain its growth.

It answers the questions above in more detail, as well as addressing the following:

- What are Volkswagen’s strengths, weaknesses, opportunities and threats?

- What happens to Volkswagen’s projections if China reduces BEV subsidies and there’s fallout from the WLTP regulations in the EU?

- And more

This is part of our series of automaker profiles. Fill in the form on the page to download an executive summary.