与我们分析师联系

Unlocking exploration’s hidden value

How do we calculate the true value of new discoveries?

1 minute read

Adam Wilson

Senior Research Analyst, Subsurface

Adam Wilson

Senior Research Analyst, Subsurface

Adam is a senior contributor to our global exploration research.

Latest articles by Adam

-

Featured

Subsurface predictions: what to watch in exploration and discovered resources in 2024

-

Opinion

Global exploration: 4 things to look for in 2024

-

Opinion

What is the future of oil and gas exploration?

-

Opinion

Unlocking exploration’s hidden value

Exploration is back in the black.

After a difficult few years, the sector’s disciplined approach has begun to bear fruit. 2018 saw the highest returns from exploration in over a decade. Over US$7 billion in value was created from a conventional exploration spend of US$15 billion.

The industry is making money once again. How do we evaluate whether a company’s discoveries are worth more than they cost to find?

Full-cycle returns from exploration in 2018

To understand value, we need to go deeper

The exploration industry has become leaner as fewer companies drill fewer wells. But does efficiency necessarily translate to value creation? To understand this, we need to look at several factors together.

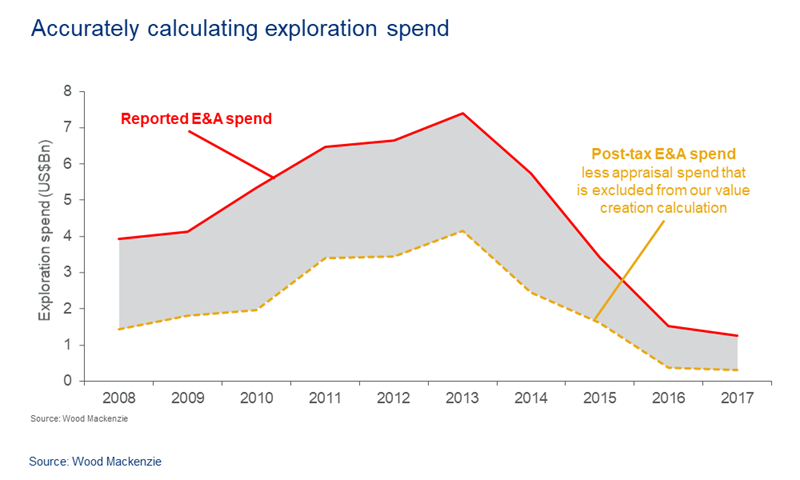

Value creation can be calculated by comparing exploration spend against development value. The simplest way to consider spend would be to refer to the exploration costs listed in company annual reports. However, this doesn’t tell the whole story. A thorough analysis of spend is needed in order to form an accurate picture of exploration value creation.

We've been analysing exploration costs over the past 15 years. In that time, we have consistently seen that drilling costs only equate to around 50% of a company’s exploration budget. The other half is made up of non-drilling costs; general and administrative and geology/geophysics costs. Taken together, these make up what we call the ‘fully loaded’ cost of exploration, or spend.

We also need to consider other factors such as tax offsets and excluded spend, along with a deep analysis of development value, including disposal considerations and the issue of incremental value. All of which can add up to material changes that significantly affect our view of how much value has been created.

How would we analyse these factors in practice? Two case studies illustrate the impact of effectively analysing costs and development value.

Read on to find out more about our methodology for calculating exploration spend accurately

Exploration hot-spots: how can we attribute value to incremental discoveries?

Can we accurately calculate value when several discoveries are found in one PSC licence over consecutive years? Take Guyana, one of the most exciting exploration plays in the world right now. With several sizeable discoveries made in the Stabroek block since 2015, how do we the attribute value to each year that a discovery has been in?

By breaking down the total development value from each discovery – of which a dozen have been made since the giant Liza field opened the play – we can link the value to each barrel that’s been discovered. We can then connect the volumes and spend from exploration drilling with the corresponding development value and assess how much value has been created in each year since 2015.

Understanding legacy costs

How do we ensure we aren’t unfairly penalising exploration performance by including past discoveries? Our methodology allows us to identify and exclude appraisal spend on what we call legacy discoveries so that we can correctly quantify performance.

If we look at Petrobras’ exploration between 2008 and 2017, legacy appraisal in this case would refer to any discoveries made before 2008. In our calculations, we exclude legacy appraisal spend before applying tax relief. We end up with a number that is 55% less than reported exploration costs – a material change that is too big to be ignored. It is this number we input into our value creation calculation.

Follow the numbers

Digging deep into the numbers means we can clearly see how exploration got its 'mojo' back and started making money again.

To help you accurately quantify exploration performance in locations around the world, find out more about our Exploration Service.