How will the operations and maintenance market adapt to offshore wind’s rapid rise?

The O&M market is still in its infancy – but it’s growing up fast

1 minute read

Offshore wind operational expenditure is expected to grow 16% annually to €10 billion by 2029. How will changing industry dynamics, such as improved economies of scale and reductions in subsidies, affect the operations and maintenance (O&M) market?

Our report Global Bottom-fixed Offshore Wind Operations and Maintenance 2021 includes analysis of how the market will evolve between now and 2029, the impact of future innovations, and the changing shape of market leadership.

Fill in the form for a complimentary extract. Or read on for an overview of some of the most important themes.

Europe dominates the market – but others are catching up

Ambition is high for offshore wind. FIDs for new capacity hit an all-time high in 2020, and a record number of alliances were formed. The decade is off to a strong start, and will translate into steady growth in operational expenditure. Our forecasts show that Europe will remain the biggest O&M market this decade, reaching €5.5 billion by 2029. Meanwhile, rapidly expanding markets in Asia and the US also bring new challenges and opportunities for domestic industry and international investors.

In fact, China looks set to overtake the UK as the world’s largest single offshore wind O&M market. We expect to see 41 GW of growth throughout the 2020s, leading to a total of 49 GW capacity. That’s equivalent to €1.7 billion of opex opportunities by 2029.

How will O&M strategies adapt to a changing market landscape?

The industry is moving from highly subsidised projects, featuring smaller turbines placed nearer shore, to a new model with larger turbines, placed in father to shore – and reduced levels of subsidy.

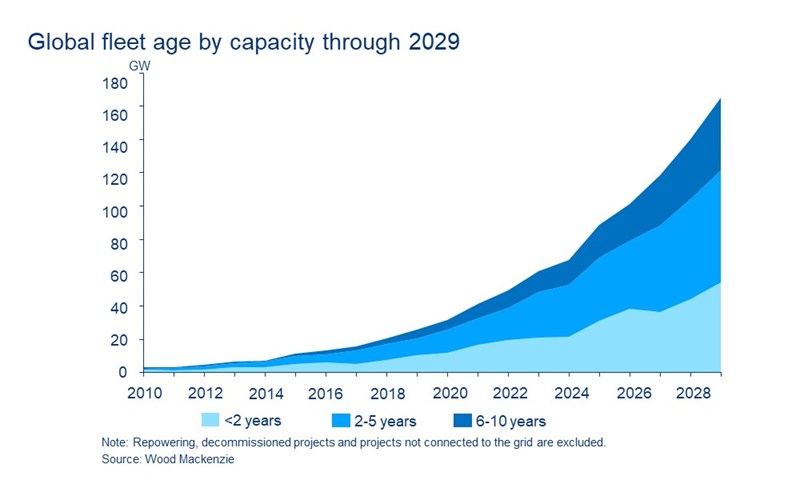

The global offshore wind O&M market is still in its infancy and lacks experience in long-term O&M issues and failures. Just 1.8 GW of global capacity has been operating for more than 10 years. By 2029, this figure will have increased to around 20 GW, but nearly 90% of the operational fleet – 165 GW – will still be under 10 years old.

This young but growing industry is set to face financial challenges, as over 34 GW plants come out of their subsidy term in the 2030s, and enlarged new built projects face low- or zero-subsidy tariffs. Furthermore, factors including curtailment, price cannibalisation and the growing complexity of turbine technologies raise operational risks, directly challenging project profitability in Europe.

However, these challenges will facilitate new technologies and innovations in asset management and O&M, creating opportunities for new service suppliers across the supply chain.

Innovations and economies of scale are driving down operating costs

Economies of scale and improved efficiency of asset management and O&M services will continue to drive down costs for asset owners.

Average opex per megawatt dropped 44% in Europe between 2012 and 2020. This was fuelled by the implementation of flexible service operation vessels, remote operation innovations (such as drones), cameras, new digital technologies and the impact of offshore wind clustering.

The recent coronavirus pandemic has tested the operational resiliency of offshore wind, forcing a re-evaluation of digital technology strategy.

Looking further forward, in addition to increased efficiencies, further innovations will reduce opex on newly built offshore wind farms and operational assets. These include machine learning and deep learning from big data, as well as robotics and autonomous systems that will partially offset labour costs.

Should operators bring maintenance in house?

The rapid growth of the offshore wind O&M service market provides a stable revenue stream for turbine manufacturers and enhances their value proposition in the turbine service market.

Large European asset owners with established in-house O&M capabilities tend to carry out their own O&M services, these in-house maintenance strategies are increasingly common for large-scale developments.

However, building in-house O&M competence is costly, especially in light of diminishing subsidies and increasing development costs (such as seabed leasing fees). Operators without in-house servicing capabilities need to balance costs and benefits when selecting their O&M strategy.

The full Global bottom-fixed offshore wind operations and maintenance (O&M) trends 2021 report provides an offshore O&M landscape and explores strategy and trends, as well as the potential of advanced technologies, specifically the key requirements and opportunities they bring for the industry.

Fill in the form at the top of the page for a complimentary extract of the full report including charts on:

- Predicted growth in the O&M market to 2029.

- A breakdown of O&M market by value-chain segment

- Global fleet age by capacity and market share