1 minute read

Every major E&P company collects mountains of data. But while there is plenty of data available, companies aren’t getting as much value out of it as expected.

The real value comes in only when data-driven insights can materially improve business decisions. And when these decisions have a sustained, positive impact.

Many oil and gas companies are yet to reach this point.

Fortunately, there’s a proven, tried and tested approach, used by banks and insurers for decades: the data consortium.

What can the oil and gas industry learn from other sectors about maximising value from data?

Not only can data consortiums help answer companies’ most pressing questions today—but they can provide the foundation the industry needs for future innovation and discovery.

How insurers went beyond data to deliver best practice

In the insurance industry, a data consortium was first established as a means to streamline regulatory filings across all 50 US states. As more companies got involved in the consortium and the dataset expanded, so did the breadth and depth of available intelligence. Now, the insights drawn from consortiums underpin industry standards for insurance price premiums.

The consortium also allows insurers to more accurately predict risks and gain valuable insights on claims histories, the likelihood of serious events, and more.

Banks follow their customers

The consortium helps banks and financial institutions to derive deeper insights into consumer behaviour. Companies can track wallet share and spending patterns across any given consumer’s credit or debit cards, regardless of where these cards were issued.

This detailed view not only allows companies to conduct micro-targeted marketing campaigns but also enables them to track the response instantly.

Importantly, this near ‘real-time’ capability has significant benefits for fraud detection.

Informing better business decisions

For both the insurance and banking industries, each consortium started as a way to solve specific problems. But over time, as the datasets grew, the concept evolved into something that had a sustainable business impact.

Today, the banking consortium tracks around 6.7 trillion in consumer spending annually. And 21 billion insurance policy transactions are recorded each year, alongside more than 1.3 billion insurance claims.

-

6.7 trillion

consumer spending tracked

-

21 billion

transactions recorded

-

1.3 billion

insurance claims

What are the lessons for oil and gas?

At first glance, the oil and gas industry data landscape is very different from insurance or banking.

But the fundamental nature of the business problems encountered is actually very similar. Take a closer look, and similar patterns start to emerge.

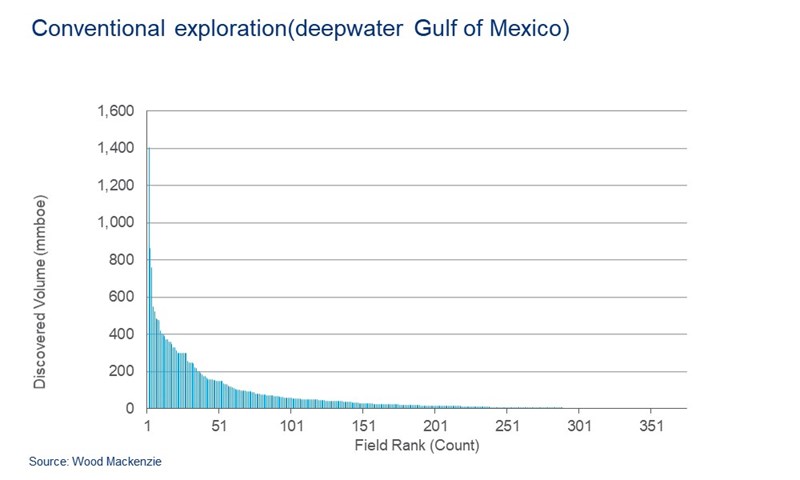

This chart displays all deepwater Gulf of Mexico discoveries by size. It’s clear there are only a few large fields and many smaller ones, which will barely break even on a full-cycle basis.

There is a very similar dynamic in the insurance business, where a small number of large claims will dominate outcomes for a portfolio.

In both cases, the best way to get the most out of the data is to assemble a dataset with as complete a set of observations as possible – a challenge solved by the data consortium.

Going beyond the quick wins

Data analysis is already helping oil and gas companies to identify quick wins: for example, companies can optimise equipment on-site or predict drilling problems.

But consortiums can unlock benefits far beyond this. Multiple teams can spend weeks analysing complex decisions such as a major project FID.

The real value lies in being able to pinpoint the specifics: for example, which operator behaviour or what project characteristics are driving profitability. And this is where a data consortium will come into its own.

This report is part of Wood Mackenzie’s series on data management best practice. In a recent presentation at the 24th annual Petroleum Networking Education Conference and Exhibition, Preston Cody looked at how a data consortium could add value to the upstream industry. Fill in the form on this page to receive a copy of his presentation deck.