与我们分析师联系

An Accelerated Energy Transition *batteries not included

An accelerated energy transition would create a huge ask in terms of battery raw materials

1 minute read

The Accelerated Energy Transition

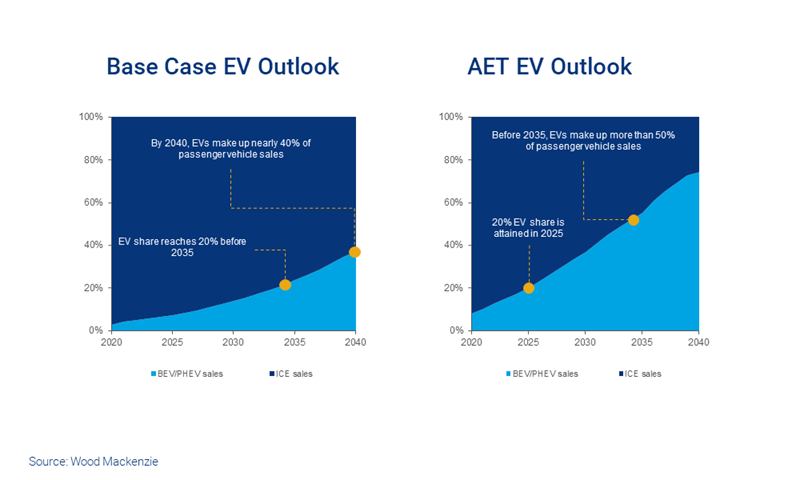

The phrase ‘EV revolution’ gets used a lot. We’ve probably even used it ourselves in some reports. But our base case view is not so much a revolution as a steady climb in adoption, in line with successful reductions in battery costs, the rollout of charging infrastructure, the proliferation of new models and changes in consumer attitudes. Not so much a revolution as ‘EV creep’!

Yet in the midst of the coronavirus pandemic, an increasing number of plans being brought forward to extricate countries from the associated economic malaise have a distinctly ‘green tinge’ to them. From the EU’s own recovery plan, that builds on last year’s Green Deal, to Presidential Candidate Joe Biden’s US$2 trillion climate plan for the US, there appears growing consensus to build a better world. And the decarbonisation of transportation through electrification remains one of the key routes to this.

Governments are not just offering incentives through subsidies and tax breaks, but in some cases are bringing in bans and penalties for combustion engine vehicles.

Electrification of transport, plus increased deployment of energy storage systems, requires a huge ask in terms of the ramp-up in supply of battery raw materials. Under our most recent base case view, supply of materials like lithium, cobalt, nickel, graphite and manganese appears largely adequate over a 10-year forecast horizon, but most markets move quickly in deficit beyond 2030 as EV sales ‘take off’.

So the prospect of a fast-tracked decarbonisation story, an ‘Accelerated Energy Transition’ as we call it, naturally raises many questions for us in terms of how these materials supply-chains might cope. In this report, we examine two possible scenarios for faster decarbonisation of transport, and their key implications. Read on for the highlights of this research, or visit the store to purchase the full report, with detailed analysis of the growth in demand and other implications for battery raw materials.

Demand

In addition to our base case views across various commodities, we run two scenarios at Wood Mackenzie through our integrated research team.

The Accelerated Energy Transition (AET) builds on our base case view, but as the name suggests, reflects heightened societal preference to meet the challenges presented by the quest for sustainability. It is broadly consistent with a 2.5 degrees Celsius global warming view. Our ‘2-Degree Scenario’ (AET-2) sees the cumulative trajectory align with the Paris agreement, and limits global warming to 2.0 degrees Celsius. Both scenarios naturally require more aggressive adoption rates of EVs, and greater deployments of Energy Storage Systems as renewable energy carves out a higher share of demand.

Looking just at the AET, bringing EV uptake forward by 10 years understandably accelerates demand for batteries and the raw materials that go into them. Under the AET scenario, of course, metals demand is markedly higher, but it is the incremental additional demand required through the medium-term which looks particularly challenging.

In the full report, we look at demand from the EV sector under both of those scenarios between now and 2030 for the following battery raw materials:

- Lithium

- Cobalt

- Nickel

- Graphite

Visit the store or contact us to learn more.

Implications

The challenge in terms of cell supply and raw materials demand from both the AET and AET-2 are crystal clear. While AET-2 looks to all extent impossible to achieve given current technologies and metals supply projections, AET merely looks ‘extremely challenging’. Both scenarios leave us with two simple options: increase supply or decrease demand. In the full report, we look at possible routes to match supply and demand:

- What if OEMs vertically integrate through to mines?

- What if governments intervene to accelerate mining projects?

- What if alternate metals were fast-tracked?

- How could faster charging decrease demand for raw materials?

- What if fuel-cell technology displaces demand for lithium-ion technology?

- How likely is a technology breakthrough?

Conclusion

The accelerated energy transition scenarios – AET and AET-2 – starkly illustrate the challenge from a battery raw materials perspective of limiting global warming to below 2.5 degrees Celsius. They also illustrate the current distance between rhetoric from some politicians and environmentalists, and what is required on the metals and mining side.

Clearly, if the world is to pursue an accelerated energy transition, much more capital will be required in a very short space of time for the development of the battery raw materials supply chain – from mines through to refineries and cell production facilities. Yet with low prices and the global economy in the midst of its worst recession for years, the prospect of this is currently pretty limited.

In the full report, we have outlined various ways that the huge scale of the challenge could be reduced. But this is not to say these scenarios are necessarily achievable. Most of these ‘enablers’ have quite a low likelihood of materialising in the timescale required. Moreover, if anything, the scale of the challenge is so large that we would need all to materialise at once. That is, the stars need to perfectly align! Perhaps the main conclusion we can draw is that for an accelerated energy transition to succeed in transportation, ‘normal rules’ in areas like capital allocation, governmental support for mining and even globalised supply-chains, will need a re-think.