Six ways the onshore wind O&M market will transform this decade

Annual operations and maintenance spend will hit US$25 billion by 2029 — but not everyone stands to gain

1 minute read

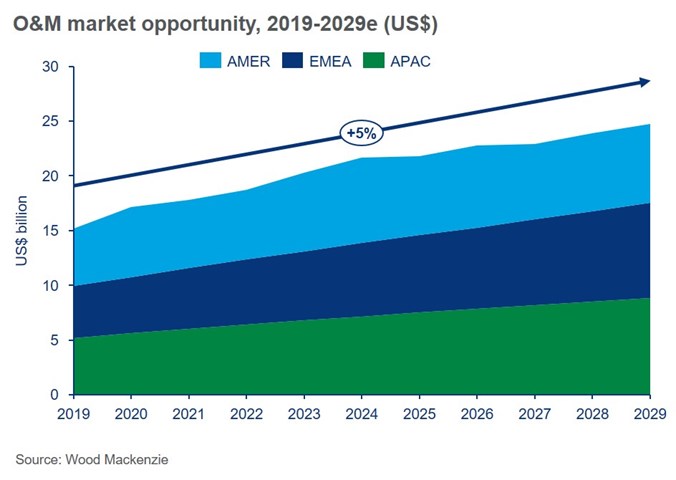

With the addition of 148,000 new turbines, overall global operating capacity for onshore wind is set to surpass one terawatt before the end of the decade. Annual operations and maintenance (O&M) spend will hit US$25 billion. So, where will this spend be focused? And how will the O&M market change?

In our 2020 Global Onshore Wind Operations & Maintenance Report we explore the key global trends for the sector and provide a spend forecast for the major O&M segments, as well as offering analysis at a regional and country-specific level. Fill in the form for a complimentary brochure featuring sample charts from the report. Or read on to find out about six things to expect in the onshore wind O&M market in the next few years.

1) O&M spend per MW will vary considerably by market

Average O&M spend per megawatt (MW) in the leading 11 onshore wind markets ranges from US$14,000 in India to US$39,000 in the US. This huge variance in per-MW O&M spend is due to factors including technology, operational practices and strategy, as well as local labour market conditions. Most

leading markets will see overall declines in per-MW spend during the decade, but several markets, including China and Brazil, will see increases over time.

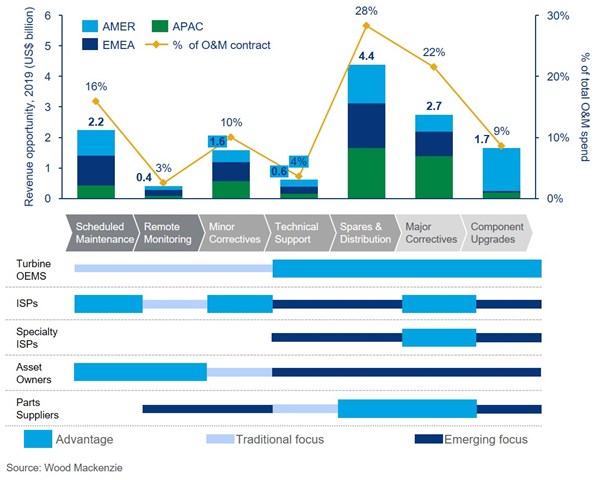

2) Ageing fleets will drive significant growth in the correctives market

Larger-rating turbine platforms and re-powering activities will help drive down fleet-wide per-MW O&M expenses. However, asset owners with ageing fleets are entering a challenging period where, despite efforts to reduce operating expenses, age-related equipment failures will increase over time and drive up costs. The corresponding correctives market opportunity — including both spare parts and repair work — will grow to nearly US$17 billion by 2029.

3) Blade and motor corrective activity will grow to make up 20% of global O&M expenses

A significant portion of the correctives market is dedicated to blade repair and retrofits. As a portion of overall O&M activity, blade and rotor related corrective activity will grow to US$5.2 billion over the decade, equivalent to 20% of global O&M expenses. This growth will largely be driven by increased labour costs for repairs, as well as the need to replace ageing equipment in many leading markets.

4) Flexible service arrangements will become the norm

With operational strategies continuing to evolve in onshore wind, flexible services arrangements are becoming prevalent. Many leading asset owners such as utilities, large independent power producers and infrastructure asset owners are adopting this operational strategy. Such contractual arrangements

allow asset owners greater flexibility in managing year-to-year expenditures and cashflows, however the trade-off is having to assume the operating risk of major component failure.

5) Transactional services will be worth US$5 billion by 2029

The growth of flexible contract scopes will create a need for subcontracting transactional services, for which market spend will rise to US$5 billion by 2029. As a result, new opportunities will arise both for independent service providers and original equipment manufacturers (OEMs) to focus on individual specifics of O&M service.

6) OEMs will lose market share in O&M over time

Current market share segmentation remains dominated by OEMs, who retained 65% of market share in operational capacity in 2019. However, that share is expected to decline as experienced asset owners increasingly take a more hands-on operational strategy approach. Operational flexibility demands mean the market is open to new forms of service packages tailored to meet the needs of the asset owner’s operational risk appetite. We expect to see more companies enter the highly profitable correctives repair market — including those focusing on providing end-to-end subcomponent service packages.

Our full 2020 Global Onshore Wind Operations and Maintenance Report provides detailed market analysis, including key trends and opportunities, major segment spend forecasts and individual market summaries for 11 countries.

Fill in the form at the top of the page for a complimentary extract, which includes:

• A breakdown of onshore wind O&M market opportunity by region and country

• Analysis of new opportunities arising from flexible contracts

• Predicted year-on-year spend for major correctives repairs

• Expected growth in blade repairs and retrofits