1 minute read

The word abundance comes to mind when we think of hydrogen. It’s the most abundant element in the universe. It’s also used abundantly as an input into oil refining, ammonia and methanol production, and steel manufacturing. Global demand for hydrogen is 70 million tonnes annually.

The vast majority (99%) of hydrogen today is produced from hydrocarbons, namely natural gas and coal. As a result, its production is an abundant source of carbon dioxide (CO2) emissions.

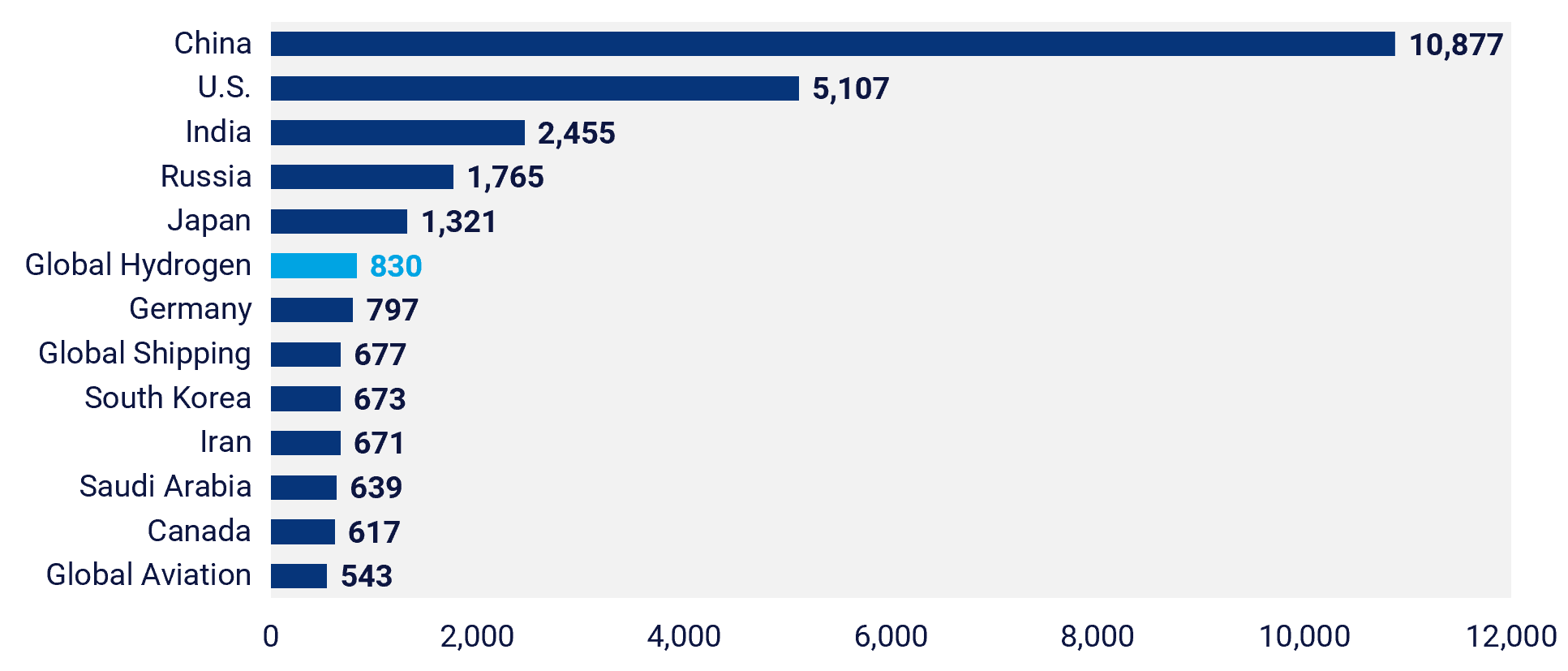

2017 CO2 emission by country and sector (Mt CO2 /year)

Source: CO₂ and other Greenhouse Gas Emissions, Wood Mackenzie

In 2017, global hydrogen production accounted for more annual CO2 emissions than both the entire nation of Germany and the global shipping industry.

Not all hydrogen is created equal though. Our latest report examines ‘green hydrogen’, which is produced by wind and solar via electrolysis, splitting water molecules into hydrogen and oxygen atoms. Produced with no hydrocarbons, it can go a long way to reducing a nation's or company’s emissions.

The process of electrolysis via renewables

Source: Wood Mackenzie, U.S. Department of Energy

Source: Wood Mackenzie, U.S. Department of Energy

Why green hydrogen?

According to our latest forecasts, solar PV and wind’s cumulative installed capacity will grow to 1,251 GW by the end of 2019, and by 2024 the figure will double. And as renewables proliferate, they have and will continue to become cheaper and cheaper.

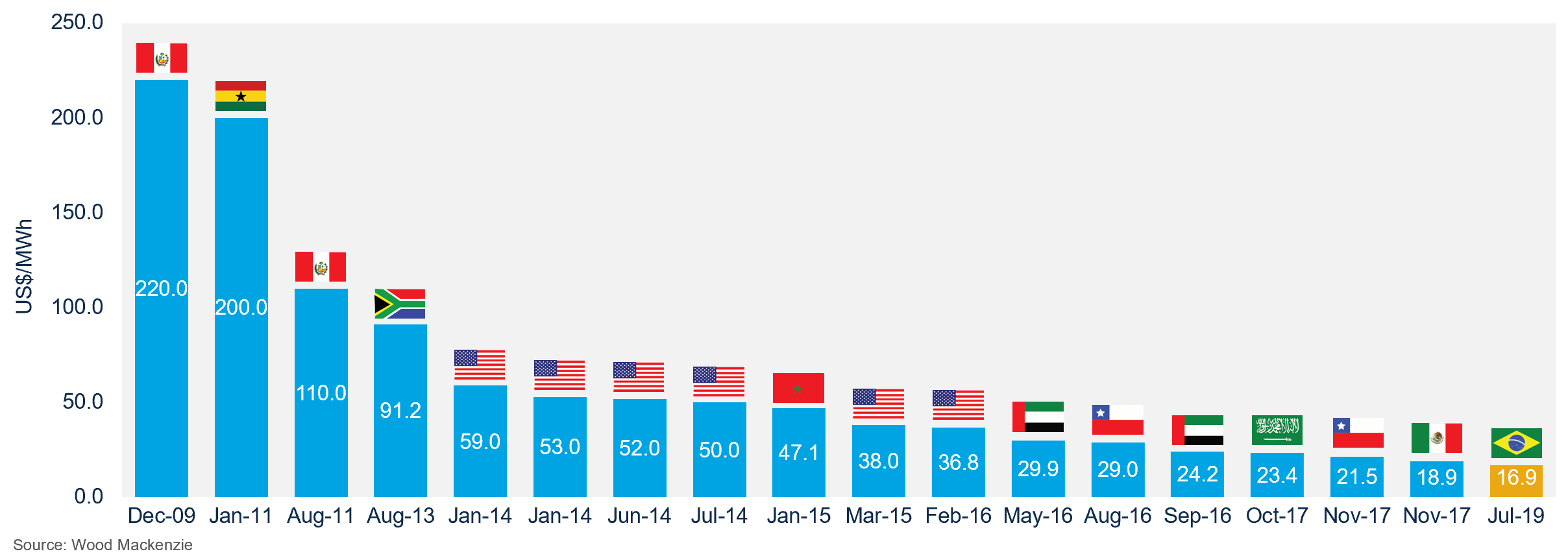

The United States, the world’s second-largest solar market, is now home to power purchase agreements (PPAs) below $25 per megawatt-hours (MWh). And globally we’re regularly seeing records set for the lowest PPA.

Global record-low solar PV PPA prices, December 2009-H1 2019

This growth in renewables is leading to intermittency problems, which, coupled with low PPA prices, has led in some cases to negative power prices. Green hydrogen however can help mitigate or even solve some of these issues.

Electrolyzers used for green hydrogen production can operate dynamically, requiring only seconds to be able to operate at maximum capacity. As such, they can be easily paired with renewable assets that are frequently curtailed for either a long or short duration. Moreover, hydrogen can be stored for long periods in large tanks in order to be sold for industrial applications, integrated into the gas network or used to power fuel cells.

This would provide solar and wind asset owners with additional revenue opportunities.

What’s the catch?

Green hydrogen today is expensive compared to the production of hydrogen via fossil fuels. According to our analysis, with sub-US$30/MWh electricity prices, green hydrogen production can be competitive with fossil-fuel-based hydrogen in Australia, Germany and Japan by 2030.

Today, wind and solar PPA prices range from $53 to $153/MWh in those markets.

According to our current view, only Australia will be able to produce green hydrogen competitive with natural-gas-based hydrogen.

Future growth

Despite its current lack of cost competitiveness, green hydrogen will be a growth market in the near term.

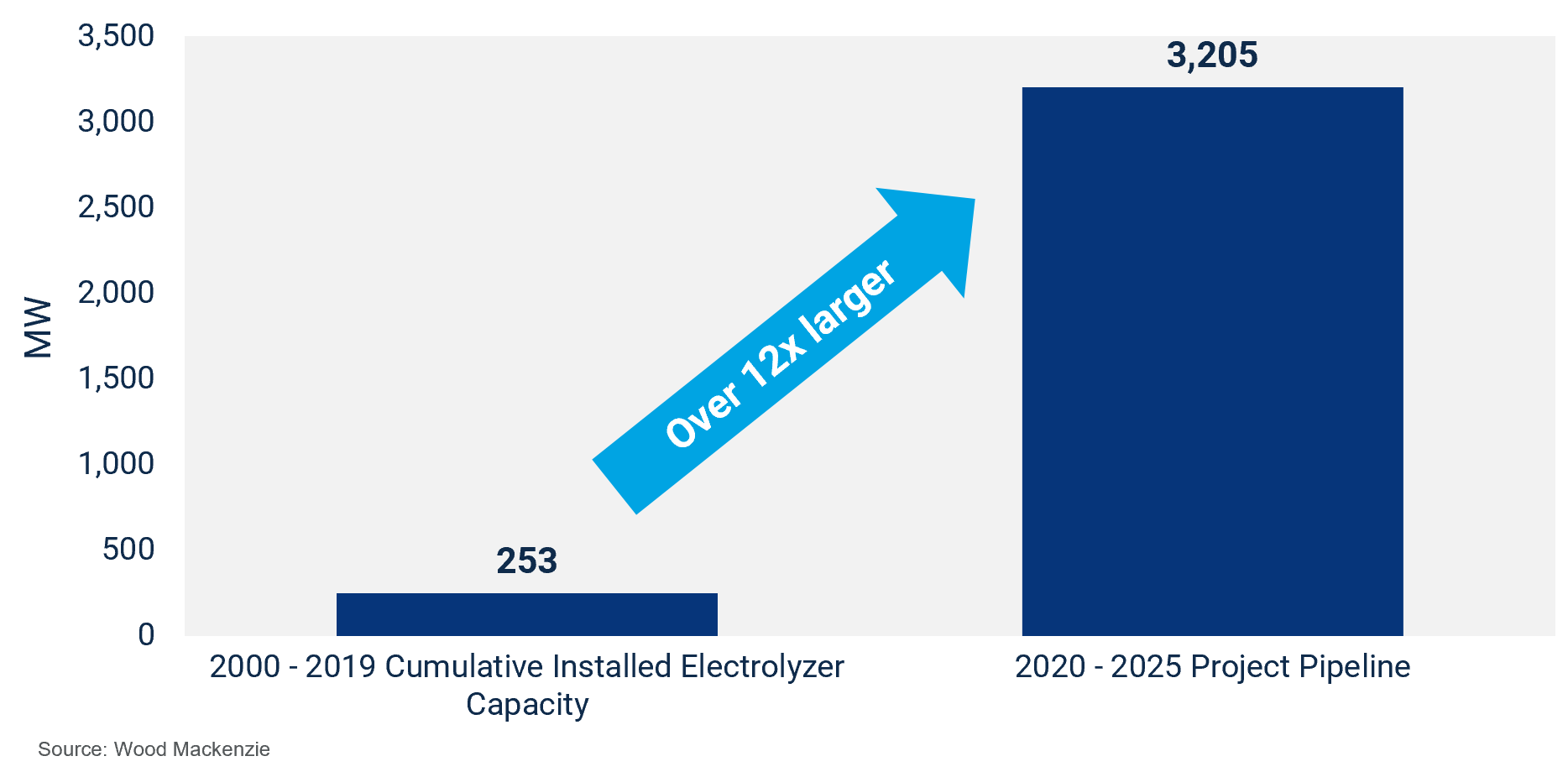

Cumulative installed capacity vs. 2020-2025 project pipeline (MW)

From 2000 to the end of 2019, a total of 252 megawatts (MW) of green hydrogen projects will have been deployed. By 2025, an additional 3,205 MW of electrolysers dedicated to green hydrogen production will be deployed globally – a 1,272% increase.

From 2000 to the end of 2019, a total of 252 megawatts (MW) of green hydrogen projects will have been deployed. By 2025, an additional 3,205 MW of electrolysers dedicated to green hydrogen production will be deployed globally – a 1,272% increase.

Until the past few years, the green hydrogen market was diminutive. As such, the large increase in the 2019-2025 period is partially due to the nascency of the market. But aggressive targets in East Asia and increased interest from major international stakeholders will drive deployment over the next few years.

While cost-competitiveness might be out of reach in most scenarios by 2025, national targets and pilot projects will produce enough volume to realize substantial capex declines beyond 2025.

Our report details several key long-term growth drivers including national and regional targets for hydrogen fuel-cell vehicles and charging stations, larger-scale pilot projects with industrial end-users, corporate decarbonisation initiatives, and the growth of renewables paired with falling PPA prices.

We are just embarking on the energy transition. There are several unknowns that would further spur adoption of green hydrogen: changing policy dynamics, new carbon regimes, new ways to monetize grid flexibility and lower-than-expected costs of renewables.

For more, complete the form on the top of the page to download the executive summary and overview of our new report, Green hydrogen production: Landscape, projects and costs.