A new route to commercialisation for floating wind

Commercialisation is not a step; it is a leap

1 minute read

By Søren Lassen, Head of Offshore Wind Research and Finlay Clark, Research Analyst, Global Offshore Wind Power

Floating wind’s virtually unlimited potential has from its inception made it a strong vision. In 2015 Wood Mackenzie (MAKE Consulting at the time) co-authored a report on floating offshore wind. The title of the report is From Technical to Economic Feasibility, and it concluded that the “next step is to prove that floating foundations are economically feasible” and go commercial. Now, seven years later, this is still the challenge for floating wind, and we can conclude that commercialisation is not a step; it is a leap.

Increasing momentum for floating wind

The industry has meanwhile been taking many steps. The increasing momentum of floating wind can best be demonstrated by the swelling pipeline which has tripled since the end of 2020. In 2021 alone, 70 GW of new floating wind pipeline was added which is more than 20% of the total offshore wind pipeline added in 2021. This spike showcases the appetite and need for floating wind by the developers as they look to seize new opportunities in deeper waters.

To facilitate these new projects, we have seen the number of floating specific alliances rise to almost 300 in 2021 as new companies enter the supply chain and existing offshore wind players eye up potential synergies forged through increased collaboration. Given that the sector has proposed over 100 different floating design concepts and is set for explosive growth in the second half of the 2020s, alliances will remain key in assisting market innovations as the industry moves towards large scale commercialisation.

The ramp up on the design side is far from the only focal point of the sector – policy remains pivotal to the commercial success of floating wind. Until now, policymakers have awarded 400 MW of floating capacity, which is due to be installed by 2025, and Wood Mackenzie forecasts show that more than 7 GW of additional capacity will be connected in the second half of the 2020s, which puts pressure on infrastructure and supply chain investments.

Economic feasibility is not only achieved by lowering LCOE

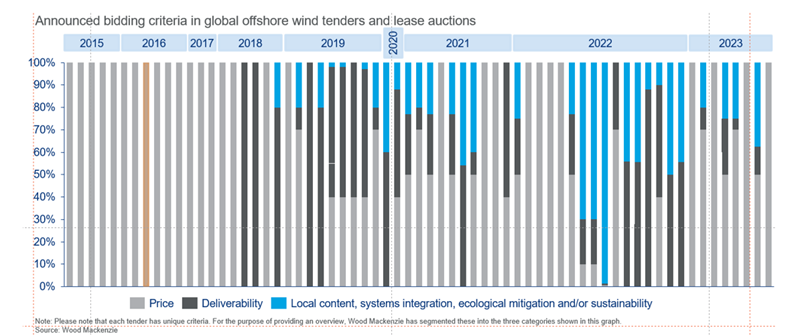

Previously, the market primarily saw economic feasibility, the degree to which the economic advantages of something to be made, done, or achieved are greater than the economic costs (Cambridge Dictionary, 2022), as a way of reducing the levelised cost of energy (LCOE). However, fueled by the record-breaking offshore wind tenders and auctions, the broader elements of ‘economic advantages’ is now getting more attention as policymakers are looking to offshore wind for more than just green power.

And while there are many economic advantages presented by the floating wind market, they can be split into four primary buckets – local content, systems integration, ecological mitigation and emissions.

Local content: Given the infancy of the floating sector, there is abundant opportunity for markets to establish themselves as floating technology leaders, particularly as many markets where floating is best suited have not been legacy players in offshore wind. As floating wind structures vary, they bring new opportunities for local content such as full or partial assembly at the quayside.

Systems integration: Systems integration is well established as one of the largest challenges facing the offshore wind sector and the energy transition as a whole. Given the rate at which new capacity targets are emerging, the importance on offtake and systems integration will only increase.

Floating wind brings advantages in this context as it allows policy-makers to tap into areas with different and higher capacity factors compared to onshore wind and bottom-fixed sites.

Ecological mitigation: Floating wind has a lower environmental impact from installation activities compared to bottom-fixed and the fact that it is not fixed to specific areas allows for a much more dynamic approach to site selection. This offers floating wind new opportunities to maximise the use of the sea while minimising the environmental impact.

Emissions: While the offshore wind industry has one of the lowest carbon footprints in the energy sector, in absolute terms it is becoming significant in tandem with the growth of the sector. More than 100 floating wind concepts have been introduced, depending on the weight and the ability to manufacture components closer to sites, the floating wind sector can optimise on offshore wind’s emission footprint.

To learn more about the new competitive parameters in the offshore wind industry and how it is changing the industry, access Wood Mackenzie’s: Sea change: navigating the trillion-dollar offshore wind opportunity for free.

Increased focus on the full economic advantages of floating will pave the way for commercialisation

The lead time for new projects remains the core challenge for floating wind’s commercialisation. While 2022 has seen the world’s first floating wind lease auctions, and the first floating wind tenders for commercial scale will be awarded next year, Wood Mackenzie expects the first final investment decisions for these initial commercial projects won’t be made until the mid-2020s, and because of this, connection won’t pick up until the end of 2020s.

Until now, the primary focus for economic feasibility of floating wind has been around reducing the levelised cost of energy (LCOE). Instead, the market should be focusing on the economic advantages, including local content, system integration, ecological mitigation, and emissions reduction, that floating wind has to offer. And while this will have a limited impact on project timelines, it will make the technology more attractive for policy-makers, and in turn increase the outlook and proliferation of floating wind. This will help attract the much-needed investments that the industry needs to able to scale up and make the long anticipated leap to commercialisation.

Fill in the form at the top of the page to download the Floating wind: What will you be competing with, and what will you be competing on? extract.