与我们分析师联系

Floating solar: still niche or ready for the mainstream?

Floating photovoltaics (FPV), or 'floatovoltaics', has seen 150% year-on-year growth – and continues to gain traction

3 minute read

Sagar Chopra

Senior Research Analyst, Solar

Sagar Chopra

Senior Research Analyst, Solar

Sagar focuses on PV system pricing for US and LATAM regions.

Latest articles by Sagar

-

Opinion

Liberation Day tariffs threaten to disrupt US wind and solar industries

-

Opinion

Supply shortages and an inflexible market give rise to high power transformer lead times

-

Opinion

Top 10 solar PV inverter vendors cornered 86% of the market in 2022

-

Featured

Brighter skies for US solar in 2023? | 2023 outlook

-

Opinion

Is the end of high US solar system prices in sight?

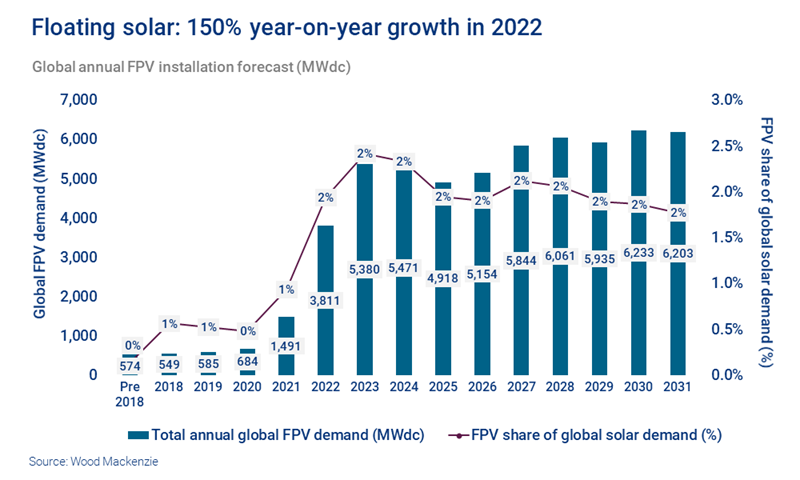

The global floating solar market may be a niche segment right now, but as the technology evolves and more stakeholders enter the fray that may be about to change. In 2022 the total market is expected to be just shy of 4 gigawatts direct current (GWdc) – reflecting 150% year-over-year growth.

And while floating solar only accounts for 2% of overall global solar demand today, compounded annual growth is expected at 15% in the next ten years, with cumulative global installations expected to surpass 58 GWdc.

We explored the future of this exciting market segment in Floating solar landscape 2022. Visit our store to access the report in full, or read on for an introduction.

Market drivers: offshore and near-shore floating PV developments gain traction

The confluence of land scarcity, increased land costs, new market entrants and growing market maturity will all contribute to the growth of the floating solar market. Offshore and near-shore floating PV developments are also gaining traction where in-land water bodies, or their use for solar, is limited.

Many new project announcements and capacity auctions are happening around the hybridisation of floating PV with hydropower. The two technologies can complement each other. During the dry season floating solar can maximise production and during the wet season hydro can be the majority power producer. Together they can also help manage peak demand and smooth out the total power production. Co-location with existing offshore wind projects can also help with cost amortisation as floating solar can take advantage of existing transmission infrastructure.

The segment continues to evolve with disruptive solutions on all fronts of the component stack to make floating solar more adaptable and robust for water-based applications. We’re seeing new market entrants and stakeholders develop innovative technologies to design such floating systems – examples include dual glass modules, wave-dampening floats and flexible mooring solutions.

Regional markets: Asia Pacific sets the pace for floating solar

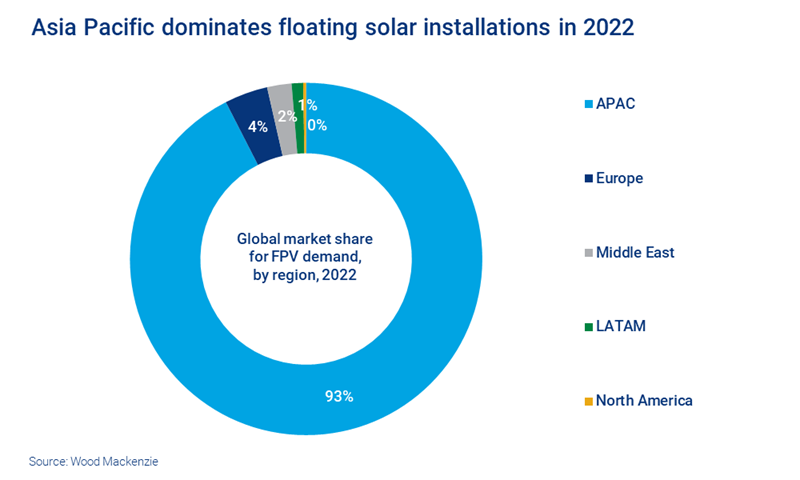

The Asia-Pacific (APAC) region continues to be the largest market for floating solar. With 3 GWdc, the region captures over 93% of installations in 2022.

This dominance is due to high population density, which leads to land scarcity and high land acquisition costs. Capital expenditure (capex) for floating solar is also one of the lowest in the region compared to others due to the availability of locally-made components and comparatively cheap labour rates.

China bolstered its leading position in 2022 with the commissioning of the 320 MW floating project by Huaneng Power International in the Dezhou region of the Shandong province. This is currently the largest floating solar project in the world.

India, Indonesia, South Korea, Vietnam and Thailand have all either executed large-scale floating solar projects or have announced pipelines for the development of projects in the next two to three years.

Faced with competition from agriculture for land use in Europe, solar developers have looked at floating solar as an alternate method to develop capacity. The Netherlands and France continue to lead, sharing over 85% of Europe’s total floating solar capacity in 2022. This is expected to change as new markets, such as Spain and Portugal, also adopt and develop new projects.

Despite abundant land availability, the US is also exploring floating solar projects and is expected to have about 10% yoy growth in installations in 2022. Even though the cost of floating PV development is about 20-40% higher than ground-mount solar, the elimination of land lease costs in urban areas, where there is demand for solar, can be a big driver.

With demand for solar increasing across the globe and developers looking for innovative ways to increase capacity, floating solar has the potential to emerge as a mainstream solution.

Floating solar landscape 2022 explores global, regional and country-level installation demand forecasts through 2031, alongside all-in system cost estimations and a manufacturer and developer taxonomy. Visit the store to find out more.

This article is based on a piece by Sagar Chopra originally published in Energy Global.