Global wind turbine market: state of play

After a record-breaking year, what are the key wind turbine market trends – and which OEMs have secured the most market share?

1 minute read

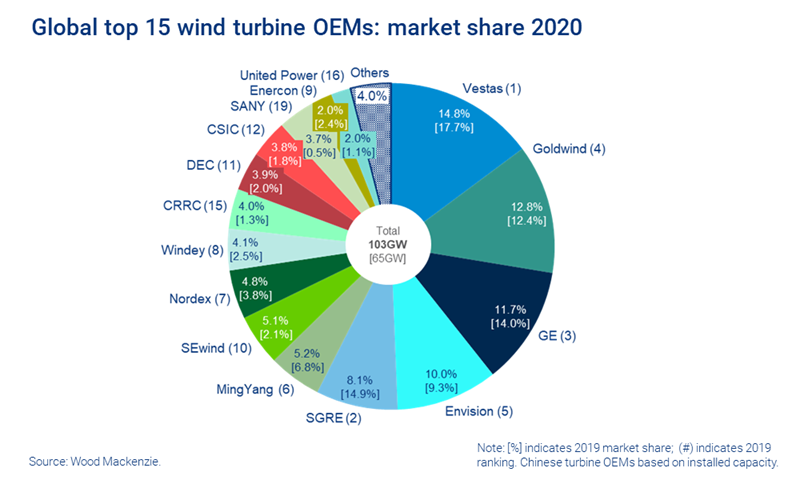

The global pandemic seems to have had little impact on the momentum of the wind turbine industry. An impressive 12 of the top 15 wind turbine original equipment manufacturers (OEMs) registered record new capacity in 2020. In a competitive field, who’s setting the pace and securing the most market share?

Our Global Wind Turbine OEMs 2020 Market Report provides a detailed drill-down by region, including both year-on-year and cumulative comparisons of market share. Fill in the form to receive a complimentary extract with a selection of charts. Or read on for an introduction to five key themes.

1. Wind turbine OEMs were active across 50 markets despite the pandemic

There was little evidence of any Covid-19 related slowdown in wind turbine markets in 2020. In fact, OEMs demonstrated the strength and maturity of the global supply chain by installing new capacity across 50 markets globally.

European OEMs dominated in terms of number of countries served, with Vestas maintaining its global reach by engaging in 34 individual country markets. It was also the strongest performer in terms of market share, although at 14.4% this had shrunk from its 17.7% share in 2019.

2. Chinese OEMs dominated the global rankings for new wind capacity

Chinese OEMs upended recent global market share consolidation trends by securing 10 of the top 15 places in the global rankings for new installed capacity in 2020. This was largely thanks to a massive surge in Chinese onshore market activity ahead of the phasing out of subsidies at the end of 2020. The Chinese domestic market accounted for the vast majority of new installed capacity by Chinese firms, with their penetration into global markets remaining low.

3. Onshore wind continued to dwarf offshore

Record onshore installations completely dwarfed new capacity in the offshore segment, contributing to 92% of total global installations in 2020. New offshore installations barely grew over the previous year, at 6.8 GW compared to 6.6 GW in 2019.

However, the huge potential of offshore wind means we expect that to be a blip rather than any sign of a long-term trend. Siemens Gamesa Renewable Energy (SGRE) and SEWind were the top performers, accounting for nearly half the offshore market between them.

4. China and the US accounted for three-quarters of global wind turbine installations

China contributed 58% of global installations, with the US accounting for another 18%. More than twice as much capacity was installed in China in 2020 compared to 2019 (59.9 GW compared to 27.6 GW).

Envision closed the gap in absolute numbers with market leader Goldwind, although both saw their market share drop as Tier II and III OEMs took advantage of the top players’ limited supply to capitalise on the installation rush ahead of the feed-in-tariff phase-out.

5. The top five wind turbine OEMs ex-China enjoyed 92% market share

Despite the proliferation of Chinese firms in the top 15, three of the top five by market share — Vestas, GE and SGRE — were western OEMs. Outside of the hard-to-access Chinese market, western firms enjoyed almost total dominance, with Vestas, GE, SGRE, Nordex and Enercon taking a 92% slice of the pie. Worth noting is Vestas’ 32.1% share of global markets ex-China — the highest in the past decade.

Our full Global Wind Turbine OEMs 2020 Market Report provides detailed market insight, from key trends and onshore-versus-offshore comparisons to regional analysis. It also includes separate analysis for the Chinese market, Asia Pacific ex-China and Global ex-China.

Fill in the form to receive a complimentary extract, which includes charts on:

- Markets served and capacity installed by the global top 15 OEMs

- Breakdown of market share for the Americas, Asia Pacific and EMEARC (Europe, Middle East, Africa, Russia and the Caspian)

- Track record of historical changes in new capacity market share for key OEMs.