No country for old fields Why high-impact oil and gas exploration is still needed

November 2024

November 2024

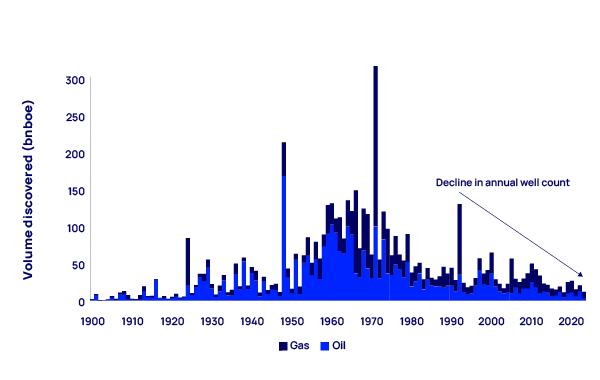

The oil and gas industry has long seen exploration as its lifeblood, satisfying its existential need to replace produced reserves and create value. Few now hold it in such high esteem, however, even within the industry. Exploration is suffering from a chronic perception problem and investment has plummeted by two-thirds in a decade. It is under attack on both environmental and economic grounds, with many stakeholders happy to stop drilling altogether.

So, why continue to explore? One could argue that successful exploration lowers the cost of oil and gas to consumers, cuts carbon intensity and adds value for both resource holders and explorers. Demand is proving resilient and investment in new supply is needed. High-impact exploration, targeting resources large enough to support new infrastructure hubs, offers a compelling opportunity for those with the requisite skills and appetite to achieve economic and decarbonisation goals.

An emotive topic

Oil and gas exploration is not easy to love. Amid growing climate concerns, public opinion is negative, which spooks investors, while some governments are curtailing exploration licensing. Such stakeholder unease alone might be enough to finish off the sector, but the industry itself also harbours doubts.

The worry is that the world already has abundant oil or gas resources. Decades of drilling have amassed 3 trillion barrels of oil equivalent (boe) inventory. Resource lives today are more than 45 years for oil and over 60 years for gas, though, of course, not all of this resource is developable at current prices. Existing fields and discovered resources have recovery upside that could satisfy future oil and gas demand for the foreseeable future, even the higher, more prolonged levels Wood Mackenzie sees under a delayed energy transition scenario.

Others fear that exploration success grows the industry. In fact, new fields do not swell demand. Global oil and gas demand growth of almost 50% since 2000 is far in excess of everything happening in exploration. Demand neither grows when exploration succeeds nor shrinks when it fails. The main exception is where gas discoveries can displace high-carbon-intensity coal in the power sector.

In theory, new lower-cost supply from exploration might eventually lead to higher demand. But this presumes a highly resource-constrained market that looks unlikely before 2050. For oil in particular, new supply in the coming decades will mostly come from further investment in existing fields.

And yet, exploration continues

Despite these concerns, many of the biggest players in the industry continue to explore. Their approach has become more selective, with greater attention to balancing risk and reward. These companies are not only mopping up small prospects around existing infrastructure to maintain near-term cashflows. Much of their investment is in high-impact exploration. These wells seek to open new plays and basins that only begin to add revenues several years into the future.

These explorers want better options to improve portfolio quality; growth or replacing production might be secondary considerations. The industry urgently needs new barrels to help fix its acute shortage of advantaged resources. These are the low-cost, lower-emissions resources needed to displace dirtier and higher-cost alternatives. Many leading companies now have upstream project investment hurdles that preclude the development of anything else – a trend that will be adopted more and more by the whole industry.

Exploration creates value

Of course, companies also explore to make money. While not all succeed, the sector’s overall value-creation performance is encouraging. Exploration has been the most economic means of rejuvenating a portfolio with new fields, particularly for companies that seek advantaged resources. Such prized assets are difficult to buy at a good price; it’s much better to discover them.

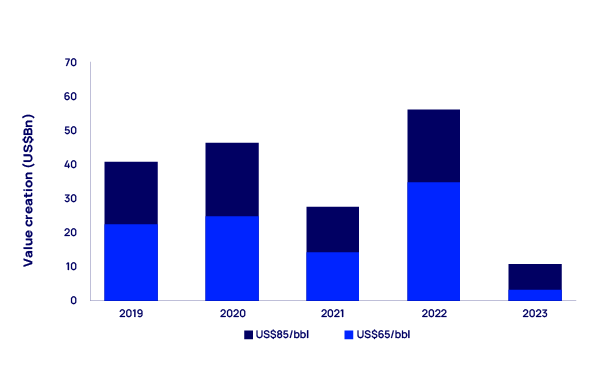

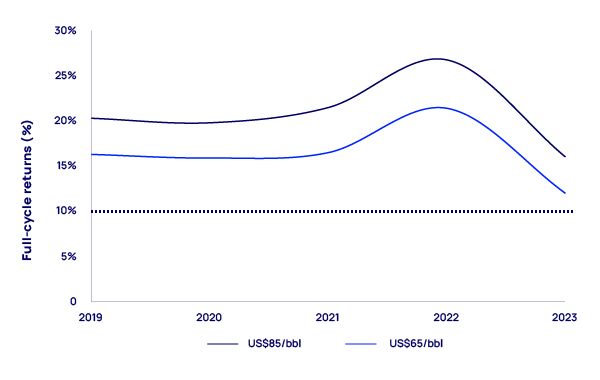

The industry’s exploration economic performance has been attractive since upstream costs reset a decade ago. Full-cycle returns have been consistently in double digits every year since 2015, averaging 15%. We value new field discoveries at much more than they cost to find, with net value creation of over US$160 billion since 2015, assuming an industry planning price of US$65/bbl Brent long term (almost double the current market value of supermajor BP). Even the relatively modest performance of 2023 is ripe for an upgrade as the best of these recent discoveries are appraised and move towards development.

An important caveat on risk: there is no guarantee that any individual explorer will enjoy these positive returns. Long-established industry success rates see only one well in three making a discovery, of which only half typically prove commercial.

Indeed, there is a wide spectrum of company results. A typical year will see a handful of big winners and a long tail of relatively smaller losers. Companies need to spread their exploration risk and invest consistently over several years to improve their chances of delivering average or above-average returns. One-off shots or a scattergun strategy are recipes for failure.

Better to find than buy

Companies seeking to rejuvenate their upstream portfolios with new fields might also consider inorganic strategies. However, it is usually cheaper to find than to buy, especially if asset quality is important. The mergers and acquisitions (M&A) market for advantaged pre-final investment decision (FID) assets is very competitive and fully priced, whether these are conventional or shale reservoirs.

Over the past five years, we calculate industry-average breakeven prices for exploration at around US$45 per boe (Brent, NPV10%) versus US$65 per boe for M&A. The gap for advantaged resources is even wider because of the shortage of such assets on the market. Given the greater risks involved in exploration, such economic outperformance is as it should be to justify investment.

Some of the best explorers can arbitrage this spread by drilling with high equity and then selling down soon after discovery. Eni refers to this approach as its ‘dual exploration’ strategy, making big divestments of new discoveries in Mozambique and Egypt in recent years. Galp plans to sell some of its 80% equity in its giant Mopane discovery in Namibia, found earlier in 2024.

Exploration can cut carbon

Good returns on investment are only part of the story. Less widely appreciated is exploration’s role in lowering emissions. With minimal influence on demand, these benefits are limited to upstream scope 1 and 2 emissions rather than the order-of-magnitude larger scope 3 emissions.

The goal of lower scope 1 and 2 emissions is better served by finding new fields than by cleaning up old ones. New fields are cleaner, thanks to modern decarbonisation technologies and higher facilities throughput. Retrofitting old fields is expensive.

Lens Upstream reveals that new fields about to begin production in the next few years will average scope 1 and 2 emissions intensity of 17 kgCO2e/boe over 2025-30. That compares with existing supply from mature fields averaging 28 kgCO2e/boe.

Potential gains are not trivial. For example, exploration through the current decade is on track to provide 12% of global oil and gas supply. If we assume that these new fields displace existing supply options with emissions intensity typical of older fields, then global scope 1 and 2 emissions in 2030 would be cut by around 6%, or 100 Mtpa CO2e.

As exploration does not increase demand, it does not add to global scope 3 emissions. That said, gas has much lower scope 3 emissions than oil and accounts for around half of the resources discovered in recent years. Finding gas can help companies address scope 3 targets by increasing the share of gas in their portfolios.

The best exploration is high-impact exploration

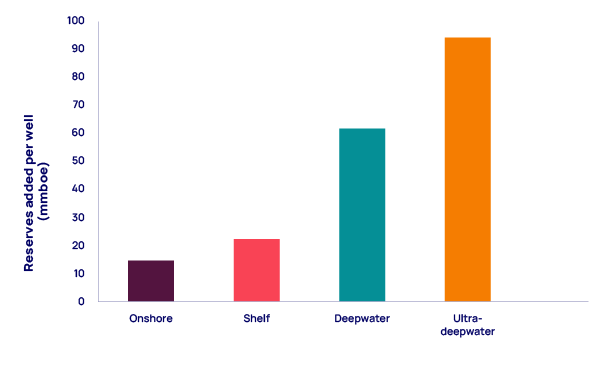

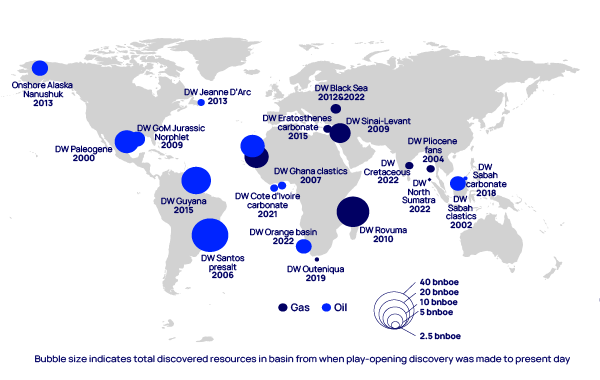

Two themes characterise much of the industry’s recent exploration success. Firstly, it helps to arrive early. First movers and fast followers into new basins and plays capture most of the value. Secondly, explorers are finding most of their bigger discoveries in deepwater. To make a difference, explorers will usually need new frontiers or deepwater, or very often both.

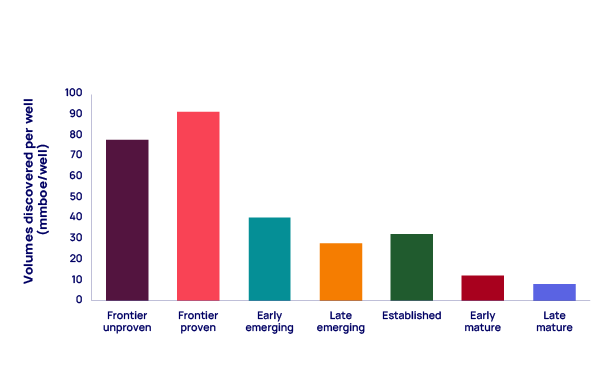

Frontier plays, defined as having no production from similar reservoirs in the same basin, stand out by resource scale. They account for over 40% of total volumes discovered in the past decade. These plays saw most giant discoveries (more than 500 million boe) compared with emerging, established and mature plays. Frontier drilling added over 80 million boe per well, more than seven times wells in mature plays. Most of these new frontiers are in the deep offshore, which also stands out by scale of resources. Deepwater projects enjoy high recovery per well and tend to have lower emissions intensity (<15tCO2e/kboe) than shelf and onshore projects.

However, frontier exploration is not without its challenges:

- Exploration well success rates are lower, which can lead to smaller players going out of business before making a commercial discovery.

- Lead times from discovery to production are longer.

- Development may be impeded by a lack of infrastructure and ready markets.

- Fiscal and regulatory regimes should reflect the greater risks involved but may be untested.

While frontier-focused strategies win on resource scale and value, overall returns in frontiers and mature plays turn out to be roughly similar. All types of exploration help cut emissions when they deliver advantaged resources.

Giant discoveries continue to be found in frontier plays, even in well-explored basins. The Côte d’Ivoire basin, explored since the 1950s, is a prime example. In 2007, Kosmos decided to venture out from drilling mature plays in the shelf and test the deepwater sandstone play, resulting in the Jubilee oil discovery. In 2021, Eni struck gold when it boldly tested a new deepwater carbonate play in the same basin, resulting in the giant Baleine oil discovery. In Asia, Harbour Energy’s Timpan and Mubadala’s Layaran gas discoveries successfully tested a frontier deepwater fan play in Indonesia’s North Sumatra basin in 2022-23, after more than a century of drilling mature onshore and shelf plays.

Plenty more prospects to drill

After more than a century of exploration, it may seem that there must be few good prospects left to drill, but it was ever thus. The next big thing is seldom obvious before its discovery.

Very often, it is new technology that provides the key ‒ for example, the ability to drill in ever deeper waters. Today, the industry is excited about the potential of artificial intelligence (AI) to continue improving seismic data and interpretation. Ever sharper resolution of the subsurface could be the catalyst for a wave of innovation and new geological ideas. AI should also bring efficiency gains that will be invaluable for exploration teams, which suffered deep headcount cuts during the pandemic years.

Recent trends offer three strands of evidence that suggest there is plenty of oil and gas left to find, which should encourage explorers.

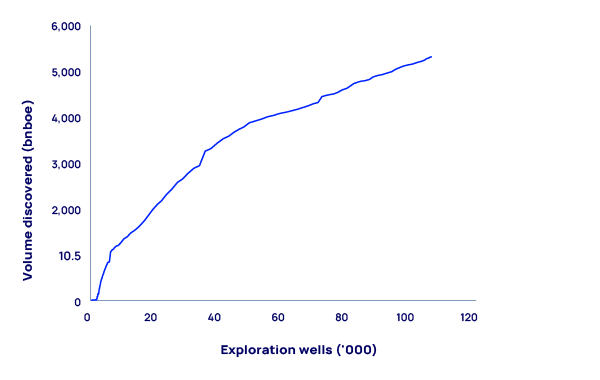

First, creaming curves. These plot cumulative volumes found against cumulative exploration wells drilled and provide a measure of resources found per well. While the industry has been finding rather less in recent years compared with previous decades, that is down to drilling fewer wells. The global creaming curve reveals a near straight-line trajectory with a steady gradient of around 30 million boe discovered per well, including the dry holes. It is a trend unchanged over the past four decades and more than 50,000 wells. An abrupt decline in such a long-established trend seems unlikely.

Second, the frequent emergence of big new plays. Since 2000, we observe that important new geological plays typically emerge every 18 months. An overwhelming majority of these ‘needle-moving’ discoveries lie in deepwater environments. After three decades of such exploration, most of the world’s deepwater basins, in waters from 400 metres to over 3,000 metres, are barely drilled.

Third, recent acreage capture by leading explorers. Those with the greatest knowledge of subsurface potential continue to invest. The Majors have jumped on the bandwagon of deepwater exploration, eager to unlock the next frontier. They now hold nearly 70% of their net acreage in deepwater and dedicate a similar proportion of their exploration and appraisal (E&A) spending to the sector.

Increasingly, national oil companies (NOCs) are following suit, as government mandates to increase production and ensure domestic energy security prevail. Although NOC portfolios show greater variance in their deepwater acreage footprint, companies such as Qatar Energy, Petrobras, PETRONAS and CNOOC now hold 40% to 90% of their global acreage portfolios in deepwater.

Between 2000 and 2013, high-impact successes were dominated by exploration-focused mid to large caps. Exploration and production companies (E&Ps) such as Anadarko, Kosmos, Tullow and Woodside opened many new plays and ranked high among the sector’s leaders for a while. Financial backing largely dried up with the oil-price fall in 2014, and many of these companies were forced to take a more conservative approach to exploration, often shifting towards infrastructure-led opportunities or developing other capabilities. Investors are not yet showing much enthusiasm for E&Ps’ return to exploration frontiers, nor is it obvious what might change that in future.

Liked this article? Join the debate

Hear our authors live in conversation and pose your questions in our Q&A.

Join us for a live stream event on 9th December

Explore our latest thinking in Horizons

Loading...

Why sign-up?

By submitting your details you’ll gain access to the latest Horizons report, part of a thought-leadership series exploring the themes shaping the energy natural resources landscape. You’ll also receive the Inside Track, our weekly newsletter, so you won’t miss out on future editions.