Electric vehicle and battery supply chain: how a risked EV adoption puts 5 million sales at risk

In our latest report, we examine the challenges in EV manufacturing, supply chain, charging infrastructure and geopolitics that could disrupt electrification

5 minute read

Electric vehicle (EV) sales in the US and Europe have fallen short of base case estimations for 2024, causing governments and automakers to hold back electrification investment and focus instead on hybrids (PHEVs and HEVs). This shift puts 5 million battery electric vehicle (BEV) sales at risk and will reduce installed battery capacity in the US by 23% and in Europe by 20%.

Also at risk through to 2035 is cumulative installed battery capacity and several gigafactories from the fall in demand. In our latest report, we examine the challenges in the market.

Complete the form at the top of the page to download a complimentary extract from our full report, or read on for a summary of the key findings.

The electric vehicle outlook – exploring the challenges and risks

There are several key factors affecting the EV market and supply chains that are preventing EV production and adoption. BEVs remain costly, averaging at over 50% more than average vehicle prices in the US in 2023 and causing the US to fall short by 69,000 units and Europe by 224,000 of base case sales.

Industrial protectionism continues to impact markets as subsidies, regulatory norms, and low-cost imports are reduced. Elevated interest rates are also hindering capital-intensive investments in electrification causing OEMs to shift to hybrids and delay EV targets due to market saturation. This year alone Ford delayed its 600,000 EV production goals and GM reduced its target by 50,000 units.

One of the major constraints to EV adoption in the US and Europe is a lack of available charging infrastructure. In the US this is caused by high labour contracting requirements and stringent minimum operating standards, and in Europe by longer permitting timeframes and a lack of incentive in 80% of EU member states.

Despite production incentives, local gigafactory production in both regions will likely fall short of base case demand and, as the trend for high domestic manufacturing costs and hiked tariffs on battery imports continues, access to affordable local cells and low-cost cells from China is limited.

Both the US and Europe lack the battery midstream capacity to meet domestic demand, increasing reliance on China’s cathode active material (CAM) supply. Even with additional supply from Japan and South Korea in our base case outlook, there is still insufficient to meet demand. In terms of battery technology, at present, sodium-ion (Na-ion) technology is too immature to meet lithium-ion shortfalls and there is also the risk of using lithium metal anodes in solid-state batteries (SSBs) increasing the cost of EV batteries.

Taking a risked EV outlook

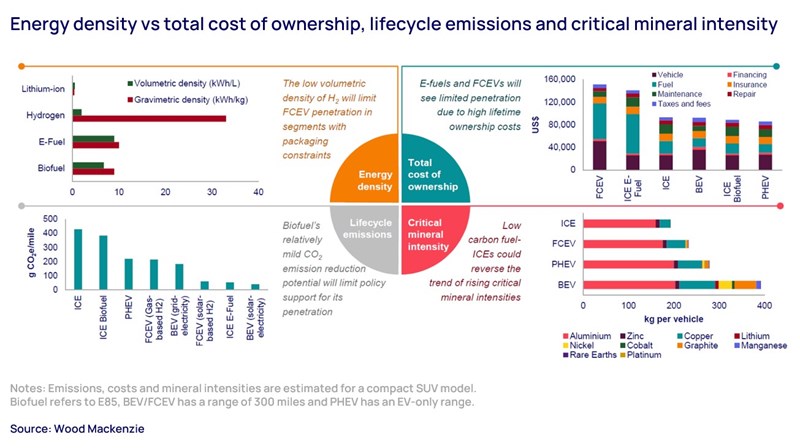

Prioritising EV incentives has constrained investment low-carbon fuel powertrains, making it difficult for alternative vehicles to fill the gap as EV sales slow. In the US, automakers are yet to implement innovations in fuel-cell passenger cars, instead targeting renewable fuels to reduce emissions in larger SUVs and pickups. GM and Ford offer biofuel and E-fuel models, however high prices and a limited choice of models means no significant reduction in emissions.

In the EU, switching to renewable fuels can be done without engine modifications for some ICE models, however, many automakers prefer to update diesel-engine models with electrification rather than substitute with a renewable fuel model. Constraints around packaging, lifecycle emissions and total cost of ownership will also continue to affect the adoption of low-carbon technologies.

Inadequate charging infrastructure and ongoing price pressures will limit EV sales, with annual sales of five million at risk in the US and Europe that will lead to 420 GWh loss of annual installed capacity in 2035. Increased economic pressure and deficits in production capacity, as well as restrictive policies and higher interest rates all affect the rollout of mass-market EVs.

Potential impact of the risked outlook

In the US, we expect that joint ventures will remain stable on the back of assured supply to automakers, however, we predict that new entrants will struggle to scale up. In Europe, high production costs and significant gaps in supply chains create a challenging environment for domestic players, while Chinese players face issues from import tariffs and lower demand, leading to limited overseas capacity expansion. A reduction in gigafactory supply will limit supply of scrap to recyclers, potentially reducing the availability of recycled battery raw materials by up to 10% in 2035.

Realigning with the base case outlook

Rising gas prices, accelerated development of charging infrastructure, and incentivising sales would significantly boost EV adoption in the US. Also, removing restrictions on Chinese battery material sourcing would reduce overall costs and could be easily managed by linking subsidies to OEMs that commit to US investments.

In Europe, giving PHEVs a partial exemption from the EU’s 2035 100% zero emission vehicle mandate, would increase R&D into improving engine efficiency to lower emissions in the long-term. Similarly, mandating the electrification of corporate fleets would deliver improvements in electrification rates and increase the development of workplace charging infrastructure.

Increasing the production of Na-ion to reduce raw material demand would be possible with a US$29 billion investment into 80 new gigafactories and reduce annual Li-ion demand by 400 GWh. Smaller EV pack sizes would also reduce demand pressure; if the average BEV packs size was reduced from 75 kWh to 50 kWh it would save 544 Mt of LCE demand in 2035.

The midstream supply gap in the US could be bridged with a US$54 billion investment but, in reality, OEMs would still need to partner with Chinese companies to meet growing demand for iron-based batteries. And in Europe, a US$59 million investment would be needed to fill the gap but, again, the only way to meet the shortfall would be by continuing to import cells and CAM from China.

Learn more

Fill out the form at the top of the page to download your free copy of an extract from our latest report; ‘Electric Vehicle & Battery Supply Chain – Risked EV Outlook’.