Discuss your challenges with our solutions experts

Solar raw materials: a challenge to Europe’s net zero ambitions?

Europe must find a way to navigate high raw materials costs while rapidly scaling up solar deployment

1 minute read

Solar power has a crucial part to play in the European energy transition. But to benefit from rising demand, the sector needs to scale up rapidly while navigating a challenging high-cost environment.

Our report Solar raw materials: a real challenge for Europe on the way towards net zero draws on insight from our Solar Data Hub to analyse the impact of rising prices for key raw materials including polysilicon, silver, aluminium, glass, steel and copper. Visit our store to access the report, or read on for an introduction.

Solar demand is heating up

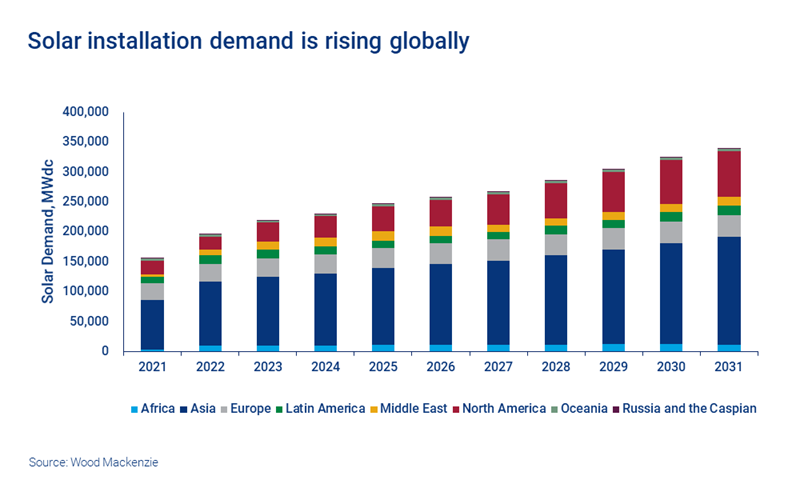

Our latest Global solar PV market outlook update predicts annual solar capacity will grow by 25% in 2022, helping total installed capacity to exceed 1,000 GW. Having passed this major milestone, we forecast global solar PV installations will continue to grow strongly, increasing at an average compound annual rate of 8% over the next decade. Total global installed capacity will hit 3,500 GW by 2031 – and we expect Europe to account for around 331 GW, or just under 10%.

Rising costs put pressure on new solar developments

However, demand isn’t the only thing on the up in the solar arena. Raw materials prices have increased across the board over the last year. Polysilicon, the main feedstock for producing the wafers for crystalline silicon solar cells, has tripled in price since January 2021. Meanwhile, the cost of anti-reflective ultra-clear glass – used in the front cover of solar modules – is under pressure from rising natural gas and tin prices. What’s more, other vital materials, including aluminium, galvanised steel and copper have all gone up in price by more than 30% over the last year.

These higher raw material costs, combined with Covid-19 disruptions, rapid demand recovery and soaring freight rates, caused solar module prices to increase by more than 20% in 2021 alone. If the current situation persists, increasing capex costs combined with higher potential operations and maintenance costs could cause projects to be delayed or cancelled, choking European solar development.

Europe needs to develop a self-sufficient solar value chain to meet its solar deployment goals

Europe’s current annual polysilicon production is enough for around 16 GW of capacity – virtually all of it produced in Germany by the firm Wacker Chemie. That’s less than half of what’s needed to keep up with European solar installation demand. But Europe’s supply chain is further restricted by its ingot and wafer production capacity, which is a mere 1.5-2 GW. Instead, in 2021 almost all of Germany’s polysilicon output was exported to China.

Even before Russia’s war with Ukraine began, Europe had stated its intent to decarbonise its economy by 2050. However, recent events have highlighted the urgent need for Europe to transform its energy system and move rapidly away from reliance on Russian gas. As part of its REPowerEU initiative — which aims to make Europe completely independent from Russian fossil fuels — the EU wants to add at least a further 420GW of extra solar capacity by 2030.

With anti-Russian sanctions mounting and electricity and fuel prices showing no sign of slowing down, there is no time to waste. Europe needs to act fast to address the supply issues for solar raw materials and move towards a self-sufficient solar value chain which will enable the rapid expansion required.

Get the whole story on how solar raw materials impact Europe’s net zero journey

The full report includes analysis of cost drivers and pricing for a range of solar raw materials including polysilicon, float glass, aluminium, copper and galvanised steel. Visit the store to access it in full.