Next-stage decarbonisation in Europe: five key considerations

Near-term reduction targets are crucial on the road to net zero

2 minute read

By Dan Eager, Principal Analyst, European Power & Renewables, and Rory McCarthy, Senior Research Manager, European Power and Renewables.

The EU’s recently announced target to reduce greenhouse gas emissions to 55% below 1990 levels by 2030 clearly acknowledges that decarbonisation cannot wait. So, while 2050 net-zero targets may grab many of the headlines, near-term goals over the next decade are arguably even more important. But what will be needed to achieve them and what are the enablers and drivers in play?

This article is based on a presentation from our Power & Renewables Conference: Europe. Read on for a short summary of some of the key points – and fill in the form for a complimentary copy of a selection of presentation slides and charts.

1. Policy must go beyond electricity generation to cover industry, buildings and transport

While huge progress has been made in the power sector, with emissions having fallen by well over 50% from their peak, this alone is not enough. Rapid decarbonisation now needs to happen across industry, buildings and transport.

For example, under our accelerated energy transition -2 (AET-2) scenario – which shows a way to limit global warning to two degrees by 2050, by the end of this decade – all new passenger vehicles sold would need to be electric vehicles (EVs). Similarly, in the residential sector, there will need to be a far more rapid switch away from gas and oil-fired boilers towards electric heat pumps for heating. Regulation, potentially including bans on traditional carbon-intensive technology, would be required to ensure rapid decarbonisation of industry, buildings and transport.

For analysis of the steps the EU will need to take to deliver on the new 2030 target, read Fast and furious: Europe’s race to slash emissions.

2. Low-carbon hydrogen will be a vital part of the solution

Hydrogen is already used as a key feedstock in the refining and petrochemical sector, but its importance is set to grow significantly as part of a net-zero future. Low-carbon hydrogen will provide the means to decarbonise sectors where direct use of electric power is not an option, from shipping and aviation to industrial processes like steelmaking.

Green hydrogen is also an excellent complement to variable wind and solar generation, as it can act as a form of long-term energy storage, being converted back to electricity later when required.

However, with the market needing to move from around 80,000 tonnes today to between 20 and 35 million tonnes by 2050, governments will need to heavily incentivise green hydrogen – and soon – in the same way as has been done in the past for wind and solar.

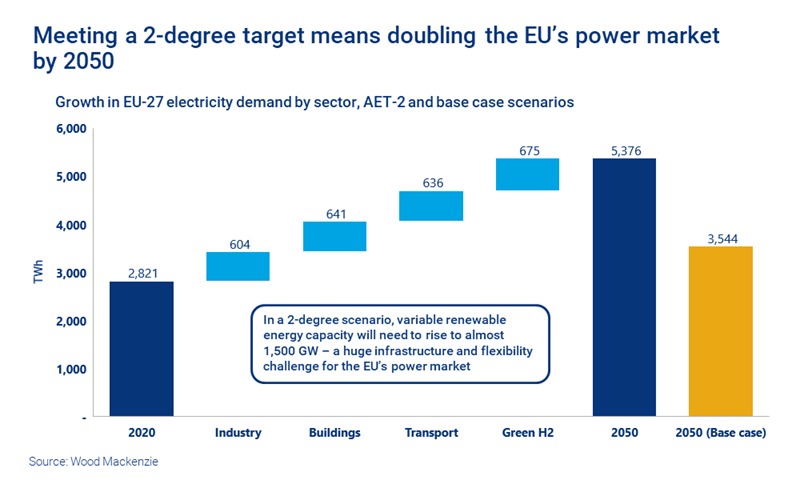

3. New sources of demand will require electricity generation to double by 2050

In our AET-2 scenario, power demand would almost double to 5,376 TWh by 2050 (compared to 3,544 TWh for our base case) – as can be seen in the chart below. As well as powering vehicles and industrial processes and heating buildings, much of this additional demand will come from green hydrogen production.

In many cases it will be a better solution to produce hydrogen using dedicated off-grid wind and solar power, rather than connecting electrolyzers to a grid infrastructure struggling to meet this range of new demands.

4. Gas will fulfil a different role on the road to net zero

Net zero does pose significant challenges for gas and outside of the UK policy support is reducing. Nevertheless, global gas demand is expected to grow through 2040 as a lack of commercial alternatives in multiple sectors supports prices.

Lower coal and nuclear will offset some of the pressures from renewable growth over the next decade and help maintain demand – gas will therefore continue to provide a similar amount of capacity but will change from being a baseload provider to providing backup and meeting residual loads. Innovations in technology such as carbon capture, utilisation and storage will be required to extend gas’s role in a low-carbon future.

5. Flexibility in power supply will be vital

There will be a move from a world where supply volumes are focused only on positive terawatt-hours and system headroom to one where negative terawatt-hours and system footroom become just as important.

In this environment, resources which can reduce their power output or increase their demand to balance the needs of the system will be key. Battery storage will become more competitive and displace growth in a gas peaking capacity. The ability to ramp-up quickly, load follow, import, export and store will be central to the effective operation of power networks and will become a key investment opportunity.

Finally, it’s worth noting that simply placing new technology into an existing system is rarely the most efficient way to decarbonise. Putting electric batteries and motors into a vehicle designed for an internal combustion engine would not create a truly efficient EV. In the same way, a more radical market redesign may be necessary towards the end of this decade to make it truly fit for purpose in a net zero future.

To find out more about the enablers of success and drivers of change for next-stage decarbonisation in Europe, you can download a selection of key slides from this presentation.

This includes charts on:

- EU-27 CO2 emissions by sector, Wood Mackenzie base case and AET-2 scenario

- Hydrogen supply and demand, 2020 vs 2050

- A variable renewable energy system requires a new flexibility fleet: Spain in focus

- The future of gas generation.

Fill in the form at the top of the page for your complimentary copy.

Power & Renewables Conference: APAC – June 22-24

Global expectations for action on climate change in Asia have soared since China announced a 2060 carbon neutrality target in September of 2020, followed by 2050 targets from South Korea and Japan in October.

Our Power & Renewables APAC Conference will shed light on the path to carbon neutrality.