Find out how our Consulting team can help you and your organisation

How will Europe’s Green Deal shape renewable energy project finance?

The big push for net-zero creates big opportunities – but there is volatility to navigate

1 minute read

Prashant Khorana

Director, Power & Renewables Consulting

Prashant Khorana

Director, Power & Renewables Consulting

Prashant is Director, Data Product Owner – Asset Valuations within Wood Mackenzie's research and data organisation.

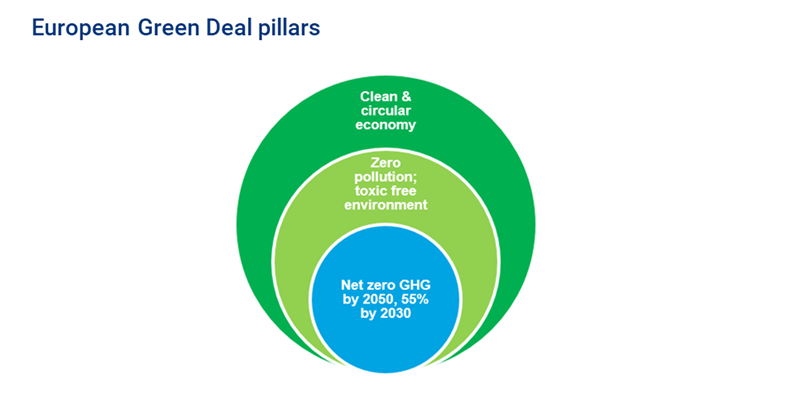

View Prashant Khorana's full profileThe European Green Deal is a set of policy initiatives aimed at making the EU climate neutral by 2050. At its core, it seeks to boost the bloc’s economic sustainability by fostering green technology and renewable energy.

A huge push is needed to stay on track with ambitious net-zero targets. But at the same time, the coronavirus pandemic has stoked fears that green ambitions may be diluted as Europe looks to weather the economic turmoil. This has made the clean energy space both exciting and volatile. So, what does that mean for project finance?

As I discussed in a recent article, it’s impossible to predict exactly how capital allocation behaviour for power and renewables will develop over the next two decades. But I do expect two things: that active investors will continue to take the lead in mobilising capital in the risk-on spectrum of energy transition infrastructure for the foreseeable future; and that these firms will continue to sell down assets to risk-off investors.

The EU aims to cut greenhouse gas (GHG) emissions to 55% below 1990 levels by 2030.

At our recent Power & Renewables Conference Europe, I asked a panel of experts for their views on how Europe’s Green Deal would shape global energy project finance over the coming decade. Read on for a few highlights from our discussion.

Question: One of the narratives we've heard quite a lot is that the volume of people chasing renewables capacity has exploded in recent years. What’s your take on the situation?

David Diaz, Chief Financial Officer of X-Elio:

The renewables market is really exploding and the boost to capacity in wind and in solar will be huge. I see this as a space for many different bidders with many different strategies. The amount of interest from bidders is high and will continue. Banks and other players have environmental, social and governance commitments so they really need to take advantage of this window of opportunity to enter or reinforce their position in this market.

Peter Highmore, Head of Structured Solutions at Ørsted:

I think we are seeing a large amount of liquidity on both the equity and the debt side for assets, so we're seeing new players come in. In those deals, we are seeing more and more new participants coming in, being pushed by ESG drivers, in particular. On the debt side, we're seeing good oversubscription levels, even for the larger projects.

The more established players who have been looking at the offshore market for a while now, they're increasingly looking to get in at earlier stages to justify higher returns.

Question: So it’s not all just irrational exuberance. There is some differentiation. Offshore wind has been labelled as the space in which we are seeing a “clash of the titans”, as the big oil dollars chase opportunities. Is this the price you pay to enter the market?

Lisa McDermott Director, Executive Director Renewable Project Financing at ABN AMRO:

There's no shortage of dollars, but for the right projects. But I don't think it always feels that way for certain parties trying to come into the market, especially when you look at the Green Deal as a whole.

The ones that will struggle for liquidity are those trying to enter the market with technology that's not been proven at scale yet ‒ floating wind, waste-to-fuel technologies, hydrogen technologies and where the deal involves a jurisdiction that's still considered quite exotic for commercial lenders in the renewable energy space, and where few of us actually have a local presence.

Peter Highmore:

Poland and the newer EU markets are going to be expanding quite quickly in the next five years. I think that is a particularly important market for the banks that have traditionally put forward large tickets in the more established jurisdictions. They need to step up… and open up those markets in conjunction with the likes of the European Investment Bank, which is obviously going to have access to more funding through the Green Deal process.

Christiane Kuti, Senior Director, Fitch Ratings Infrastructure and Project Finance Group:

It still depends on what government sets as support. We think that there will also be competition between jurisdictions, and that is clearly a reflection of the national actions plans. We think the renewable sector, in particular, is very well set to attract investors and there may very well be this rebalancing of investments that come from carbon-intensive industries or the hydrocarbon sector into the renewable sector in the future. It may not necessarily be new money. It may be reallocation of existing money as well.

Question: We’re seeing tremendous appetite from off-takers, especially the big tech firms, data centres, etc. What is your feel for the market?

Lisa McDermott:

It's definitely an off-takers market. The jurisdictions in which we have seen the most activity for corporate power purchasing agreements (PPA), whether physical or financial, are probably the Nordics and Spain. The UK to a lesser extent ‒ it never really took off as much. I think everyone's waiting for the contract for difference to come back.

Find out more about investing in the energy transition, with Prashant Khorana’s look at six capital allocation principles for power and renewables investors.

Power & Renewables Conference: APAC – June 22-24

Global expectations for action on climate change in Asia have soared since China announced a 2060 carbon neutrality target in September of 2020, followed by 2050 targets from South Korea and Japan in October.

Our Power & Renewables APAC Conference will shed light on the path to carbon neutrality.