Find out how our Consulting team can help you and your organisation

Can carbon offset crude move from idea to reality?

Companies along the value chain must be proactive in response to the prospect of a carbon offset crude market

4 minute read

Lisa Gillespie

Director, Energy Consulting

Lisa Gillespie

Director, Energy Consulting

Lisa is an experienced project manager working across upstream and the energy transition.

Latest articles by Lisa

View Lisa Gillespie's full profileDavid Parkinson

Vice President, Upstream Consulting

David Parkinson

Vice President, Upstream Consulting

David leads our exploration strategy team and is also responsible for exploration consulting.

Latest articles by David

-

The Edge

Nigeria’s bold strategy to double oil production

-

Opinion

Emboldened and disciplined exploration: results from our Future of Exploration 2024 Survey

-

Opinion

Three critical factors to developing Africa’s oil and gas resources

-

Opinion

Can carbon offset crude move from idea to reality?

-

Opinion

What is the future of oil and gas exploration?

Back in 2019, Shell sold the world’s first carbon offset LNG cargo (COLNG) to Tokyo Gas in a deal that offset the emissions from the entire LNG value chain. Since then, more than 30 COLNG deals have been reported globally, with an estimated 5.5 MtCO2e offset – many using Wood Mackenzie’s LNG Carbon Emissions Tool to estimate emissions.

The obvious next step would be to extend this approach to crude. However, in the three years since that first cargo there has been little movement in the crude markets to price carbon offsets into trades. A combination of macro events, external pressure (or lack thereof) and confusion over value chain ownership means the rationale to pay a premium for carbon offset crude is currently limited.

Nonetheless, the prospect of an emerging carbon offset crude market is looming ever closer. Companies along the crude value chain should be considering how it fits into their long term strategy.

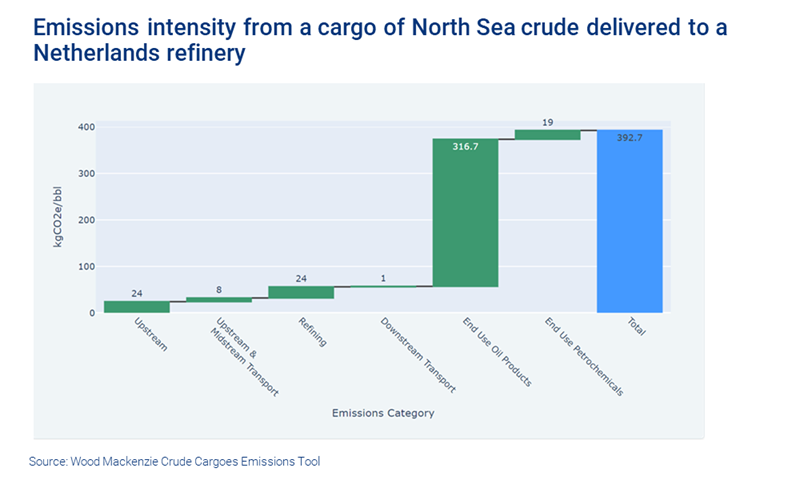

In this article, we draw on our Crude Cargoes Emissions Tool to set out five key drivers and enablers of this market – and how companies can estimate their emissions to effectively plan and execute a carbon offset crude strategy.

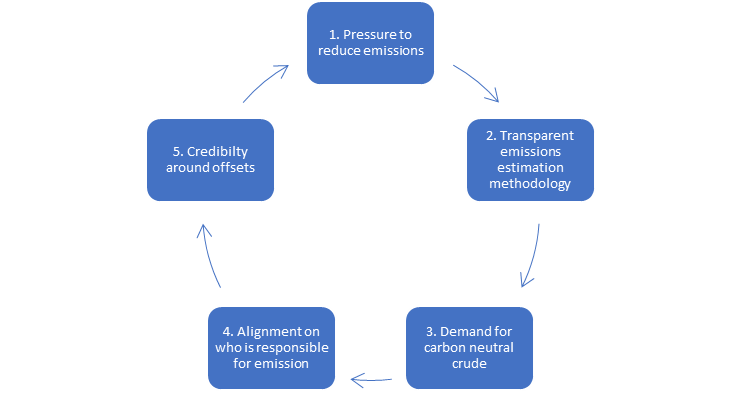

1. Pressure to reduce emissions

COP26 was a driving force for companies and countries to focus on emissions mitigation and reduction. However, Russia’s invasion of Ukraine and widespread subsequent energy price rises have shifted the focus of governments, policymakers and some sections of society away from emissions and onto security of energy supply and managing the cost of living.

Simply put, without external pressure there is no urgency for buyers or sellers to act. But the stark reality is that global warming is not an issue that will disappear. It’s a matter of when, not if, the pressure to act returns. And as this pressure grows, producers have two main options – reduce emissions from operations or, for those unavoidable emissions, offset.

2. Transparent emissions estimation methodology

Before we can begin to look at how companies mitigate emissions, establishing a systematic and transparent way of estimating these emissions is a critical first step in satisfying the needs of regulators, producers, consumers and activists.

Companies and consumers must be able to quantify and benchmark emissions in a clear and consistent way. To support this, Wood Mackenzie has created the Crude Cargoes Emissions Tool to allow companies to estimate emissions along the value chain using a transparent methodology. Covering over 100 of the most traded international marketed crude streams, the tool estimates emissions along the value chain, from ‘well to wheels’.

3. Sustained demand for carbon neutral crude

Without external pressure to reduce or offset emissions, or a clear and transparent methodology to quantify it, there is limited demand for carbon offset crude. That makes the commercial rationale for producers and refiners challenging.

If we assume a similar evolution as has been seen with COLNG, kickstarting the market needs sustained interest from refiners or consumers who are willing to pay a premium for a lower carbon fuel in return for a lower carbon footprint.

This will be driven somewhat by external pressure. However, if we take the example of the Carbon Neutral LNG buyers alliance in Japan – formed in 2021 to promote COLNG and help Japan meet its net zero targets – corporate and/or country-level targets and overall decarbonisation strategy could also play a part.

4. Alignment on who is responsible for emissions

Unlike the broader energy value chain, there is still no clarity on who ‘owns’ the emissions at each stage of the crude value chain, and no standardised reporting methodology.

Even within the Majors peer group, each company has adopted a slightly different approach to reporting Scope 3 emissions. This in turn has a cost implication. Producers and refiners are understandably reluctant to pay to offset post-combustion emissions, which typically account for 75-85% of total emissions.

A key characteristic of the broader energy transition is collective responsibility, from producer to consumer. Each player along the value chain must be willing to contribute in order to reduce or offset emissions.

5. Greater credibility around the offset market

Offsetting has its critics. Some see offsets as a ‘greenwashing’ tactic, used to perpetuate the combustion of fossil fuels. The goal will always be to reduce or remove as much emissions as possible, but in our view offsets can be a useful tool for hard to abate emissions. Our report on the carbon offsets market earlier this year highlighted that companies such as BP, Shell and Chevron are committing to purchasing high-quality offsets – but concerns do remain around quality and sustainability.

A middle ground must be reached. The offset market must increase its credibility to investors and activists, who in turn need to adopt a more pragmatic mindset around how high-quality offsets contribute to the broader net zero story.

The future of crude markets: proactive carbon emission mitigation strategies are vital

Crude markets have a long way to go to meet net zero targets. Reducing emissions as much as possible will always be the most desired outcome. However, for those hard-to-abate emissions, carbon offset crudes – if underpinned by a clear and consistent estimation methodology and combined with high quality offsets – can offer an interim solution for companies and consumers.

The argument about who pays may take some time to decide. In the meantime, using tools such as the Crude Cargoes Emissions Tool will enable companies to be proactive about estimating emissions and implementing successful mitigation strategies.