Pioneer plus Parsley: What’s our Permian prognosis?

Our analysts' key takeaways from the deal

1 minute read

Benjamin Shattuck

Research Director, Americas Upstream Oil & Gas

Benjamin Shattuck

Research Director, Americas Upstream Oil & Gas

Benjamin leads our US upstream analysis and specialises in the Lower 48.

Latest articles by Benjamin

-

Opinion

A focused Lens on Permian private players

-

Editorial

Pioneer plus Parsley: What’s our Permian prognosis?

On 20 October 2020, Pioneer Natural Resources announced that it will acquire Parsley Energy in an all-stock transaction. Parsley equity holders will each receive 0.1252 shares of Pioneer, representing a premium of 8% to Parsley’s mid-day share price. The stock portion of the transaction amounts to US$4.5 billion and Pioneer will assume Parsley’s debt bringing the total enterprise valuation for Parsley to US$7.6 billion.

News on Pioneer/Parsley broke less than 48 hours after ConocoPhillips announced its acquisition of Concho Resources. Tight oil consolidation is booming, and it's starting with the big, financially-strong producers.

On paper, Pioneer and Parsley are a perfect fit. Offsetting positions with converging development strategies will make this one of the more seamless deals of the year. But what are some more important takeaways from the transaction that aren’t necessarily reflected in the publicized deal metrics?

Base decline set to improve

Pioneer now expects that it can achieve 5% production growth spending 65-75% of cash flow compared to 70-80% before the acquisition. This should mean more cash to shareholders. We think that Parsley’s shallower base decline, amongst other factors, is part of the reason for the revised view.

Pioneer drilled many of the biggest wells in the basin through the mid-2010s when a “glut and strut” strategy was all too common among Midland players. The result is that for four consecutive vintages, the company’s oil declines accelerated.

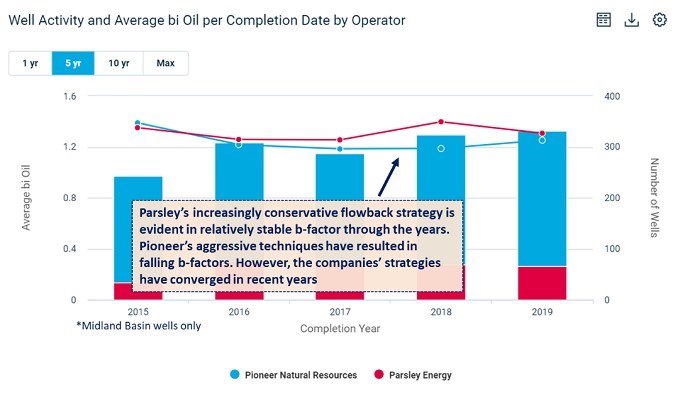

Parsley on the other hand, began upspacing and implementing more conservative flowback strategies after drilling a series of high-decline wells in 2014. This is evident in the company’s stabilizing b-factor in recent years. A shallower decline means lower maintenance capital moving forward.

Refashioning the company

This is a softer point, but in our view, a critical one. There’s no doubt that US upstream has a testing relationship with investors right now. And a piece of that extends beyond financial performance. How are shale E&Ps future-proofing the business for the energy transition journey? To attract capital, shale needs to rethink its approach to ESG.

Parsley’s progressive leadership took one of the most vocal stances on ESG and was very tuned-in to strategy, messaging, and action. The company articulated the roadmap.

Parsley cut flaring by 90% this year on assets acquired from Jagged Peak. Leadership supported stronger state flaring regulations in Texas, and executives laid down a challenge for peers to improve environmental stewardship and funding of reclamation projects. Parsley has also openly called on midstream producers to play a GHG emissions reduction role through technology investments to reduce downtime and undertake better preventative maintenance.

Pioneer has made progress as well. It was early to assign a 15% weight for ESG metrics in executive compensation. The company has led water management innovation, and its average GHG emissions intensity has shrunk to that of Parsley’s three-year average.

But we’ll be keenly watching where the combined ESG and modernization strategy goes. Parsley’s CEO and one other officer will take seats on the expanded and influential Board of Directors, but there was no clear messaging for specific operational roles within Pioneer.

Cost of capital and other synergies

Pioneer has one of the best balance sheets in the Lower 48 with gearing of just 14%. Parsley’s is 40% and the company spends approximately US$155 million per year servicing its US$3.1 billion in debt. At Pioneer’s average interest rate of 2%, Parsley’s debt payment would be US$93 million less per year. The deal has conservatively estimated the annual cost of capital savings to be US$75 million.

It’s not all positive though. Pioneer’s gearing will more than double to roughly 30% after the deal which is a little uncomfortable in this climate. The company will likely direct excess cash flow in 2021 towards debt reduction.

Who controls the Permian now?

Dating back to the Permian’s roots, there’s been an ongoing pendulum swing between Majors and independents as the controlling peer group of the basin’s destiny.

Through the first era of Wolfberry and Wolfcamp unconventional activity in the late 2000s, firms like Cimarex and Pioneer lead tight oil exploration and commercialization. But things changed a few years ago after ExxonMobil acquired BOPCO. The Majors stepped-up and unveiled integrated value-chain strategies with company production targets above one million boe/d.

The Majors were in the driver’s seat for two years, with many independents somewhat shell-shocked at how fast capital programs ramped. ExxonMobil had over 60 rigs running at peak last year. As the Majors went, so went the Permian.

But with new deals like Pioneer/Parsley, the pendulum is swinging back. And fast. The combined Pioneer/Parsley entity holds almost a million acres in the heart of the Midland Basin. Except for some fringe acreage in Ward, Pecos and Upton counties, the new Pioneer is essentially all desirable leasehold with sub-US$40/bbl half-cycle breakevens.

Pioneer is once again a Permian heavyweight. The combined company will produce more regionally than ConocoPhillips and Concho, more than ExxonMobil, and more than Occidental and Anadarko.

Considering the massive spending pullbacks of Chevron and ExxonMobil earlier this year, Permian forecasters need to recalibrate their models back to Pioneer’s plans. Even with a lower reinvestment rate than before the deal and the variable dividend not coming into play until 2022, Pioneer will still grow five percent next year.

Lower 48 Valuations

Brought to you by Wood Mackenzie Lens®, a leading data analytics platform designed to empower strategic decision-making.

Evaluate new investment opportunities in minutes with analysis-ready well and company data.

While we're talking about deals in the US Lower 48, take a look at this short video to see how Ben Shattuck uses completions, drilling and production data from Lens Lower 48 to understand how ConocoPhillips sets itself apart from other operators. Analysis powered by Wood Mackenzie Lens® Lower 48.