Get access to the video insight for this article

Could a return to shale exploration be part of the solution to Europe’s gas supply problem?

Are there longer-term opportunities for unconventional exploration and appraisal as Europe diversifies away from Russian gas?

3 minute read

Kateryna Filippenko

Research Director, Global Gas Markets

Kateryna Filippenko

Research Director, Global Gas Markets

Principal Analyst with a focus on the European gas market and the development of alternative scenarios.

Latest articles by Kateryna

-

Opinion

Gastech 2024: Our top three takeaways

-

The Edge

Future energy: biomethane’s time has come

-

Opinion

From digester to burner tip: navigating the fast-growing RNG industry

-

Opinion

Transforming energy: 5 key questions ahead of Gastech 2024

-

Opinion

Global gas industry in the 2050 net zero world

-

The Edge

WoodMac’s Gas, LNG & Future of Energy conference – five key takeaways

Robert Clarke

Vice President, Upstream Research

Robert Clarke

Vice President, Upstream Research

Robert leads our US onshore research, with a particular focus on the evolution of the tight oil sector.

Latest articles by Robert

-

Opinion

Video | Tariff turmoil: how big a cost hit will US oil and gas operators take?

-

Featured

Upstream oil & gas regions 2025 outlook

-

Opinion

Global upstream update: oil supply questions and portfolio resets

-

The Edge

Three factors driving US liquids production to new heights

-

Opinion

What's new in global upstream

-

Opinion

Chesapeake-Southwestern Energy deal: ten key takeaways

April Read

Senior Analyst, CCUS

April Read

Senior Analyst, CCUS

April is focused on intelligence and analysis, cultivating insights that support clients’ strategic decision-making.

Latest articles by April

-

Opinion

Can CCUS momentum overcome headwinds to the industry?

-

Featured

Subsurface predictions: what to watch in exploration and discovered resources in 2024

-

Opinion

Discovered resources: 3 things to look for in 2024

-

Opinion

Taking the power back

-

Opinion

Could a return to shale exploration be part of the solution to Europe’s gas supply problem?

The European gas market is in turmoil. Russia’s invasion of Ukraine has shaken things up, triggering a complete rethink of European energy strategy and policy. And as Europe searches for viable alternatives to Russian gas, LNG seems the most popular solution to plug the supply gap. But LNG prices are rising fast, and contracting patterns are changing. Could there be other, more local, longer-term supply options?

A decade ago, Europe hosted some of the most active unconventional gas exploration programmes outside North America. Then the commodity downturn in 2015 – combined with some high-profile dry holes – brought a swift end to almost all of Europe’s onshore exploration.

Is it possible that shale exploration could come back into vogue as Europe searches for alternative gas supply?

In a recent video we talked through the potential for unconventional gas to eventually become a meaningful part of the solution to Europe’s gas supply problem – and the numerous barriers. Fill in the form to access the film and read on for some highlights from the discussion.

Russia’s war with Ukraine changed the game

Europe’s gas balance has changed fundamentally as a result of the conflict. In January-August 2022, Europe’s imports from Russia totalled only 55% of the volumes in the same timeframe last year.

Europe no longer has any illusions about the reliability of Russia as a gas supplier. Diversifying supply has become an imperative. So, without Russian imports, how much more gas does Europe need?

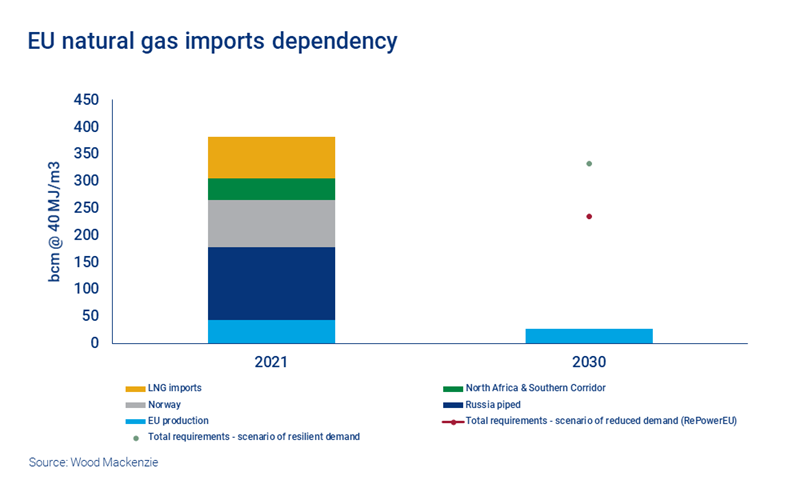

In a hypothetical scenario where the EU stops importing Russian gas by the end of 2023, the next couple of years would see record high import requirements. But longer term, there is significant uncertainty around demand – with a range of up to 100 bcm in terms of potential requirements. If demand remains resilient, we forecast that the supply and demand gap would be about 300 billion cubic metres (bcm). In a scenario where Europe’s recent decarbonisation and diversification plan, the REPowerEU, is successful, that gap would be closer to 210 bcm.

In either scenario, Europe will turn to LNG to plug the gap. In the next couple of years, it will need to compete with Asia for limited supply – all while LNG prices are rising.

That could open the door to alternatives like unconventional gas. But has the opportunity for European shale closed indefinitely after the last round of failed exploration? And can these options be delivered fast enough, before demand risks increase?

European shale has vast potential, but there has been no material production

Ten years ago, exploration and appraisal work across Europe spanned from Poland to the UK, Sweden, Germany and Austria. Target plays were shale and tight gas sands, which both had huge resource potential. Parallels to booming US unconventional gas supply were drawn, aided by some European shale plays showcasing excellent geologic and geochemical properties.

However, none of the in-place gas volumes were commercialised, and in five years of evaluation not much drilling and completion progress was made. Even in the UK and Poland, where activity was the most promising, only a few wells were finished, and sky-high costs coupled with management fatigue in the 2015 downturn stalled the projects.

In the current race to find alternative gas sources, could the tide be turning? The UK and Germany are both reportedly discussing lifting national bans on hydraulic fracturing. That would be a bold move that would set the stage for shale gas pilots again.

Would investors and E&Ps still be interested?

In the first round of European shale gas exploration, many of the Majors led this activity.

Now though, the Majors have shifted their unconventional focus to the Permian, or in some cases, scaled back global shale projects completely. Their shale portfolios appear to be largely set: they are unlikely to want more exposure to new unconventional assets.

So, who could fund European projects now? What role will energy super basins play in meeting Europe’s gas needs? Watch the video to find out more. Fill in the form at the top of the page for complimentary access.