Assessing the refineries at risk of closure

Which refineries will be most at risk of closure by 2030?

3 minute read

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan is responsible for formulating our research outlook and cross-sector perspectives on the global downstream sector.

Latest articles by Alan

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

Oil and refining market implications of Israel’s strike on Iran

-

Opinion

What is the impact of US tariffs on oil and refining?

-

Opinion

Oil and refined products in 2025: a commodity trader’s guide

-

Opinion

Global refinery closure outlook to 2035

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

Emma Mitchell (née Fox)

Principal Analyst, EMEA Refining

Emma Mitchell (née Fox)

Principal Analyst, EMEA Refining

Emma is a Principal Analyst in the oils and chems research team.

Latest articles by Emma

-

Opinion

Trump’s tariff plan: implications for the future of global liquids trade

-

Opinion

Assessing the refineries at risk of closure

-

Opinion

Red Sea crisis: what crisis? Not for US refiners as refining margins boom

-

Opinion

Part 3: unlocking the value of refinery-petrochemicals integration

Avanpal Sehmi Singh

Research Analyst, Oils and Chemicals

Avanpal Sehmi Singh

Research Analyst, Oils and Chemicals

Avanpal is focused on refinery evaluation modelling and long-term outlooks for Europe and FSU.

Latest articles by Avanpal

View Avanpal Sehmi Singh's full profileWhile refining margins are expected to be healthy in a post-COVID environment, closure is still a pertinent threat for many refineries.

The future viability of facilities will be dependent on a combination of factors. Our latest Global refinery closure update assesses the threat to over 450 refineries and highlights which facilities are most at risk of closure by 2030. Fill in the form to download an extract from the full report or read on for a quick overview of the key factors that could threaten the long-term existence of refinery assets.

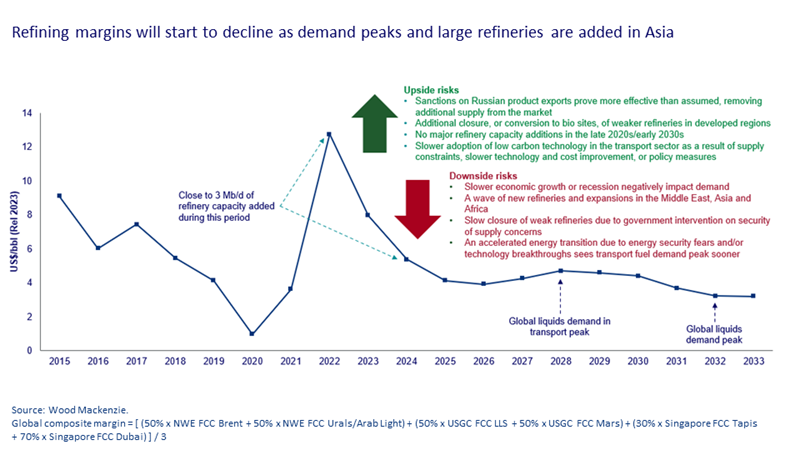

1. Profitability

Refining margins will start to weaken by the end of the decade as fossil fuel demand declines. In OECD countries, transport fuel demand will start to fall from 2025, while the unwinding of free allowances for carbon emissions will also impact European net cash margins from 2030 onwards. China will see liquid demand peak by 2027 and start to fall as the country actively electrifies their road transport. Non-OECD countries will enjoy continued demand growth beyond 2030, but their refiners will not be immune as global demand for transport fuels falls.

Petrochemical integration can help make refineries more profitable, but integrated sites account for nearly half of the global capacity at risk by 2030. Asia Pacific and Chinese facilities in particular fail benefit little from petrochemical integration, as petrochemical yields are often limited and mainly focused on aromatics, which is suffering from chronic oversupply.

Overall, based on forecasted 2030 net cash margins we identified 121 out of 465 screened sites at some risk of closure. This represents a cumulative 20.2 million b/d of refining capacity, or 21.6% of global 2023 capacity.

2. Emissions costs

In the future carbon taxes could make up a significant portion of operating costs, depending on a given site’s specific emissions. Location will be a key factor in this respect, as in the absence of international agreement on carbon pricing, rates will vary by region.

We considered the total cost of Scope 1 and 2 emissions for refineries in our analysis, and found Europe to be most heavily impacted. Increasing carbon prices and the phasing out of free allowances, combined with a lack of planned decarbonisation investment, results in 11 sites in Europe are considered at high risk of closure.

3. Ownership

Our ownership ranking reflects the importance of an asset’s non-commercial factors, such as social value, on its continued operation. In general, most capacity at risk is owned by national oil companies (NOCs), independents and joint ventures (JVs). Of the three types, the future of NOC refineries is considered more secure than independent refineries and JVs, since host governments are likely to support an asset even if it is unprofitable.

Although refineries owned by international oil companies (IOCs) tend to be at lower risk, the high cost of carbon emissions in Europe mean IOC-owned facilities make up a significant portion of sites under threat in the region. Standalone sites with high emissions will typically be the first to face closure or be sold.

4. Strategic value

The strategic value of an asset is another element affecting ongoing viability. For NOC refineries, the host government’s view on its role in the wider economy will be an important factor. Changes in a country’s net trade position if a site closes are taken into consideration, as well as an assets contribution to security of domestic supply.

5. Environmental investments

As stakeholder pressure grows and governments increasingly commit to the energy transition, taxes, allowances and regulations for heavy-emitting sectors including refining will be adjusted accordingly. Given that their products are inherently emissions intensive, refiners will need to pursue broad-based strategies to limit exposure to transition risk. Our analysis therefore incorporates an environmental investments score, which reflects ongoing energy efficiency and product quality enhancements, along with the impact of decarbonisation and/or carbon mitigation projects (either for the site or for the liquid fuel through biofuel projects).

Other upside and downside risks

While these five factors will be key under our base-case scenario, there are a number of other elements that could affect closure risks for refineries globally. On the upside, more effective sanctions against Russia could reduce its exports, while slower than expected electrification could maintain demand in the road transport sector. On the downside, slower economic growth, breakthroughs in low-carbon technology and security fears could all see oil demand peak sooner.